ECONOMIC OUTLOOK

SA annual factory gate inflation eases to 2.7%, lowest level in almost three years

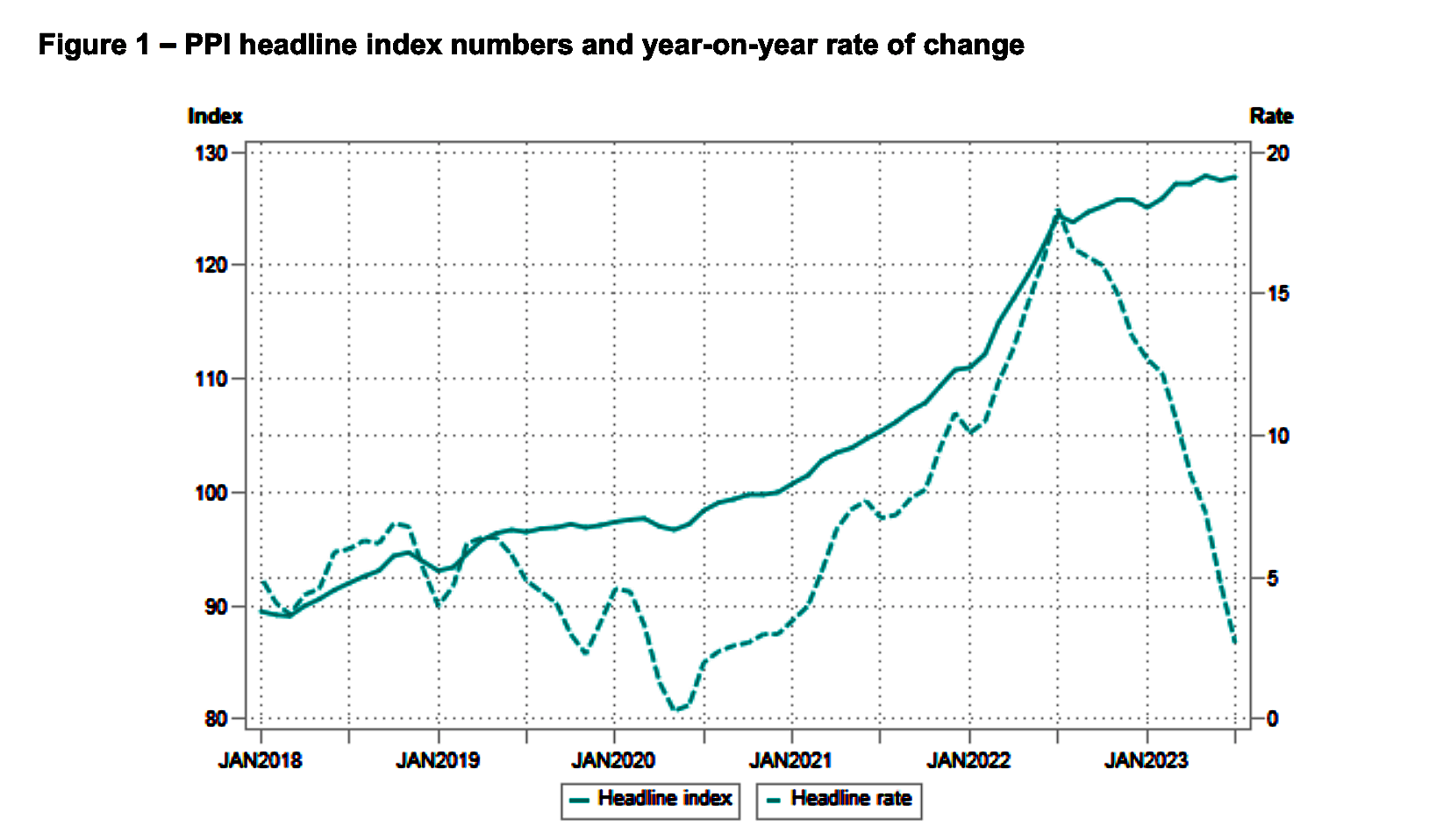

Some more glad tidings on the inflation front. South Africa’s Producer Price Index (PPI) hit the brakes year on year to 2.7% in July, its lowest level since October 2020, from 4.8% in June. That raises the prospects of the South African Reserve Bank holding rates steady when its Monetary Policy Committee (MPC) meets later in September.

Inflation in South Africa is finally being brought to heel, and that is good news for hard-pressed consumers grappling with a cost-of-living crisis against the backdrop of record levels of unemployment and inequality.

PPI was 2.7% on a year-on-year basis in July, down from 4.8% in June. This was its lowest read since October 2020 when it was also 2.7% and the economy and demand pressures were groaning under the weight of Covid lockdown measures. In July last year, PPI was running at a blazing rate of 18%.

Cooling fuel prices played a major role.

“Fuel price dynamics are largely responsible for the annual moderation in the headline PPI reading. It detracted -2.5% points from the headline reading in July, versus -0.8 of a % point in June. Specifically, petrol price inflation slid by a notable -18.5% y/y, from a contraction of -8.2% previously, while diesel prices fell by a further marked -23.3% y/y (-16.2% y/y previously),” Investec economist Lara Hodes noted in a commentary on the data.

This comes after the Consumer Price Index (CPI) slowed to 4.7% in July from 5.4% in June, taking the inflation measure for consumers to near the midrange of the SA Reserve Bank’s 3% to 6% target range. That, in turn, signals that the central bank will likely hold rates steady again, as it did in July, when the MPC next meets later this month.

Read more in Daily Maverick: SA Reserve Bank holds rates steady, but Kganyago’s finger remains on the hiking trigger

Its key repo rate currently stands at 8.25% and the prime lending rate at 11.75% after the MPC hiked rates by 475 basis points since November 2021.

Still, there are causes for concern.

At 6.8%, producer food inflation remains a key driver of the overall rate and that will keep feeding into consumer food inflation, which remained an income-sapping 10% in July. Poor households especially bear the brunt of this burden.

But both are at least slowing in line with global trends, and South Africa is reaping a bumper grain harvest currently. DM

Become an Insider

Become an Insider

Comments - Please login in order to comment.