The Reserve Bank will ease in November and February, and then signal a move to alternative measures in response to rising risks at home and abroad, NAB said. If the government doesn’t then respond with its own stimulus — such as new infrastructure investment or bringing forward planned tax cuts — the RBA will likely cut again and adopt unconventional measures, NAB predicts.

Governor Philip Lowe last weekend repeated his calls for increased spending on new infrastructure projects in Australia. Treasurer Josh Frydenberg, however, maintains that tax rebates being delivered to households now are sufficient.

“Unless something meaningful is done on fiscal stimulus, we think the RBA could cut the cash rate further to 0.25% by mid-2020, simultaneously undertaking unconventional monetary policy,” NAB chief economist Alan Oster said Wednesday. The RBA has said that would most likely involve buying government bonds, “but we anticipate additional steps, such as long-dated repurchase agreements to lower bank funding costs.”

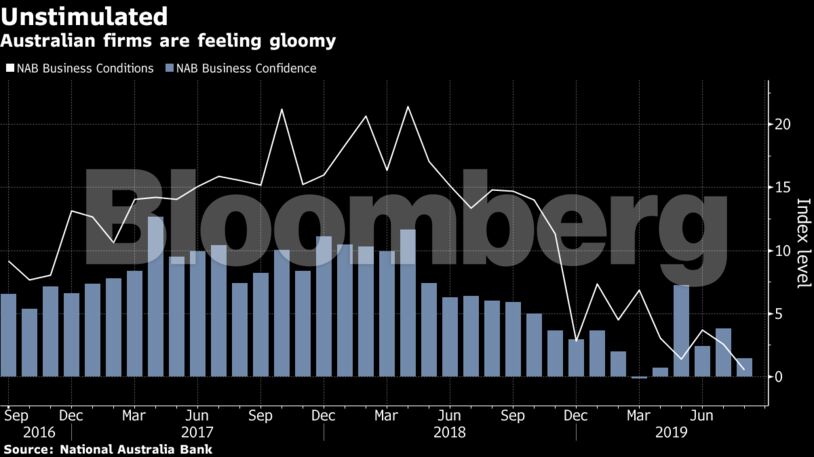

NAB’s call comes as business and consumer surveys in the past 24 hours showed sentiment deteriorating across the board, suggesting the economy’s 12-month slowdown shows no sign of abating. Australians are struggling with record-high household debt and weak wage growth, prompting them to cut back spending. Lower cut rates in June and July to try to support growth, but so far the only sector that’s impacting is property.

“Our internal data suggest that rate cuts and tax refunds have done little to boost consumer spending,” Oster said.

Become an Insider

Become an Insider