INVESTMENT FRAUD INVESTIGATION

Unpacking the United African Stokvel scam – the trail of death threats and ties to nonprofit, Sexpo

The fraudulent scheme has left a trail of victims in its wake, stripping investors of their savings, homes and pensions. Daily Maverick is in contact with about 600 investors, 236 of whom have lost a cumulative amount of between R12-million and R22.8-million.

The United African Stokvel (UAS) scam has spilled over, with victims and former employees claiming their lives have been threatened, allegations of inappropriate sexual comments from the man implicated in the scam and ties to a nonprofit organisation and Sexpo.

The founder of UAS, Darren Langbein, initially failed to respond to Daily Maverick despite repeated calls and emails since Monday, 24 July. Daily Maverick is in direct contact with about 600 investors who have lost money since UAS stopped paying out money in about March this year. However, many are reluctant to come forward with their real names, as members of the group and former employees started receiving threatening calls earlier this year.

Scam victim Michelle* said that, after members stopped receiving payments, people became suspicious and started asking questions on the UAS Facebook page.

“You have to understand – although there was a Facebook page, this was not a social media scam. We responded to adverts on reputable sites including various newspapers and radio stations such as Radio 702 and the Sowetan. We saw that people from Ernst & Young [EY] and Bowmans [law firm] were endorsing this stokvel,” she said.

The UAS stokvel was started in 2019/2020 by Langbein, and was featured in articles on various media sites including Ventureburn and Disrupt Africa.

UAS has 79 reviews (mostly complaints) on the Hello Peter website, with a net promoter score of -96. Scores of less than 0 mean it is unlikely that reviewers would recommend the business being reviewed.

When UAS started blocking comments on the Facebook page, disgruntled investors banded together and formed a WhatsApp group. There are currently two WhatsApp groups with about 600 members altogether.

Daily Maverick conducted a poll within the WhatsApp groups and 236 investors responded. They lost a cumulative amount of between R12-million and R22.8-million.

The number is lower than the R100-million quoted by a former UAS employee on the Devi investigative show.

However, the UAS Facebook page has 95,000 followers, and if even half of those (say 50,000) invested similar amounts to the 236 investors, R100-million becomes credible very quickly.

By 28 July, about 30 investors confirmed that they had lodged complaints with the Financial Sector Conduct Authority (FSCA).

Reviews posted on the United African Stokvel’s Facebook page. Stock images were used for these social media ‘testimonials’.

One investor told Daily Maverick that he had lost R152,000. He was initially promised that he could triple his money within six months. “The money was for my children’s education fees. Now I am battling to make ends meet and to try to make sure my four children are not deregistered,” he said. He has one child at university and three children at boarding schools.

Another investor, who put in R100,000, said he had lost his home and furniture, and had been reduced to staying with a friend. “I am so stressed right now with that money gone. It’s like a nightmare,” he said.

Many distressed investors said they had used their retirement savings or money set aside for their children’s education, and would now have to disclose to their families that the funds were no longer available. They said they just wanted their capital back.

The victims started approaching various media in April and May in the hopes of highlighting their plight, but hit several stone walls before journalist Devi Sankaree Govender agreed to do a “sting” operation on The Devi Show.

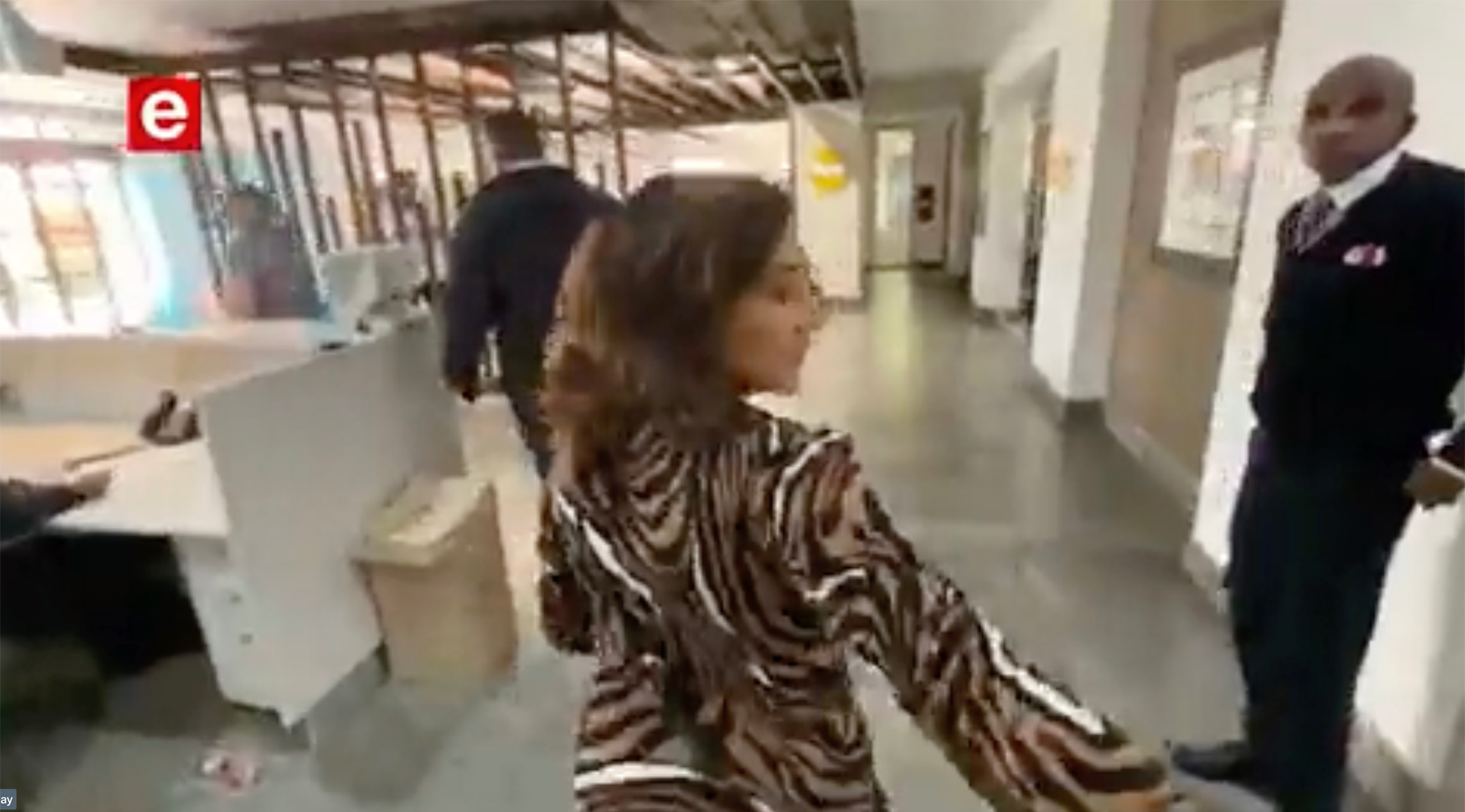

Govender got Langbein to come in on the pretext of having two potential investors with R100,000 to invest, but as soon as he saw her walk into the room, Langbein clammed up, telling her to speak to his lawyers, and hightailed it. However, the Devi show has confirmed that Langbein did not communicate further, despite various attempts by the show producers, and no lawyer came forward.

A screenshot from The Devi Show when Devi Sankaree Govender tried to speak to Darren Langbein. (Source: e.tv

Death threats

After The Devi Show aired on 25 June, members started getting threats. Dean Angelou of Trident Protection Services admitted that the company offered protection services to Siyakunakekela, a nonprofit run by Langbein’s wife, Shirley, but he denied having anything to do with UAS.

“We haven’t had contact with Siyakunakekela for a few months now,” he said. Angelou also denied having threatened any stokvel members or former employees.

However, former employee Stacey* tells a different story. She was hired by Langbein after she placed an advert looking for a job as an au pair on the Au Pair SA website.

“He contacted me for a meeting. While we were driving to his house, he said, by the way, this has nothing to do with au pairing,” she said, adding that Langbein told her he was recruiting via the Au Pair SA website because he wanted staff who were “sweet-natured, caring and trustworthy”.

Stacey worked for Siyakunakekela, but said she worked out of the Langbein residence, which was in Ballyclare Drive, Sandton. She was forced to work as a brand ambassador for another company run by Shirley Langbein – Onyxtreme.

“We had to work as ambassadors for the Onyxtreme libido tablets at Sexpo [an annual sexual products exhibition/conference], and Darren kept making inappropriate sexual comments about our bodies,” she said.

Darren Langbein. (Photo: Facebook)

Stacey said she earned a basic salary of R15,000 a month and was also paid commissions when the stokvel was doing well – even though she had nothing to do with sales. “The commission was a lot, and was often more than my basic salary, but it varied from month to month…”

According to Stacey, the Langbeins used stock images for their Facebook posts by so-called “successful investors” endorsing UAS as an investment opportunity.

“After I started speaking out, I got a phone call telling me: ‘Don’t be a hero, don’t get involved, don’t speak to anyone. Darren has a lot of money and people are going to start getting killed.’” Stacey said that, although money was channelled through nonprofit Siyakunakekela and some of it was being used for “good”, it was “nothing compared to the money coming into the stokvel”.

FSCA investigation

The FSCA conducted a search-and-seizure raid on UAS offices towards the end of June. The FSCA investigation, which is ongoing, followed a whistle-blower report and complaints from investors.

An FSCA statement said that, although the stokvel had claimed to have applied for a financial service provider’s licence, there was no record of any such application. “The FSCA suspects United African of conducting unauthorised business and breaching certain financial sector laws. United African is not authorised to provide any financial products or financial services.”

Gerhard van Deventer, the head of enforcement at the FSCA, has cautioned that, although the FSCA is investigating the matter, it has little room to take action, as UAS is not a registered financial services provider. UAS is also not a member of the National Stokvel Association of South Africa, after its application was rejected in July 2019.

Although many investors were crying out for a refund of their capital, Van Deventer said the FSCA had not handed the matter over to the Asset Forfeiture Unit because there was no evidence of any material funds in the assets that were being investigated. All monies were paid via EFT or debit orders to a Nedbank account.

Cold comfort

Nedbank did not divulge when the funds in the account were depleted, but a spokesperson said there was “zero tolerance” for all forms of dishonesty and criminality, and the bank took all allegations concerning the abuse of its accounts for fraudulent purposes very seriously.

“Where such allegations are received, we will conduct an internal investigation to establish their veracity and will act immediately to block an account if it is clear that such action will prevent further losses.

“While an account is blocked, it may still receive funds, but the owners of such an account have no ability to access any of the money in the account.

“The closure of the account is a separate process that only happens after certain legal and governance steps have been completed. Nedbank strongly recommends that fraud victims approach the police, as we have no mandate to conduct criminal investigations. We will, however, render all possible assistance to the police to ensure that perpetrators are brought to book.”

The bank’s zero tolerance policy is strongly worded but will offer cold comfort to the parents who are most likely going to have to pull their children out of school when they can’t pay school fees, the mother whose husband left her after he found out she had lost R118,000 of their savings, and the woman whose partner died in January, leaving her with two children as well as a newborn baby.

Internal Nedbank investigation

Sibusiso Khumalo, a forensic investigator at Nedbank, has responded to some investors to say they should open a criminal case so that the police can issue a subpoena for information about the fraudulent Nedbank account. According to Khumalo, the account has been blocked pending an internal investigation. However, victims say they are unable to cancel the monthly debit orders that are still going off their accounts.

An FNB spokesperson says victims should report the fraudulent transactions to their own banks, so that suspicious banking activity can be traced. “Generally, fraudsters move money between various accounts and are multibanked,” FNB notes.

Daily Maverick did finally receive a bizarrely worded response from UAS in response to questions sent to the Langbeins.

“The matter is currently with the lawyers of the company, who are addressing the unnecessary inconvenience caused by the FSCA who had closed the company accounts temporarily, an anomaly we are attending. The bank also had unlawfully closed some account [sic] by mistake, and had to open the said accounts after a prolonged engaging [sic]. Soon as the matter is sorted all clients [sic] payments will be sorted,” said UAS.

The emailed statement concluded with: “I must say we are Stokvel and not what people choose and wish us be [sic].”

Van Deventer confirmed that the FSCA had not closed any bank accounts.

“We have contacted the Langbeins and asked them to come in for an interview, and hope they will cooperate so that can be done soon,” he said.

Who are Darren and Shirley Langbein?

According to the Companies and Intellectual Properties Commission (Cipro), the couple who are allegedly the masterminds behind the United African Stokvel are also directors of United African Holdings, which was incorporated in January 2013. Darren has been the director of Dartan Realty Auctions, Go-Fetch Solutions and 353 Property Investments. Daily Maverick was not able to find any further information on any of these companies.

Darren’s wife Shirley Langbein is listed as a director of Onyxtreme (libido products), Siyakunakekela, The Foundation for Nutritional Resource Development, App Central, UAS and Slow Stroke. Apart from Onyxtreme, Siyakunakekela and UAS, we were unable to trace the other companies/nonprofits that Shirley is linked to. It is unclear whether Slow Stroke is/was a company dealing with the side effects of strokes or a reference to another sexual libido products company. DM

*Names have been changed on request for safety reasons.

This story first appeared in our weekly Daily Maverick 168 newspaper, which is available countrywide for R29.

Nice touch!

“It is unclear whether Slow Stroke is/was a company dealing with the side effects of strokes or a reference to another sexual libido products company.”

This really made me laugh!

I notice that NEDBANK is statistically over represented in questionable activity. could this just be coincidence? I think not. and what is it about not cancelling debit orders when requested to do so by clients? I have had similar problems with NEDBANK in the past and found that the only way to stop their debit orders was to close the accounts. I would advise anyone with a similar problem to do the same. They are very serious about money, they just never say whose money!!

Ahem , no red flags about large amounts of $$$ coming into an account ?

It may just be bit of ‘Slow Stroke’ !

Another sad story about heartless greed and the loss of people’s savings and fees for childrens education so that a few people can ‘get rich’. It sickens me. I hope he gets caught along with other miscreants who’ve behaved in the same way.

He will get caught for sure! He is not an anc cadre or elite. No danger too of being rewarded with an ambassadorship. We can rest in peace.

It’s hard to believe that in this day and age people still fall for the “double/triple your money in six months” line. It’s like they still believe “the cheque’s in the post” when nobody issues cheques anymore.