“Over time this project will double this country’s GDP,” Walker said at the signing ceremony.

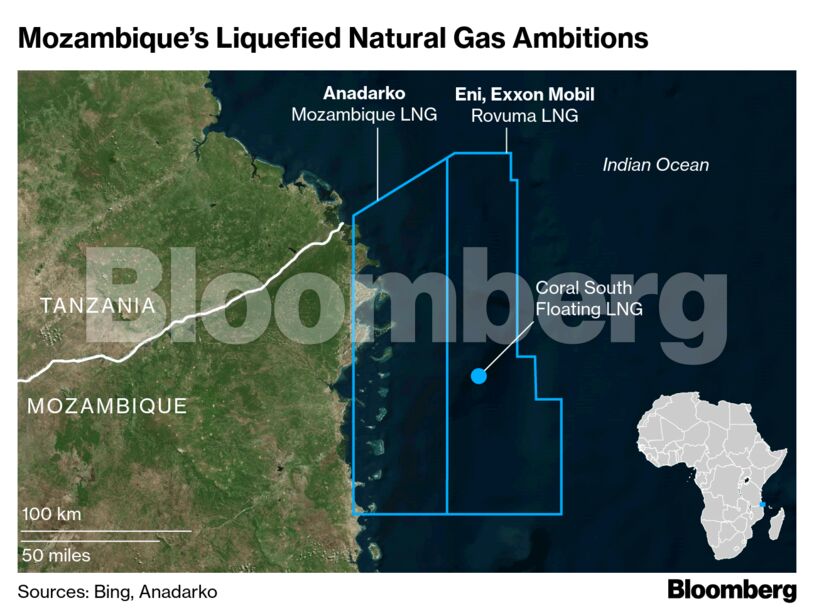

It’s taken the American company nearly a decade to green-light the development after discovering gas in Mozambican waters in 2010. The country had to draft new regulations for its nascent oil and gas industry, even as uncertain global demand for LNG slowed down plans. The Mozambique government expects $95 billion of revenue over 25 years from this project and others led by Exxon Mobil Corp. and Eni SpA.

“It is the start of a new era for Mozambique,” said Darias Jonker, a London-based director at consultant Eurasia Group Ltd. The size of these projects “will bring tens of billions of dollars of investment” and revenue to the government, he said.

Developing the hydrocarbon resources is crucial for the southern African nation, which has struggled to service its debt in the past. Nyusi could use Anadarko’s planned investment in the project, called Mozambique LNG, to showcase his achievements ahead of elections in October, and hope to compensate for the problems with borrowings, according to Jonker.

Mozambique LNG is at the center of a new restructuring deal the government reached with a core group of its Eurobond holders last month. While investors will no longer have access to future revenue from the project, the in-principle agreement allows the administration to pay a lower interest rate until after the country’s gas production begins in 2023.

Total’s Deal

Occidental Petroleum Corp. agreed to buy Anadarko earlier this year. Once the deal is completed, Total SA has an arrangement with Occidental to acquire all of Anadarko’s African assets for $8.8 billion, including Mozambique LNG.

The project will have the capacity to produce 12.9 million tons a year in the first phase, with the scope to expand to as much as 50 million tons. It has contracts with key global importers in Asia and Europe and Mozambique’s location between the Pacific and Atlantic basins is an advantage that will help the country compete with a booming number of LNG suppliers.

Flexible commercial arrangements, including an innovative co-purchase agreement with Tokyo Gas Co. and Centrica Plc, have helped the project secure “high-quality customers in a crowded LNG market,” Frank Harris, head of LNG consulting at Wood Mackenzie Ltd. said in an emailed note.

Gas from the Anadarko-operated offshore field will be sent to a processing plant on land, where it will be liquefied and then exported. The onshore plant is being built in the northern Cabo Delgado province, an area where suspected Islamic insurgency began in 2017. While the company says it hasn’t been targeted, one of its convoys was attacked and a contractor beheaded in February.

Anadarko has implemented a resettlement program in the area, and is building roads and an airport. The company has said it will continue to develop the infrastructure until Total takes over.

The Exxon-led project, called Rovuma LNG, is planning a 15.2 million-ton-a-year facility adjacent to Anadarko’s and expects to reach a final investment decision by the end of the year. Eni approved another $7 billion project in 2017.

Become an Insider

Become an Insider