BUSINESS MAVERICK

The Eskom Pension and Provident Fund overpays for underperformance at the expense of Eskom employees

The Government Employees Pension Fund, and Eskom Pension and Provident Fund are respectively the largest public and private pension funds in the country, as measured by member assets under management. But Eskom’s fund balance of R140-billion is dwarfed by the government fund’s R1.4-trillion, yet it costs 80,000 private members more to keep the Eskom fund up and running than it does for the 450,000 participants of the public pension fund.

The Eskom Pension and Provident Fund (EPPF) is South Africa’s second-largest retirement provider of defined benefits. Most investors are focused on its solvency ratios and metrics of material costs, and less so on operational costs because of the proportion of the assets under management.

A few percentage point changes in the operation costs has never been much of a cause for concern. But when operational costs become a significant financial burden, pensions should take notice.

The CEO and principal officer of the EPPF, Linda Mateza told Business Maverick the justification for self-administration, as opposed to outsourcing the administration, is that it keeps operational costs down.

However, a Business Maverick analysis finds that what EPPF employees earn is excessive and totally out of touch with industry norms, but strangely enough, this has never been scrutinised or explained.

Unpacking the numbers in the EPPF’s annual financial statements of the last few years is shockingly revealing. It shows that the monthly cost-per-member at the EPPF is five times higher than comparable private-administered retirement funds, or even the Government Employee Pension Fund (GEPF). And there seems to be no stopping the spending spree.

The cost of operations increased by 30% in the 12 months to June 2019 and according to Business Maverick’s calculations. The cost per member went up from R199 in 2018 to R258 a year later, which demonstrates that self-administration does not come cheap. It is in stark comparison with the measly R50 the GEPF made off members for managing their money in 2018, even after the 7% hike to R53 a year later.

It’s worth asking whether the cost difference is why the GEPF can afford a pension increase of 3,6% from 1 April 2020, while its EPPF, which is a private pension fund, could only manage 2% at the beginning of the year?

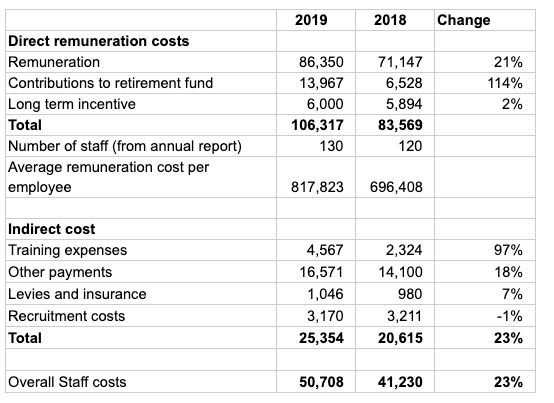

The EPPF’s wage bills totalled R106-million in 2019, up 27% from R83-million the year before, which makes that seem likely. With a total staff complement of 130 on the payroll, the average annual salary amounts to R68,150 per employee per month. That doesn’t even include the entertainment and travel expenses of R5-million and R12.5-million respectively reported over the two years. It also excludes the remuneration of the principal officer and board of trustees.

Here is a breakdown of staff costs over the past two years: (in R ‘000s)

Notes to the financial statements indicate former CEO and Principal Officer Nopasika Lila was on a salary of R8.85-million for the nine months she was in charge of the fund. The former CEO took over from S’bu Luthuli after his contract was not renewed. But she didn’t stick around for long, and even got leave pay of R330,000, despite being “afforded” special leave for serving her three-month notice period by sitting at home.

Her predecessor, Luthuli, was on a salary close to R10-million when he left in 2018. Between 2016-2018, his basic salary was pumped up by about R2-million a year, which doesn’t even include bonus payments or any other perks of his package.

Whether Lila or Luthuli received any retirement benefits on their departure is unknown as disclosure is not a regulatory requirement. The EPPF denies that any retirement rewards were extended, but insiders say that Lila was paid some pension benefit at departure. Luthuli’s parting payslip was prepared at board level and only known by a trusted few.

What the GEPF pays its principal executive officer, Abel Sithole after five years of service is a flat R5-million and salaries are payable to only a handful of other full-time employees. It also outsources the administration function to the Government Pensions Administration Agency. The total IT and staff costs of administration is about R48 per GEPF member for the 2019 financial year. The costs of IT and staff members at the EPPF is a staggering R219 per member per month, during the same period.

What the EPPF pays the trustees of the board is another contentious issue. The regulations prescribe that half the board is made up of Eskom executives, who are paid by the employer already to serve on behalf of employees. Then there are three union reps paid by their respective unions, so why they are being paid fees by the fund is an open question. The pensioners can only choose one representative elected by majority vote.

There are only two independent directors according to the annual report. One is former Public Investment Corporation CEO, Elias Masilela, who resigned from his post in September 2019. The other “independent” is the board chairman, Mantuka Maisela, who signed off on Luthuli and Lila’s remuneration packages and approved their membership of the retirement fund.

What the 2019 financials reflect in the remuneration of the trustees does not look unreasonable or out of line with industry norms, but it seems excessive with only one independent director on the board and with actuarial or investment expertise in short supply.

A true reflection of the conflict of interest that exists at the trustee level can be found in an audit finding in the 2018 financial statements. The PwC called the cost of compensation, following very generous increases put forward by Luthuli and approved by the chairman, “a material risk that requires resolution”, before PwC would sign off on the financials.

The responsibility fell on Lila to do so, and subsequent to her actions, the board called for a vote of no confidence against her, calling her performance and competence into question. She resigned from her post soon after, citing personal reasons. Lila has yet to respond to requests for interviews. BM

Become an Insider

Become an Insider