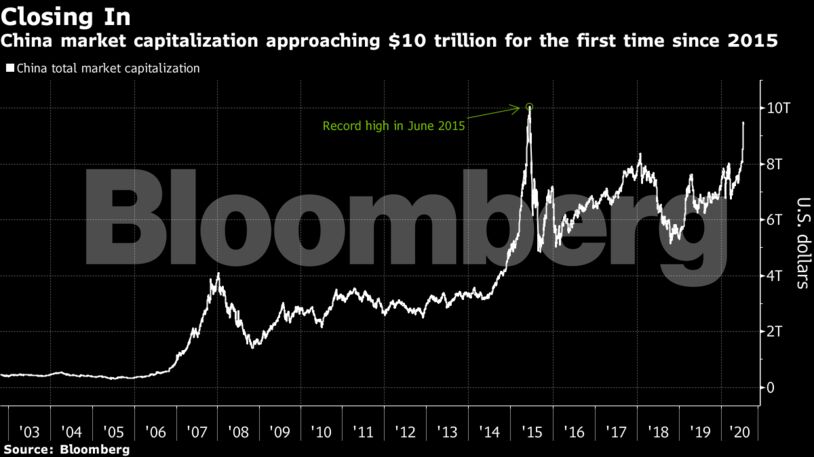

But the $10 trillion level also marked the top of the bubble five years ago, a memory that’s still fresh in investors’ minds. Similarities between now and then have started to displease policy makers, who have taken steps to rein in stocks: Shanghai’s large caps slumped Friday after two government funds said they plan to sell shares. And while state media are still championing the bull run, a front-page commentary Monday underlined the importance of a “healthy” stock market.

Despite the warnings, investor interest remains high. The CSI 300 Index fluctuated early Tuesday, at one point climbing as much as 0.2%. Hao Hong of Bocom International Holdings Co., one of the few who predicted the start and peak of China’s last equity boom, says stocks are unlikely to stop at the $10 trillion mark this time. China International Capital Corp. analysts went as far as predicting the market will double in as little as five years.

“The upward trend remains intact,” Hong, Bocom’s head of research, wrote in a note. “The general mantra from the top remains supportive of the market. It helps the domestic sentiment, strengthens the national resolve, and finances capital investment into new and innovative industries.”

The value of Chinese stocks rose above $10 trillion for the first time in June 2015, as investors piled into the nation’s equities using borrowed funds. A tumble over the next three months erased more than $5.2 trillion in value as sellers scrambled to liquidate margin trades.

This time around authorities appear keen to engineer a steady bull market. At 1.33 trillion yuan as of Monday, leverage is barely half the level of its 2015 peak while valuations are still relatively cheap compared to other stocks globally.

China’s domestic brokers, whose businesses stand to benefit significantly from a boom in trading and margin financing, have every interest in being bullish on stocks. But that sentiment is also becoming consensus on Wall Street, with Goldman Sachs Group Inc. and Morgan Stanley predicting that the bull market can last for the next few months at least.

The rally has coincided with China’s efforts to accelerate market reforms, such as plans to include stocks listed on the tech-focused Star board on the Shanghai Composite Index. Combined with a market that is poised to push past a highly symbolic level, such moves are set to support further gains, according to Steven Leung, executive director at UOB Kay Hian (Hong Kong) Ltd.

“Passing the $10 trillion mark would be the beginning of a huge bull market,” he said.

Become an Insider

Become an Insider