“Ant Group’s valuation may plunge further if its payment unit is forced to break up due to potential anti-trust probes by China’s central bank,” Chan wrote in a research note.

The revised estimate for Ant is a far cry from valuations that ran as high as $320 billion before the company was forced to scrap its record initial public offering in November. China’s crackdown forced Ma’s firm to withdraw the $35 billion IPO just days before its planned listing in Hong Kong and Shanghai.

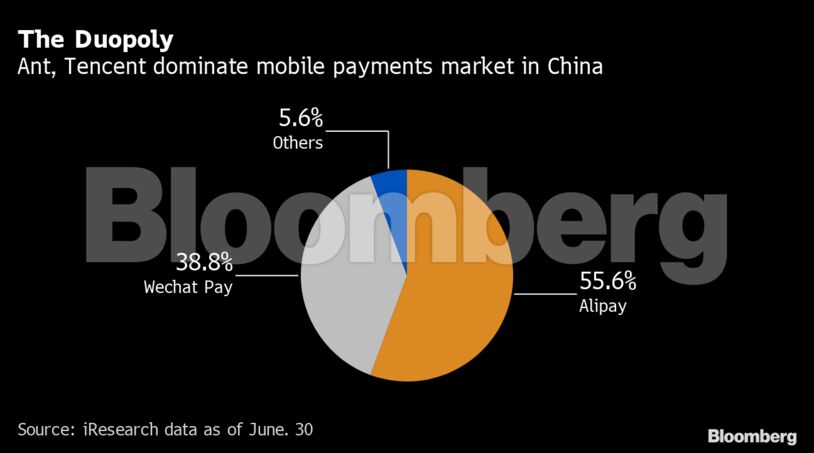

China’s central bank said on Wednesday that any non-bank payment company with half the market share for online transactions, or two entities with a combined two-thirds share could be subject to antitrust probes.

If a monopoly is confirmed, the central bank can suggest the cabinet impose restrictive measures including breaking up the entity by its business type. Firms already with payment licenses would have a one-year grace period to comply with the new rules, the central bank said.

Alipay, with about 1 billion users, controls 55% of the mobile payments market. A break up could reduce its 600 billion yuan valuation in half, Chan said, adding it’s questionable whether Ant can relaunch its IPO this year.

Alibaba Group Holding Ltd., which holds a stake in Ant, fell for a second day in Hong Kong, dropping 2.9% at 9:57 a.m. The shares jumped 8.5% on Wednesday after Ma emerged in public for the first time since China began clamping down on his businesses, ending several months of speculation over his whereabouts.

Become an Insider

Become an Insider

Comments - Please login in order to comment.