BUSINESS MAVERICK

The run-up to elections thwarts Africa’s M&A activity and South Africa is not spared

South Africa is not the only country in sub-Saharan Africa facing a make-or-break general election in 2019. Citizens in more than seven countries will be heading to the polls, among them Benin, Madagascar, Malawi, and Botswana. Any build-up to elections makes the business community nervous and this is starting to reflect in mergers and acquisitions indicators. If the latest data is anything to go by, companies and investors are deferring big investment decisions until various election cycles are over. This deferral is also evident in South Africa.

Historically, general elections are a source of angst for the investment and business community around the world.

When it comes to the run-up to elections, investors, who are usually in speculative mode, have no shortage of things to worry about.

Arguably, the top concern is whether a new government might bring in new populist policies that might adversely impact investments, the functioning of companies and the health of the economy. This uncertainty prompts investors to avoid taking risks, resulting in large investment decisions being put on until hold the future is much more certain.

The business and investment community in South Africa and Africa as a whole is no different, if the latest figures by financial data provider Refinitiv are anything to go by.

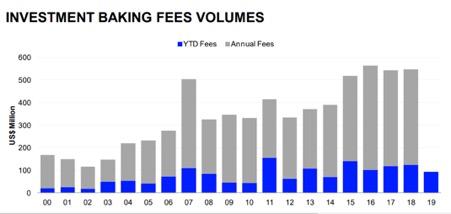

Investment banking fees achieved by bankers and corporate financiers in sub-Saharan Africa dropped during the first quarter of 2019, a key indicator that mergers and acquisitions (M&A) activity is slowing ahead of elections scheduled by several African countries.

According to Refinitiv, investment banking fees have fallen to a five-year low of $93.5-million (R1.3-billion) during the first quarter of 2019, which is 24% less than the value recorded in the same corresponding period in 2018.

Source: Refinitiv

Using Thompson Reuters data, Refinitiv tracks transactions with a value of at least $1-million (R14-million) that are either announced, on-going, pending regulatory approval and completed. It assesses mergers, spinoffs, minority stake purchases, capital raisings, and restructurings.

Industry players said political and economic uncertainty are the main reasons for the rapid decline in investment banking fees. You don’t have to look far for seismic events that spur uncertainty: the UK’s on-going and confusing Brexit negotiations, US President Donald Trump taking a more protectionist stance on global trade, South Africa’s own political madness – just to mention a few.

However, Franita Neuville, Refinitiv’s market development manager of investment and advisory for the Middle East and Africa regions, doesn’t mince her words, saying election cycles in several sub-Saharan Africa countries during the first quarter heightened uncertainty, thus impacting investment banking fees.

“The investment banking fees, which are the lowest we have seen in five years, generally a reflect the uncertainty of elections that happened in sub-Saharan Africa in the first half of this year,” Neuville told Business Maverick.

Countries that held elections during the first quarter are west African nations Nigeria, Senegal, and Guinea-Bissau, and the Indian Ocean island nation of Comoros.

Although South Africa’s elections are scheduled in the second quarter (8 May), Neuville said the build-up to elections would have impacted first quarter investment banking fees.

“Things are not going great in the US and UK. This is just leading to companies in these countries being more inward-looking and not necessarily investing in offshore markets and investing in African countries. Domestic companies are also holding off and waiting to see what is happening on the elections side. There is a general risk-off sentiment,” she said.

Neuville expects that data for the second quarter to be subdued – a period in which South Africa, Benin, Madagascar, and Malawi would have held elections. “We could see companies not making big investments until the elections are completed.”

Refinitiv breaks investment banking fees into four categories: M&A-related fees, equity capital markets fees (capital raisings on stock exchanges), debt capital market fees (issuances of government and corporate bonds) and lending fees (loans from financial institutions).

Fees from completed M&A transactions totalled $36.9-million (R519-million), a 31% increase year-on-year. Equity capital markets underwriting fees reached $11.6-million (R163-million), down 70% from the first quarter of 2018 to a two-year low, while fees from debt capital markets underwriting fell 53% to a three-year low of $14-million (R197-million). Meanwhile, syndicated loan fees increased 20% year-on-year to $30.1-million (R423-million).

South Africa boosts Africa M&A

South Africa, which is Africa’s most industrialised economy, skewed the value of M&A transactions in sub-Saharan Africa for the first quarter of 2019 because of one large deal.

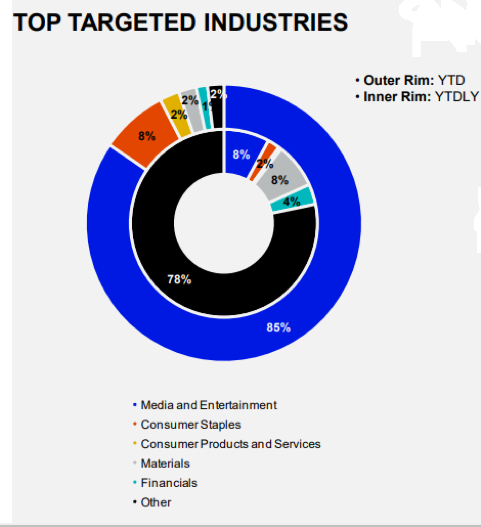

According to Refinitiv’s figures, the value of announced M&A transactions with any sub-Saharan African involvement reached $8.8 billion (R124-billion) during the first quarter of 2019, up 41% from the same period last year. This was thanks to the conclusion of Naspers’ spinoff of its pay-TV business MultiChoice on to the JSE.

The inclusion of the MultiChoice spinoff in M&A numbers can be misleading because it was initially announced in the third quarter of 2018 (September 2018 specifically) but was completed in February 2019. Asked whether the value of M&A transactions would have been substantially lower if the spinoff of MultiChoice was not concluded in the first quarter, Neuville said: “That is definitely true.”

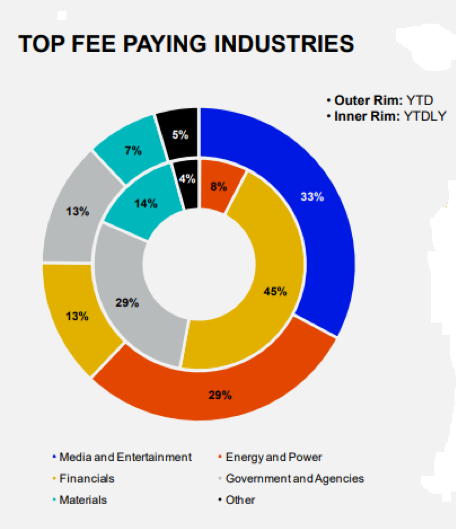

The media and entertainment sector, which the MultiChoice spinoff falls under, contributed significantly to the total value of M&A transactions ($8.8 billion) and investment banking fees ($93.5-million) – 85% and 33% respectively (see below). “From that perspective, if we didn’t have the deal, we would have not seen the level of increase in overall M&A activity.”

Source: Refinitiv

Morné van der Merwe, the head of corporate/M&A in Johannesburg at law firm Baker McKenzie, shared Neuville’s views about investors shelving investment plans until elections are concluded.

“I would be very surprised if we see a large number of new deals originating in the period running up to elections. There is a wait-and-see approach being adopted by investors,” said Van der Merwe, who engages with foreign investors in the mining sector on a regular basis.

He said South Africa has always been viewed as a complex country by foreign investors, but recent political and policy events have upped the ante on its risk. Talks to expropriate land without compensation, systemic corruption in the public and private sector, the deterioration of public finances, an economy that is stubbornly stuck at a less than 2% annual rate, and the insolvency of state-owned enterprises are some of the issues rattling investors.

These issues came to a head last year, with figures from Global Transactions Forecast issued by Baker McKenzie and Oxford Economics indicating that South Africa concluded $4.3-billion (R60-billion) worth of deals in 2018 – a drop from 2017’s $7.5-billion (R105-billion).

Despite concerns about elections thwarting investments, Baker McKenzie and Oxford Economics expects the value of deals in South Africa to increase to $6.2-billion (R87-billion) in 2019 on the back of more market-oriented policies and anti-corruption efforts under the leadership of President Cyril Ramaphosa. That’s if South Africans give the ANC a decisive vote of confidence on 8 May, which would afford Ramaphosa a mandate to govern for five more years.

Van der Merwe said a rebound in deals also hinges on whether business confidence improves, which bodes well for investments, and in turn, economic growth. DM

($1 = R14.05, April 16, 2019, 08.46)

Become an Insider

Become an Insider