For Nvidia, Arm would have provided an invaluable strategic asset, as it designs the core processors that power practically every modern smartphone plus a growing array of more powerful electronics. But regulators across Europe and the U.S. have voiced concern about the deal, adding to a chorus of objection from chip industry players. The U.S. Federal Trade Commission sued to stop the transaction in December.

Nvidia Is Said to Prepare to Abandon $40 Billion Arm Deal

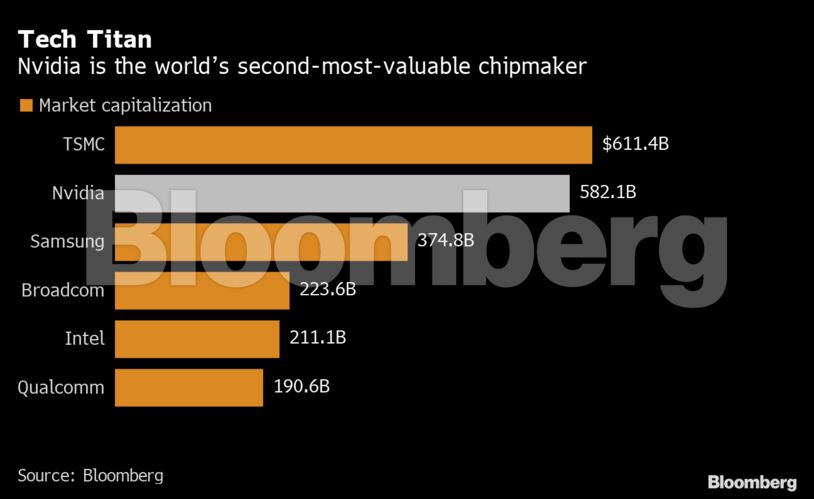

Companies like Qualcomm Inc., Intel Corp. and Alphabet Inc.’s Google have said that Nvidia can’t preserve Arm’s independence because it’s an Arm customer itself. Nvidia, the largest maker of graphics chips, competes with Intel in server processors and is expanding into new areas that would put it in direct competition with many other Arm licensees.

What Bloomberg Intelligence Says

SoftBank Group may need to tap other capital sources to fund investments if its sale of Arm to Nvidia falls through, potentially leaving its bonds to trade wide in the near term. It could raise money from third-party investors in Vision Fund 2 and an IPO of ARM, which may not boost asset value as much as a sale to Nvidia. Weak stock markets may make it tough for large divestments, while its ratings could come under pressure if borrowings rise.

— Sharon Chen and Hui Yen Tay, BI analysts

Click here for the full report

SoftBank shares closed at 5,069 yen after a 5.3% drop on Tuesday, driven down by a global tech selloff by spooked investors. The company’s investment strategy makes it a proxy for the tech industry as a whole, so its fortunes are heavily dependent on the overall sector’s performance. SoftBank is engaged in a 1 trillion yen ($8.8 billion) buyback program to bolster its shares.

“There has been scant progress with the procedures related to the acquisition,” Citigroup analyst Mitsunobu Tsuruo wrote after the report. “An IPO would delay the monetization of Arm assets, with uncertainty about the scale of the monetization also an issue.”

Become an Insider

Become an Insider

Comments - Please login in order to comment.