Risk assets shrugged off reports that Chinese officials had told agricultural companies to pause purchases of some U.S. farm goods, threatening a hard-won trade deal. Treasuries were little changed.

Global stocks are trading at a three-month high as businesses reopen around the world following coronavirus shutdowns, even with unemployment escalating. Goldman Sachs Group Inc. said the U.S. labor market is showing the earliest signs of rebounding. Euro-area data on Monday also signaled factories have started down their long road to recovery.

“May’s data suggested the worst of the contraction may be behind us, but we see a bumpy restart in coming months,” BlackRock Investment Institute strategists led by Mike Pyle said in a report.

Investors mostly looked past the sometimes violent demonstrations across U.S. cities, over the killing of George Floyd, an unarmed black man, by police. Meanwhile, New York has imposed a curfew amid mass protests that led to looting and violence.

Elsewhere, oil steadied as investors assessed whether OPEC and its allies will extend the supply curbs that helped drive prices higher. Gilead Sciences Inc. fell after its drug remdesivir showed only a limited benefit in a large trial.

Here are some key events coming up:

- In Europe, the ECB is expected to top up its rescue program with an additional 500 billion euros of asset purchases at a meeting on Thursday. Anything less than an expansion would be a big shock, Bloomberg Economics said.

- The U.S. labor market report on Friday will probably show American unemployment soared to 19.6% in May, the highest since the 1930s.

These are the main moves in markets:

Stocks

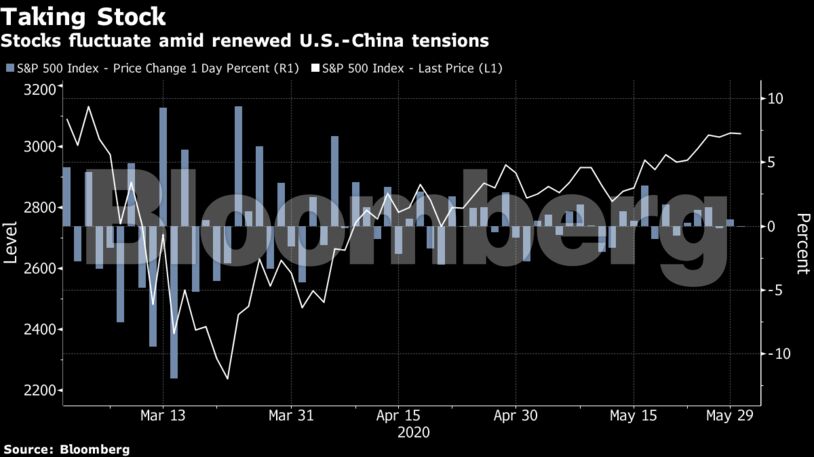

- S&P 500 futures fell 0.6% as of 11:32 a.m. in Tokyo. The S&P 500 rose 0.4% at the close of trading in New York.

- Topix index rose 1%.

- Australia’s S&P/ASX 200 Index fell 0.2%.

- South Korea’s Kospi index rose 0.7%.

- Hong Kong’s Hang Seng Index rose 0.5%.

- Shanghai Composite was little changed.

- Euro Stoxx 50 futures rose 0.4%.

Currencies

- The Bloomberg Dollar Spot Index was little changed after declining 0.7%.

- The yen traded at 107.66 per dollar, little changed.

- The offshore yuan was at 7.1320 per dollar, down 0.1%.

- The euro fell 0.1% to $1.1123.

Bonds

- The yield on 10-year Treasuries held at 0.65%.

- Australia’s 10-year bond yield was at 0.90%.

Commodities

- West Texas Intermediate crude was little changed at $35.48 a barrel.

- Gold was little changed at $1,739.15 an ounce.

Become an Insider

Become an Insider