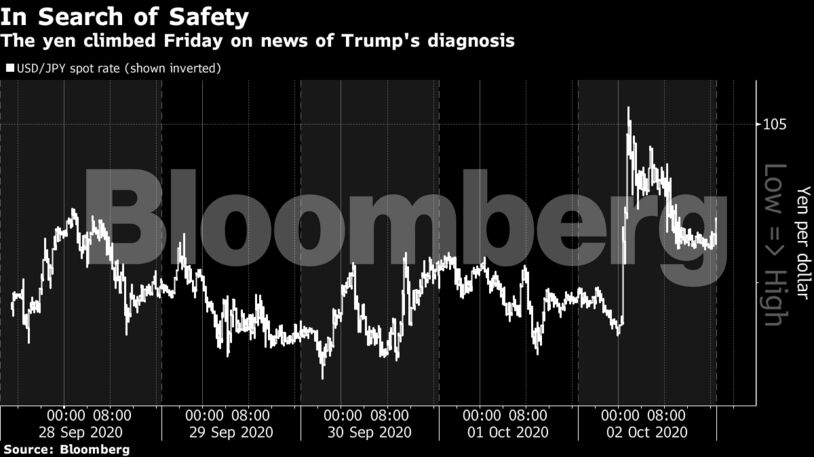

Market volatility jumped Friday as financial markets initially reacted to news of Trump’s diagnosis in a risk-averse manner. U.S. stock futures slid, Treasury rates fell and the yen advanced, although there was a reversal in these moves as the day wore on.

Speculation that Trump’s illness could help bridge the gap on stimulus talks ultimately helped to lift Treasury yields, while the S&P 500 index ended down less than 1% and the Bloomberg dollar index was little changed on the day, but all these markets closed before it was revealed that the president was headed to the Walter Reed National Military Medical Center for treatment.

“Risks will remain for global financial markets” and uncertainty over Trump’s health “adds a whole new level of complexity to the surroundings of financial market sentiment that were already far from clear,” said Jameel Ahmad, the director of investment strategy at Naga Group AG in London. “Should governments begin to announce new stimulus packages to reinvigorate economic momentum or hopeful news be delivered on the vaccine we are all waiting for, then the outlook for risk appetite becomes cautiously optimistic.”

Related Story: Bond Market’s Pre-Election Slumber Disturbed by Trump Diagnosis

Traders may obsess over Trump’s medical bulletins in coming days and the complexities that his illness brings to an already divisive presidential election campaign, but the ultimate impact on financial assets is not clear cut. Trump may be discharged from the hospital as soon as Monday as he recuperates from Covid-19, one of his doctors said Sunday, though they revealed he’s been administered a medicine to control inflammation.

The spread of coronavirus among a number of Republican senators also adds potential complications for Congress, which is at the heart of America’s contentious Supreme Court nomination battle and would also need to legislate on any fresh stimulus even if Republicans and Democrats managed to come to terms on a deal. Despite that, there is increased optimism about the chance of stimulus and Trump himself tweeted Saturday from hospital that the economy needs a deal, urging negotiators to “get it done.”

“There is an underlying belief that even if an agreement cannot be struck now, a package could be approved in the lame-duck session, and a larger effort next year” and “the configuration of political and economic considerations strongly points to more fiscal support,” said Marc Chandler, chief market strategist at Bannockburn Global in New York. “The relatively light economic calendar in the week ahead may not get in the way of a resumption underlying trend in risk assets higher,” he said.

Related Story: Escalating Chaos Again Proves Incapable of Derailing the S&P 500

With the situation in Washington in flux, markets may be wary without being panicked as trading in Asia gets underway Monday. Holidays in China may also dampen activity, while political developments from the Caucasus to the U.K. could stir movements in some individual currencies.

Britain’s pound may enjoy early gains Monday after the U.K. and the European Union agreed to step up their negotiations over a post-Brexit trade accord. British Prime Minister Boris Johnson held a video call with European Commission President Ursula von der Leyen on Saturday in which both renewed their commitment to getting a deal. Meanwhile, ongoing hostilities between Azerbaijanis and Armenians and the involvement of both Russia and Turkey in the dispute are likely to keep a strong focus on the ruble and the lira.

The focus for most traders globally, though, will be squarely on Trump, his illness and the upcoming election battle.

“We have arrived in no man’s land,” wrote Andreas Rees, an economist at UniCredit Bank in Frankfurt. “Until someone has been sworn in on 20 January, there will be lots of uncertainty and volatility in financial markets.”

Become an Insider

Become an Insider

Comments - Please login in order to comment.