Maverick News

How to avoid getting zapped by insurance claims related to rolling blackouts

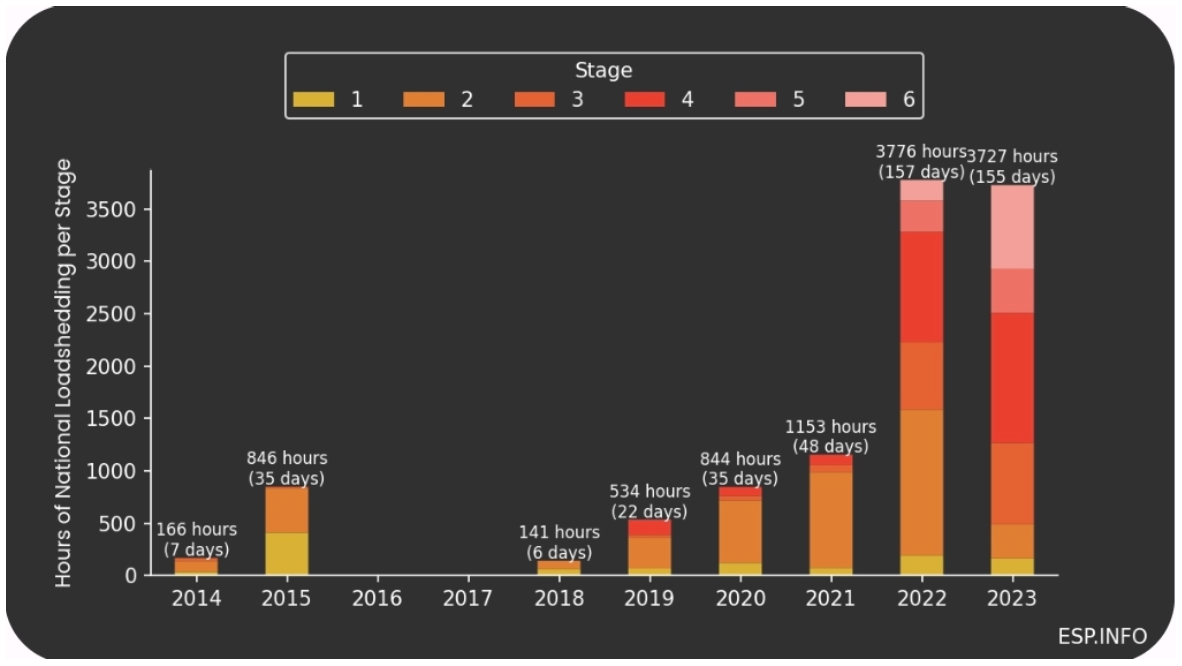

Insurance claims related to load shedding or rolling blackouts have increased significantly in the last few years, as rolling blackouts have also grown in intensity.

According to Eskom se Push, we have had 3,892 hours or 162 days of rolling blackouts to date for the year. Insurers Old Mutual and Dial Direct have reported an increase of 80% to 93% in rolling blackout-related insurance claims over the last year, compared to pre-2019.

Escalation in load shedding hours from 2014 to 1 July 2023. (Source: Eskom se Push)

Speaking at a Daily Maverick webinar recently, Christelle Colman, founder and chief executive of Ami Underwriting Managers and Ernest North, co-founder of Naked Insurance agreed that while claims have increased exponentially, insurers are taking different approaches.

North says for the most part, the actual cover for damage from power surges post a rolling blackout has not changed, but insurers have now recognised the increased risk of a total blackout or national grid failure. “That’s defined by most insurers as an event where a whole municipality or broader area is hit by an unplanned outage, and that is a level of electricity failure that’s significantly beyond anything that we’ve seen,” he said.

North says if insurers had to charge premiums based on the possibility of a national grid failure, insurance would quickly become unaffordable. “Policyholders need to understand how to reduce the impact of that risk, where the power surge impact is likely to be more significant than the power surges we currently see on a daily basis,” he said.

Colman agreed, adding that there are insurers that have made changes to their policies, such as limiting the cover for power surge claims. Colman said other insurers have noted that you are only covered if you have a form of surge protection and yet others have increased excess amounts on power surge claims or are increasing premiums to match the increased risk of power surge damage. She recommended having a surge protector installed directly on your DB board.

“I think a key message is to make sure you read through your insurance policy so that you understand what you are and are not covered for. Although household contents and home insurance is fairly standard in South Africa, there are small differences between different policies,” she said.

Solar and inverter system installations must be verified

When you install an inverter system with solar panels on your property, Indwe Risk Services advises that you:

- Use licensed/accredited suppliers and contractors for the purchase and installation of solar power systems.

- Only allow certified electricians to work on the electrical system of your home, especially when connecting external systems and devices to your primary circuits.

- Ensure that the appointed contractors have undertaken an evaluation of the suitability of the roof to carry the additional weight of the solar system being installed.

- Verify that appointed contractors provide proof of contractors’ liability insurance, with a recommended minimum cover limit of R10-million.

- Keep all relevant documents, including warranty documents, original purchase invoices, and signed contracts.

- Obtain a Certificate of Compliance (CoC) and ensure compliance with the latest edition of SANS, as these will be requested during the claims process.

- Understand the maintenance and servicing requirements of your solar system and ensure that these are accounted for in the pricing.

The biggest reason for the stringent conditions is the risk of fire damage due to poor wiring installations.

“We are seeing more (fire-related claims) coming through now as solar installations increase. The last thing you need in that scenario is to have your house burn down and realise that it was the result of a faulty solar installation,” Colman warned.

Onus on consumer to take reasonable precautions

The onus is on you, the policyholder to take all reasonable precautions to reduce your risk and ensure that your belongings are properly protected.

“If you aren’t being a reasonably responsible person by making sure your generator is serviced or your electrical wires are installed by a professional, then you have little to worry about. However, if you are using a guy down the road to install your solar panels and inverter or you are overloading a plug point, and your house burns down as a result, your claim is likely to be rejected,” North said.

Policyholders are also advised to check that backup batteries for electric fences, driveway gates and alarm systems are in working order, to reduce the risk of burglaries or car hijackings during rolling blackouts.

Colman also pointed out that solar installations increase the value of your property. “When you install a solar solution, you need to inform your insurer so that the value of your property can be adjusted accordingly. There is an insurance rule of average, which means that if you are underinsured, your claim will not be paid out in full. For example, if it will cost you R2-million to rebuild/replace your home and you have only insured it for R1-million, that means you are 50% underinsured. If you have a fire, and the claim is R500,000, the insurer is going to say sorry, you are 50% underinsured, so we are only going to pay out 50% of the claim. This means your payout will only be R250,000,” she said.

While assets do depreciate and this can reduce the cost of your insurance, the replacement value of items may mean that you need to increase your cover. Colman said across different asset classes, you need to understand the difference between being insured for replacement value and being insured for a loss. DM

Comments - Please login in order to comment.