CLAIM STATISTICS

Life insurance claims show how SA’s death toll soared in 2021

Claim statistics from life assurers corroborate what a heavy toll Covid-19 has taken on South Africa. Sanlam says most of the R3.9-billion it paid out in 2021 — almost double what it paid to clients in 2018 — was for death claims.

Sanlam Individual Life has revealed that it paid out R8.24-billion in claims last year — almost double what was paid to clients (R3.9-billion) in 2018. Of the claims paid, the majority can be attributed to death claims.

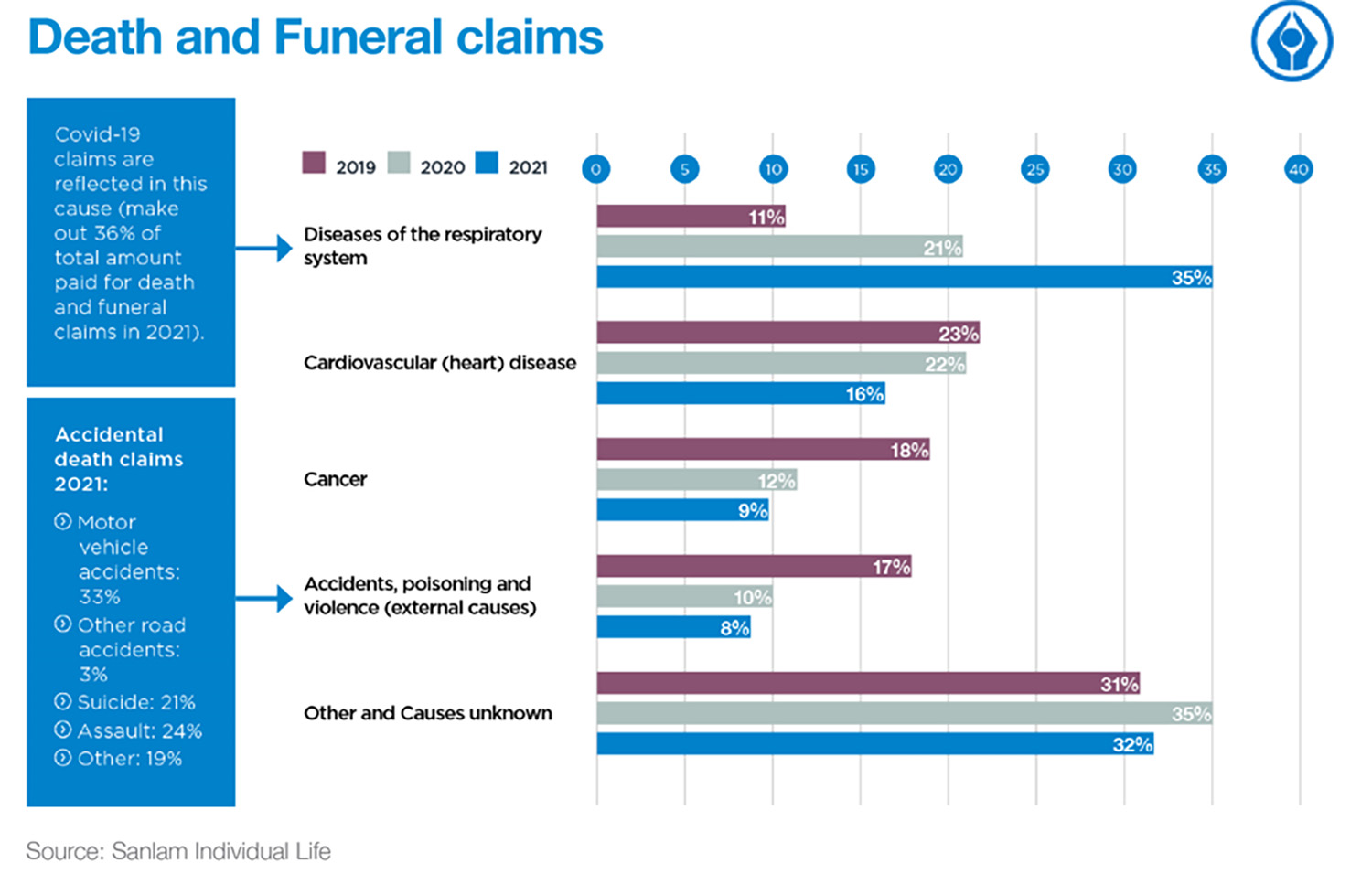

The business also paid 82% more in death and funeral claims in 2021 compared with the year before. The largest single death claim was R36.1-million, with a total of R7.2-billion paid for death claims in 2021.

Most death claim payouts were linked to “diseases of the respiratory system” for men and women. This includes R2.6-billion for confirmed Covid-19 claims and highlights the devastating impact of the pandemic.

Petrie Marx, product actuary at Sanlam Individual Life, acknowledges that it will take time to fully appreciate what Covid-19 did — and did not — affect directly.

“For example, deaths resulting from cancer and heart conditions increased somewhat between 2020 and 2021,” says Marx.

“This may be related to the indirect effects of Covid-19, which saw lower levels of routine health checks during hard lockdown, or it may be caused by another factor. This is a trend we will have to watch closely.”

Although 68% of death and funeral claims were paid to men, the disproportionate statistic may not be all that unusual. Marx says men typically tend to die earlier than women and that they may have taken out more life cover in the past.

It is well documented, however, that Covid-19 has had a more devastating effect on men. Despite this, men still have lower vaccination rates.

Claims higher for under 55s

Those aged 55 and under are showing increased vulnerability to severe illness and disability. Sanlam Individual Life reports that 61% of severe illness claims were from people under 55, while cancer accounted for 53% of the total claims in this category.

In women, 65% of all cancer claims were for breast cancer, while 25% of cancer claims from men were for prostate cancer.

On the disability claims side, 63% of claims were from clients under 55. This included a 34-year-old architect who was paid out R152,000 under his disability cover after he was involved in a motorbike accident and booked off for three months.

Covid-19 surfaced again when it came to income protection claims, accounting for 19% of claims in this category.

Marx says a further R58-million was paid under the sickness benefit for professionals who were booked off work because of Covid-19 — almost double the amount paid in 2020.

Health professionals accounted for the vast majority (74%) of Covid-19 claims under the sickness and temporary disability benefit.

Toll fades…

FNB Life says in the past six months alone, death-related insurance claims have returned to pre-Covid 19 pandemic levels. The insurance provider says the Fourth and Fifth waves were less severe compared with the first three waves.

Before the pandemic, FNB Life paid out an average of R99-million in death-related claims a month. Between the First and Third waves of Covid-19, however, this increased significantly, peaking at about R300-million in monthly payouts.

“At the height of the pandemic, we significantly improved our capacity to process high volumes of claims and payouts,” says Lee Bromfield, chief executive of FNB Life.

“While we have been able to assist beneficiaries during this difficult time, we are also pleased to see that the impact of Covid-19 on loss of life is starting to fade.

“This is also reflected in our monthly death-related claims across all of our life products, which closely correlate with the Covid-19 national database trends,” Bromfield says. BM/DM

Become an Insider

Become an Insider

Comments - Please login in order to comment.