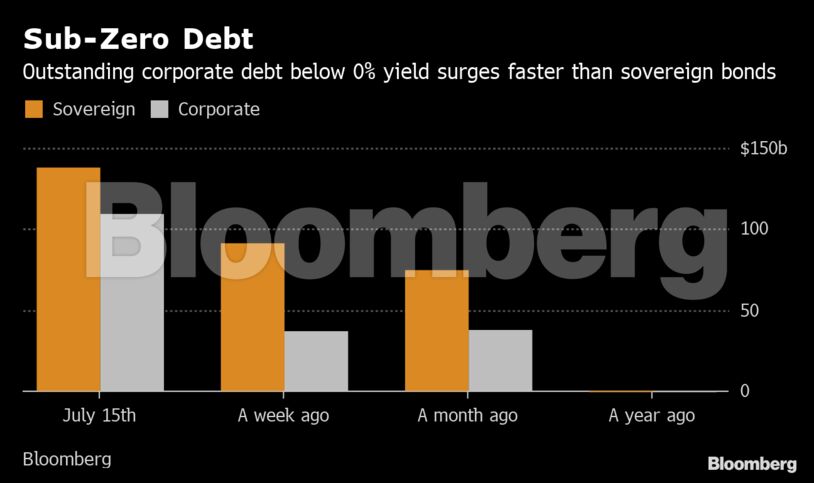

Corporate heavyweights such as China Everbright Bank Co. and Petroleo Brasileiro SA, and sovereigns including Poland and Hungary have seen their rates drop below zero after a dovish turn at Federal Reserve and the European Central Bank sparked a mad dash for yield. Emerging-market bonds handed investors 3.5% over the past two months, more than a percentage point above returns on U.S. Treasuries, according to Bloomberg Barclays indexes.

- The amount of negative-yielding corporate bonds almost tripled to $109 billion from a week ago

- Sovereign bonds with sub-zero rates climbed about 50% to $136 billion

“This is a global phenomenon, not an EM phenomenon,” said Warren Hyland, who manages emerging-market debt at Muzinich & Co. in London. “Ultimately if less and less of bonds generate a positive yield, that means more and more people are looking for a positive-yielding bond and EM has more of that than elsewhere.”

Developing-nation debt attracted inflows for a fifth straight week through July 10, according to Bank of America Merrill Lynch, which cited EPFR Global data.