The gold sector has been anticipating a wave of asset sales in the wake of Barrick’s $5.4 billion acquisition of Randgold and a second mega-merger that created Newmont Goldcorp Corp. The newly combined giants were expected to put several unloved mines up for sale, leaving lots of room for maneuvering by company executives who have missed out on the dealmaking.

“It’s not a fire-sale, it’s a considered process,” Bristow said in a separate interview with Bloomberg TV. “We’ll work with those stakeholders, and we will let the market know when we’re ready to let them know once we’ve got a way forward for each of those assets.”

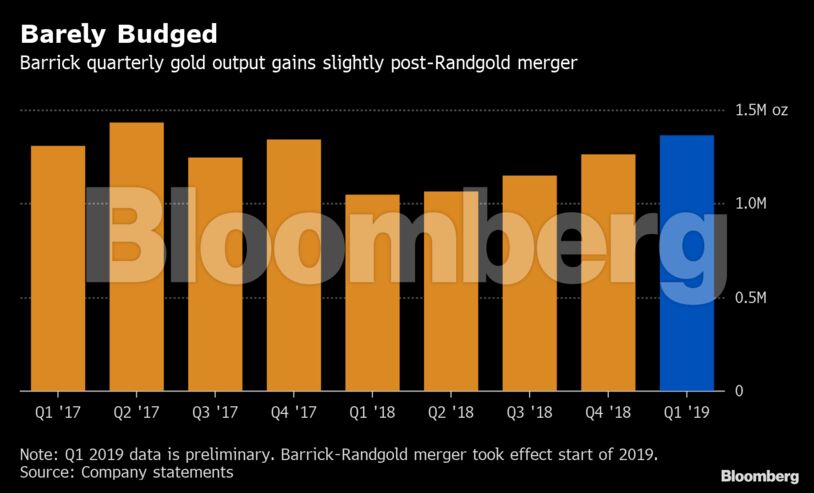

The objective is for the sale process to be well advanced by mid-2020, Barrick said in its first-quarter earnings statement, its first results since its acquisition of Randgold was completed.

Barrick will focus on finding the right buyers for its assets and is willing to help them manage the mines during a transition period, if required, Bristow told BTV. Some of the assets Barrick is selling are in countries that the company still wants to invest in, he says.

In the meantime, the Toronto-based miner also won’t hesitate to “pick up other assets” that may be available.

Barrick said its joint venture agreement with Newmont is expected to close by the end of the quarter. In March, Barrick withdrew a $17.8 billion hostile bid for Newmont after negotiating the joint venture combining most of their assets in Nevada. Barrick has a 61.5 percent stake in the JV to Newmont Goldcorp’s 38.5%.

Barrick also said it will declare a quarterly dividend of 4 cents a share.

Become an Insider

Become an Insider