SPONSORED CONTENT

Options for conservative, yield-hungry, dollar investors

Despite higher interest rates, dollar bank accounts do not reward investors. With yield back on the table, Paul Hutchinson, Sales Manager at Ninety One, explores the options available for conservative investors to enhance their returns

Yield, yield everywhere, but not (much of) a drop to earn in dollar bank accounts (with apologies to Samuel Tayler Coleridge).

In July 2023, the US Federal Reserve raised the federal funds rate for the 11th time in the current hiking cycle; to a target range of 5.25% – 5.5%, from around zero as recently as the first quarter of 2022. So, over just 16 months, the US central bank raised the fed funds rate by more than 5%. US banks, on the other hand, not so much.

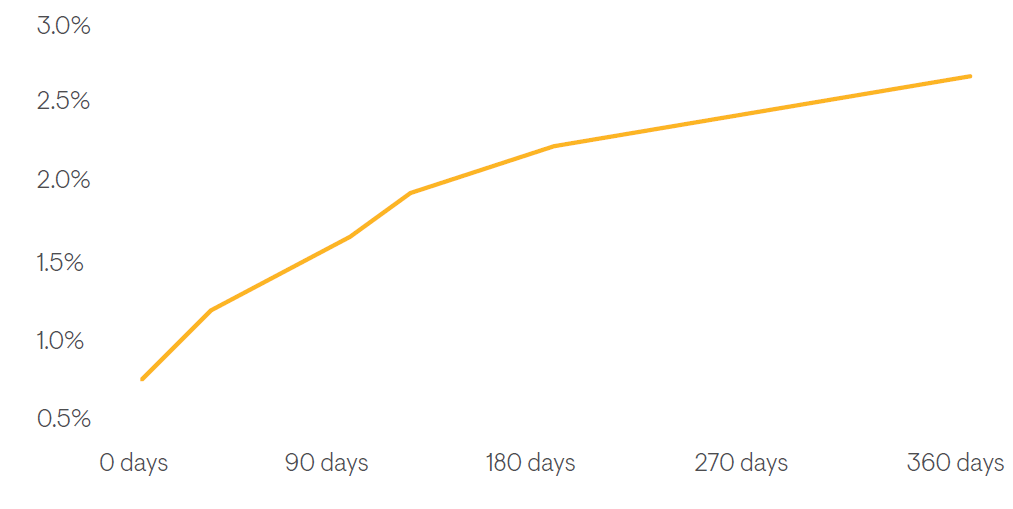

You will see from the following graph that overnight US retail deposit holders are still earning less than 1%, and even if you lock your money away for a year you are still earning an interest rate of less than 3%. Interestingly, this discrepancy is not something South African savers are familiar with; at local banks, for example, you can earn an interest rate similar to that of the current repo rate of 8.25% for an instant-access deposit on an amount of over R100 000, and above it if you term out your deposit (fix it, for say, 6 or 12 months).

Figure 1: US retail deposit interest rates

Source: bankrate.com, Bloomberg

US institutional money market investors, on the other hand, are earning above 5% for wholesale overnight deposits, with the result that US money market mutual funds are offering a current yield of above 5%. By way of example, the gross effective yield of the Ninety One US Dollar Money Fund was approximately 5.5% as at end December 2023. This, in turn, has seen assets under management in US money market funds explode to almost $5.9 trillion, increasing by as much as $370 billion (of which almost $220 billion was from retail investors alone) in just the last 20 weeks.

As an obvious starting point then, anyone with money in a US bank account should consider a switch to a US money market mutual fund where they can expect to earn at least an additional 2-3% per annum. But now that there is yield on the table once again across most fixed income assets, are there any alternatives for conservative investors to further enhance their expected return above that of a money market fund?

The short answer is yes. Conservative investors, with an investment time horizon of at least 12 months, can now access the higher income on offer across global fixed income assets through funds like the the Ninety One Global Diversified Income Fund (and the rand-denominated feeder fund version). Global fixed income portfolios like this offer attractive dollar cash-plus returns for limited additional risk; this fund specifically targets additional income of 1.5% above US dollar cash over rolling 12-month periods, while also avoiding annual drawdowns.

The portfolio managers, Paul Carr (based in London) and Adam Furlan (based in Cape Town), can achieve this dual objective by exploiting the vast global fixed income universe of sovereign (government) and corporate debt (spanning 110 geographies), which offer investors attractive income opportunities and a wide range of tools for diversification to mitigate risk. Importantly, with over seventy fixed income investment specialists in our global investment team, Ninety One is truly unconstrained by geography and asset class. We simply aim to invest where the best opportunities exist, and we have the expertise and investment process to do so.

In designing the Ninety One Global Diversified Income Fund the team adopted a similar approach to portfolio construction as the successful local Ninety One Diversified Income fund, which has a long-term track record of participating when the South African bond market performs well and protecting investors when the bond market underperforms cash. Applying this investment philosophy within a global context means that we have designed a fund – and importantly, a neutral construct around which the portfolio managers can take active positions – which enhances global income whilst maintaining defensive characteristics.

The team believes that disinflation is set to continue due to monetary policy operating with a lag (note the aggressive rate hiking cycle we have experienced as discussed above). Further, while economic growth will slow, their base case is not for a hard landing. “Therefore, the fund is positioned for both yield and stability. In fact, both disinflation and downside growth risks pave the way for interest rate cuts in 2024,” Carr said. DM/BM

Become an Insider

Become an Insider