Newsdeck

Fed ramps up economic stimulus, ready to do more

The U.S. Federal Reserve on Wednesday delivered another round of monetary stimulus and said it was ready to do even more to help an increasingly fragile U.S. economic recovery. By Mark Felsenthal and Pedro da Costa

The central bank expanded its “Operation Twist” by $267 billion, meaning it will sell that amount of short-term securities to buy longer-term ones to keep long-term borrowing costs down. The program, which was due to expire this month, will now run through the end of the year.

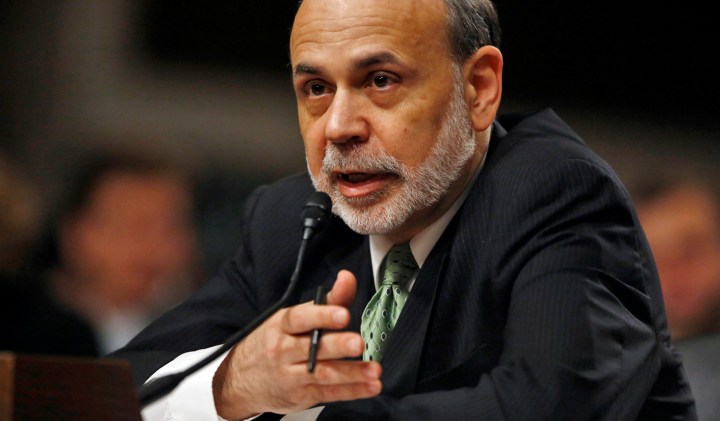

Fed Chairman Ben Bernanke, speaking at a news conference after a two-day policy meeting, said the central bank was concerned Europe’s prolonged debt crisis was dampening U.S. economic activity and employment.

“If we are not seeing sustained improvement in the labor market that would require additional action,” he said. “We still do have considerable scope to do more and we are prepared to do more.”

The Fed slashed its estimates for U.S. economic growth this year to a range of 1.9 percent to 2.4 percent, down from an April projection of 2.4 percent to 2.9 percent. It cut forecasts for 2013 and 2014, as well.

In addition, officials said they expect the job market to make slower progress than they did just a couple months ago, with the unemployment rate now seen hovering at 8 percent or higher for the rest of this year. It stood at 8.2 percent in May.

The Fed’s announcement met with a mixed reaction in financial markets. U.S. stocks see-sawed, with the benchmark S&P 500 index closing down slightly, while prices for most government bonds slipped. The dollar fell against the euro and rose against the yen.

A number of economists said the Fed was likely to eventually launch a more aggressive program to buy bonds outright. It has already purchased $2.3 trillion in debt in two earlier bouts of so-called quantitative easing.

“The burden of proof may now be on the incoming data to prove that a third round of large-scale asset purchases may not be necessary,” said Millan Mulraine, economic strategist at TD Securities in New York.

DOWNBEAT ASSESSMENT

Hiring by U.S. employers has slowed sharply, factory output has slipped and consumer confidence has eroded, with Europe’s festering crisis and the prospect of planned U.S. tax hikes and government spending cuts casting a shadow on the recovery.

The economy grew at only a 1.9 percent annual rate in the first quarter – a pace too slow to lower unemployment – and economists expect it to do little better in the second quarter.

The Fed, which has held overnight interest rates near zero since December 2008, reiterated its expectation that rates would stay “exceptionally low” through at least late 2014. Six of the Fed’s 19 policymakers do not expect an increase until sometime in 2015.

Richmond Federal Reserve Bank President Jeffrey Lacker, who has dissented at every meeting this year, voted against the decision to extend Twist.

At his news conference, Bernanke pushed back against the notion that the Fed’s earlier bond-buying was not effective, and that the central bank was running out of policy ammunition.

“I do think that our tools, while they are nonstandard, still can create more accommodative financial conditions and still provide support for the economy, can still help us return to a more normal economic situation,” he said.

Even though Greek voters on Sunday supported candidates who back taking painful steps to stay in the euro currency union, Europe’s debt crisis remains a threat to the global economy and many central banks are eyeing economic conditions warily.

Minutes from meetings of the Bank of Japan and Bank of England released on Wednesday suggest officials are poised to ease policy again. China cut benchmark rates on June 7, while the European Central Bank could take action at its July 5 meeting. DM

Photo/Ben Bernanke (Reuters)

Become an Insider

Become an Insider