The central bank will roll out more policies to stabilize economic growth, front-load actions and make preemptive moves, he said. It will address common concerns in the market in a timely manner and stay ahead of the market curve, he said.

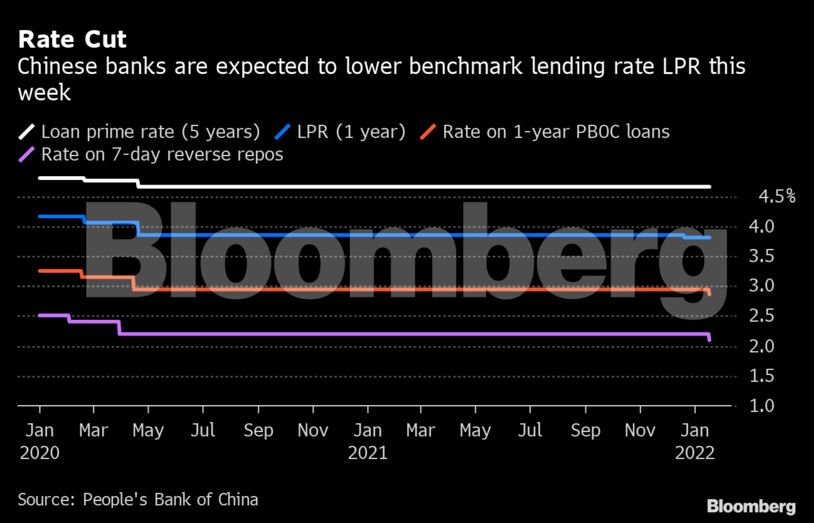

The dovish comments came a day after the PBOC cut its policy interest rate for the first time in almost two years, signaling the beginning of an easing cycle. A sharp downturn in the property market continues to roil the economy and credit markets, putting pressure on policy makers to step up support.

Read More: China’s Spreading Property Debt Crisis Pressures Xi to Ease

Economists expect Chinese banks to lower the loan prime rate Thursday following the PBOC’s action Monday. The LPR, which is based on 18 banks’ quotes for their best customers, is impacted by factors including funding costs, market supply and demand as well as risk premium, Liu said. This week’s cut in the policy interest rate — the medium-term lending facility rate — has led to a drop in rates in money and bond markets, he said.

What Bloomberg Economics Says…

We think the remark by PBOC Deputy Governor Liu Guoqiang on “avoiding collapse in credit growth” was a clear signal that the central bank will step up efforts to stabilize credit expansion in the face of considerable downward pressure, particularly financial distress among real estate developers.

Eric Zhu, China economist

For the full report, click here.

Speculation is also rising the PBOC will cut policy rates again and also lower the reserve requirement ratio for banks.

Liu said the room for further RRR cuts has narrowed as the average ratio of 8.4% for financial institutions is not high compared with other developing economies or the past. But “there still remains a space” even though it has narrowed, and the PBOC will cut the RRR depending on the economy and the need of macro policies, he said.

The PBOC “sent a loud and clear easing signal through today’s press conference, partially as policymakers try to guide market expectations,” Goldman Sachs economists led by Maggie Wei wrote in a note Tuesday.

Liu’s remarks suggest the LPR will likely be lowered Thursday and the RRR could be cut if growth disappoints, they wrote. Goldman now expects a 50-basis point RRR cut in the first quarter and another 10-basis point policy interest rate cut in the second quarter.

In response to a question about possibility of further rate cuts, Liu said the average corporate loan interest rate was 4.61% in 2021, the lowest level in over four decades.

This comment suggests there’s now less likelihood of another rate cut, though it could happen depending on how well the economy performs in the first quarter and whether the property sector recovers, Xiong Yuan, chief economist at Guosen Securities Co., wrote in a note Tuesday.

The PBOC’s easing stance is in stark contrast with other major central banks like the Federal Reserve, which is forecast to hike rates to contain inflation. China’s sovereign yield curve is poised to steepen as the nation’s bonds extend an advance on expectations the central bank will continue cutting official rates while its global peers tighten policy.

“China’s rates market has yet to fully price in fundamental economic weakness, covid disruptions, and more importantly, the prospects for further rate cuts,” analysts at China International Capital Corp. including Chen Jianheng wrote in a note. They see room for yields to slip and recommend investors add leverage and duration in the first quarter.

Stable Debt

China’s macro leverage ratio, or the debt-to-gross domestic product ratio, is expected to stay stable in 2022, Liu said. The ratio declined for the fifth straight quarter to 272.5% by the end of last year, providing room for policy action, he said. He reiterated the PBOC will match the pace of credit expansion with nominal economic growth.

On the yuan, Liu said China will aim to keep the exchange rate stable, and market and policy factors will help correct any short-term deviation from its equilibrium level. The PBOC will allow market demand and supply to play the determining role in forming the exchange rate, he said.

He also told the briefing the PBOC won’t allow one-way moves in the exchange rate, although those comments were not included in an official transcript of the event posted on the central bank’s website.

Other highlights of the briefing:

- Financial institutions should not only welcome clients but also make proactive moves. They need to look for good projects actively, to enhance the structure of the economy

- The policy rate cut this week shows monetary policy is proactive and front-loaded, and has boosted market confidence. The cut will spur borrowing demand and support the issuance of government bonds

- The five-year LPR — a reference rate for mortgages and seen by the market as a signal of the PBOC’s attitude toward the property market — is also a reference for long-term loans in areas including manufacturing, fixed-asset investment and mortgages. It’s “not just targeted at any specific industry or individual,” said Liu

- A total of 261 million individual digital yuan wallets have been set up by the end of 2021, with transaction value at 87.6 billion yuan ($13.8 billion). The PBOC will expand testing in areas including retail transactions, residents’ fee payments and government services

Comments - Please login in order to comment.