Student Debt

Catch 22 for students crippled by debt – they can’t go back and they can’t go forward

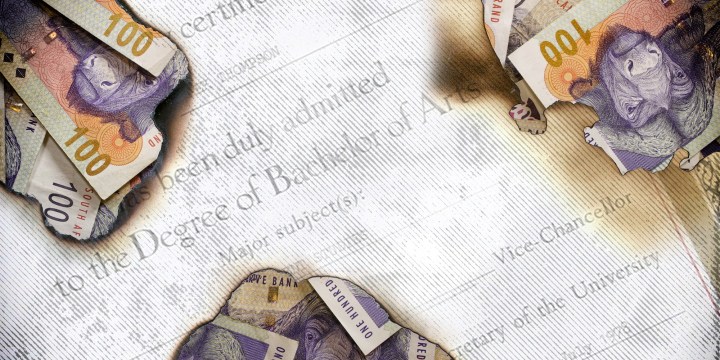

Every year around the registration period, students are confronted with the crushing reality of their outstanding financial debt owed to universities. While the focus is usually on NSFAS-funded students, those who fall into the category of the missing middle have to fend for themselves, often with a lasting impact on their future.

From a young age, Caroline Bholo, 24, had a knack for languages and a deep love of literature.

So after matriculating in 2014, she set her mind to enrolling at North-West University (NWU) to study towards a Bachelor of Arts in Language and Literary studies.

“My teachers would tell me that it was as if it came naturally to me, so I decided to take that and run with it. I knew [it] would have to be languages and literature because those proved to be my strengths,” she said.

Caroline Bholo from Vanderbijlpark, in Gauteng spent two years unemployed because she owed NWU money. Her debt meant that she could not get her degree, despite concluding her studies in record time. (Image supplied).

Bholo was born into a middle-class working family, and because her mother had her when she was fairly young, she was an only child in her family up to when she was doing her second-year at NWU.

Academically Bholo was a natural. Her marks were always good and she took to her studies with vigour.

Funding her studies was not so simple.

“At particular times my fees wouldn’t be paid on time, my rental wouldn’t be paid on time, halfway through the month I would run out of groceries because they weren’t enough initially,” she said.

And because of that, following her graduation, Bholo was subjected to two years of unemployment due to her student debt. The university would not provide her with documentary proof that she had successfully completed her course, something that prospective employers required.

In 2019, Parliament’s Portfolio Committee on Higher Education and Training noted that students owed universities almost R10-billion, but this figure only covered NSFAS-funded students. There was no indication, at the time, of how much money self-funded students owed universities. This amount is still unknown.

Fundamentally, student debt in South Africa is split into two – self-funded and NSFAS-funded – and as it stands the latter’s student debt is more likely to be paid off.

Bholo might have graduated in 2015, but she never received her certificate. In 2020 she managed to pay off her debt. (Image supplied)

The Department of Higher Education and Training allocated an additional R967-million to the National Student Financial Aid Scheme (NSFAS) in 2019 to settle historical debt owed to universities by 52,514 students.

At the time of this announcement, the then minister of higher education, Naledi Pandor, said the allocation was meant to cover the debt of students who were funded by the previous NSFAS scheme before changes were implemented in 2018. In the past, students whose total annual family income was below R122 000 a year were required to self-fund part of their study costs, and NSFAS would cover a portion.

The money made available by NSFAS to these students was never enough and as a result, students accrued debt. Since 2018, the NSFAS funding threshold has been extended to students whose combined household income is less than R350,000 a year.

This more encompassing threshold is meant to be more inclusive for students whose socioeconomic status falls within the middle-class populace. However, students, who under the new threshold would qualify for funding now, still have to pay the outstanding money they owe universities while they self-funded.

And those who would have qualified under the new threshold can’t apply for NSFAS funding to cover their fees retrospectively. Even those with approved NSFAS funding under the new threshold are unable to continue studying if they have historical debt from the time they were self-funded.

Nhlanhla Ntuli, 26, was born in a small village called KwaSwayimane, near Pietermaritzburg in KwaZulu-Natal. After matriculating in 2012, Ntuli says he was determined to pursue a career in Radio at the University of KwaZulu-Natal (UKZN) – a choice inspired by the social ills he witnessed in his community.

“I was excited that I would finally go to university and pursue a career that has been a long-standing dream. Unfortunately, that excitement was short-lived when NSFAS rejected my application for funding.

Nhlanhla Ntuli from KwaSwayimane in KwaZulu-Natal has been pursuing a three-year degree for seven years. Because he owes UKZN money, he is unable to register. (Photo: supplied)

Ntuli tried to fund his own studies by working on the side.

But this proved impossible for him and by the end of his first year, he owed the university more than R88,000. In 2014, Ntuli’s career prospects came to a standstill when the university barred him from registering due to his debt. Seven years later, Ntuli’s pursuit of a better life is still on hold because he still owes the university money.

“Ater exploring all possible avenues, I was unable to cover my tuition for 2014. I decided to approach Ntokozo FM, a community radio station in Umlazi for a job. My application was successful, and I spent five years working there, while hustling to settle the debt,” he said.

Ntuli is an aspiring radio personality and even though he has been unable to finish his studies as a result of student debt, that has not deterred him from volunteering at local community radio stations. (Image: supplied)

By the end of 2018, he had managed to pay almost 60% of the debt. He tried his luck and re-enrolled. This time his NSFAS application was approved, and despite having unsettled fees of around R34,000, he was permitted to register and complete his second year in 2019.

He is unable to register for the 2020 academic year because the university is demanding that he pay 15% of the R34,000 he owes before allowing him to do so.

“The issue of student debt is directly tied to the fact that South Africa has a system-wide approach to addressing the affordability of higher education for students who do not qualify for new DHET bursaries,” Universities South Africa CEO, Ahmed Bawa said.

He argued that it cannot be up to the government alone to deal with student debt, corporates need to come up with solutions as well.

“This will require a public-private partnership approach involving the state and the banking system…Until (this happens) the issue of student debt will be part of our challenges at the beginning of each academic year,” he added.

“This issue of debt and students finding themselves in enormous debt and being unable to complete their studies is a massive global phenomenon,” Sioux McKenna, an education PhD supervisor at Rhodes University said.

McKenna added that countries like the United Kingdom now have a negative graduate premium – a term used to describe how much more graduates are likely to earn compared to their non-graduate counterparts – as a result of the debt students are left with after graduating.

“But in South Africa, we still have a big graduate premium. There’s still incredible social mobility and improved financial success for graduates,” McKenna said.

The U.S alone has a student debt bill of about $1.5-trillion, while the UK’s, student debt stood at nearly $100-billion.

Following the #FeesMustFall protests in 2016, a Fees Commission for higher education was instituted. However, Bawa said “the solution put forward by the Fees Commission was the establishment of an Income Contingent Loan system.”

“This clearly has its drawbacks but it may be one way of addressing the short-term challenges we face,” he said.

Nonetheless, for both Bholo and Ntuli their plight of student debt meant their dreams were delayed.

“I felt like a fraudster, that I had worked so hard but had nothing to show for it,” Bholo said of her degree being withheld by the university.

“Life was tough. I had taken all the necessary steps to ensure that I became successful, I had followed the rules, did as I was supposed to but still lived like I never did,” she said.

She made all attempts to apply for jobs. She scored herself multiple interviews but got rejected as soon as those companies realised she had nothing to prove her academic success.

“I was told that the only thing that counts and matters is the actual degree, nothing else,” she said.

For two years after completing her studies, Bholo remained unemployed.

Ntuli on the one hand, despite being allowed to conclude his second year through NSFAS funding while owing the university money, is being barred again to register in 2020 because of his seven-year-old debt.

“UKZN wants me to pay at least 15% of the money I owe them before I can register. NSFAS funding is available for me to conclude my studies but I don’t have R5,144 and registration will close soon,” he said.

If Ntuli does not pay the 15%, he will spend another year or two, or even more pursuing what was meant to be a three-year degree.

Thabo Shingange, spokesperson for the South African Union for Students (SAUS) told Daily Maverick that the government only budgeted for the debt owed by NSFAS funded students only.

“Those students whose household income is R350,000 have not been taken care of. They have a historical debt from either their second and third year, which has not been cleared nor budgeted for in any particular way,” he said.

“Come 2020, those students now cannot register, and mind you this is the generation that fought for free higher education,” he added.

Ntuli said UKZN’s Student Council predicts that there are about 67% of students who are facing a challenge similar to his.

“That’s why UKZN is burning, literally,” Shingange said.

Shingange told Daily Maverick that the announcement made by the Minister of Higher Education and Training, Blade Nzimande, that NSFAS-funded students who have historical debt can register regardless of their debt is causing trouble in the system.

“NSFAS is not talking about students who in 2020 now qualify for NSFAS funding but have historical debt of the last four years, that is not an NSFAS issue, they were not budgeted for.

“Now there is that confusion because students wrongly interpreted the minister’s announcement,” said Shingange.

Bholo, with the help of her family, has managed to pay off her debt in 2020, has her degree and is now applying for work, but for Ntuli the odds are stacked up against him as he scrambles yet again to pay his debt.

“The university extended registration, so I literally have two weeks to find money to pay some of the debt so that I’m able to register,” Ntuli said. DM

Become an Insider

Become an Insider