Answer: Your situation is typical of many people with whom I have consulted. You have several assets that you need to turn into an income stream. The challenge is how to turn these assets into an income stream that will give you the best sustainable income for the rest of your life and not waste money on unnecessary costs and taxes.

In addition to this:

- You would need an emergency fund because life happens.

- If money remains at the end of your lives, you would like to transfer it to your heirs as efficiently as possible.

Do not try to use only one product to meet all these needs. I usually use several products to create the correct retirement solution. Each one has its pros and cons, but you can get a flexible and cost-effective solution if combined correctly. I will provide some and highlight their pros and cons.

Life annuity

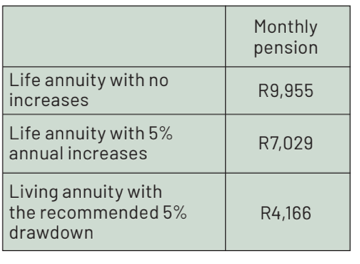

You invest a lump sum to buy a pension for the rest of your life. The great advantage is that the income you receive will be significantly higher than the one you can sustainably draw down from a living annuity. For example, a 65-year-old could buy the following pensions for R1 million:

As you can see, the life annuity will give you a much better pension. If the stock market collapses, there will be no decrease in income. The income is also guaranteed for the rest of your life, even if you live to 110.

The downside is that you no longer have access to the capital once you buy it. There is no substance for your heirs to inherit besides any residual payments.

I like to use this product as the spine for a retired person’s income. It is cheap to run, so there is little wastage in terms of costs. If the life annuity rates are good, I like to use it to cover most of the basic fixed costs. I then slot in other products around it.

Living annuity

Here you control where you invest the money and can choose your portfolios. You can select what drawdown rate you take. This can be anything from 2.5% to 17.5% – the higher your drawdown, the greater the chance that you could run out of money later.

I like to use several living annuities in my planning. If you need a higher income in years to come, you can always convert one to a life annuity. The life annuity will give you a higher income at a lower risk. Living annuities do not form part of your estate, so it is a clever way to transfer wealth to your heirs.

Discretionary income plan

If you sell your house, you cannot buy a living annuity with it. A living annuity may only be bought with the proceeds from a retirement fund. You can create your living annuity by investing it in a discretionary income plan and taking a regular drawdown from it.

If this plan is well structured, most of your income can be classed as a capital drawdown, and you will pay little tax.

I would recommend that you chat with a financial adviser who can put the right mix of products in place to ensure that your money does not run out and you do not pay more tax or estate duty than needed.

Costs can be kept in check by using a product provider who offers family level pricing. DM168

This story first appeared in our weekly Daily Maverick 168 newspaper which is available for R25 at Pick n Pay, Exclusive Books and airport bookstores. For your nearest stockist, please click here.

Become an Insider

Become an Insider

Comments - Please login in order to comment.