Newsdeck

Copper Hits $10,000 a Ton as BHP Bid Shows Tight Supply Pipeline

Copper hit $10,000 a ton for the first time in two years as speculation builds that the world’s mines will struggle to meet a coming wave of demand from green industries.

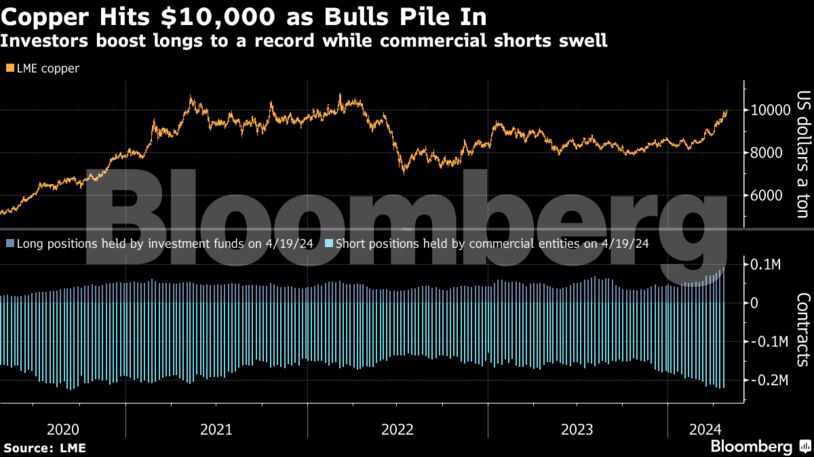

One headwind to the rally is that Chinese demand is looking alarmingly soft. The disconnect is evident in futures positioning on the London Metal Exchange, where investors have boosted bullish bets to a record while sales by commercial entities have surged.

But recent supply challenges and an improving outlook for global usage are emboldening copper bulls like BlackRock Inc. and Trafigura Group, which say the metal will have to jump even higher to spur the construction of new mines.

Millions of tons of new supply are set to be needed in coming years for use in electric vehicles, renewable energy and vastly expanded power grids as major mines become harder to find and more expensive to build or expand. BHP Group’s megabid for Anglo American Plc this week highlights that many miners would prefer to buy rivals than pull the trigger on entirely new projects.

“It tells you that building stuff is just too expensive,” said Colin Hamilton, managing director for commodities research at BMO Capital Markets in London. “Everyone was expecting that the supply pipeline would have reacted to higher prices by now, and it just hasn’t.”

Copper would need to reach $12,000 a ton to spur large-scale investments in new mines and stave off future deficits, Olivia Markham, who co-manages the BlackRock World Mining Trust, said in an interview earlier this week.

Copper futures rose as much as 1.7% to $10,033.50 on the LME, the highest level since April 2022, before trading 0.5% higher at $9,910 at 3:51 p.m. local time. Benchmark prices have rallied 16% this year.

This year’s advance has been supported by cautious optimism on the global economy, even as expectations for lower US interest rates have been pushed back. In China, the world’s biggest consumer, first-quarter growth beat estimates, helping to support demand.

Even so, there’s a stark mismatch between copper’s bullish form on futures markets and depressed conditions in the Chinese spot market. Premiums are fading, inventories remain relatively high, and spot prices have been at a discount to futures for a prolonged period, a contango structure that indicates adequate supply.

Most metals were higher on the LME on Friday.

Comments - Please login in order to comment.