Business Maverick

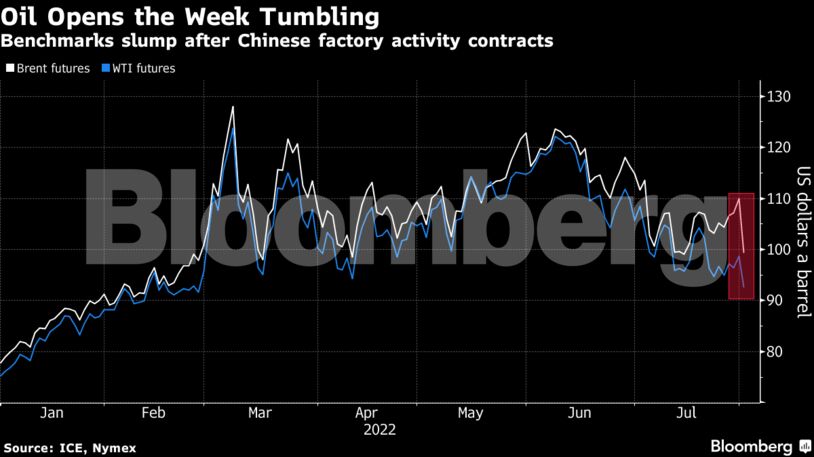

Oil Plunges as China Slowdown Spurs Concern Over Demand Outlook

Oil slumped as poor manufacturing figures across the globe fuelled concerns that a global slowdown may sap demand for crude.

The resurgence of Covid-19 cases in China and the ramifications of the country’s strict pandemic strategies will continue to “negatively impact oil demand until at least November of this year, when a strategic change in Covid policy could be announced,” said Harry Altham, energy analyst for EMEA and Asia at StoneX Group.

Oil trading has been volatile in recent months as concerns about a slowdown hurt demand for commodities even as underlying signals point to a relatively tight physical market. The US economy shrank for a second quarter while the Federal Reserve hiked rates by 75 basis points.

Libya’s crude output has rebounded after a series of disruptions that more than halved supply, according to Oil Minister Mohamed Oun. Nationwide production has returned to 1.2 million barrels a day, a level last seen in early April, Oun said in a telephone interview.

| Prices: |

|---|

|

Fellow OPEC+ producer Russia has also seen flows disrupted as multiple buyers around the world shun its crude. Yet traders are studying the possibility of a slight increase in Russian oil exports after the European Union recently adopted a number of amendments to sanctions.

How the EU Will Allow a Slight Increase in Russian Oil Exports

Traders will also be looking to the OPEC+ meeting later this week to set output policy for September. While the US has lobbied Saudi Arabia to loosen the taps — raising pressure on Russia — Moscow and Riyadh recently reaffirmed their joint commitment to a stable market.

“It is unlikely at present that the Gulf States would increase output unilaterally because of the risk of undermining OPEC’s unity and credibility,” said Altham.

Comments - Please login in order to comment.