OPEN SECRETS: UNACCOUNTABLE

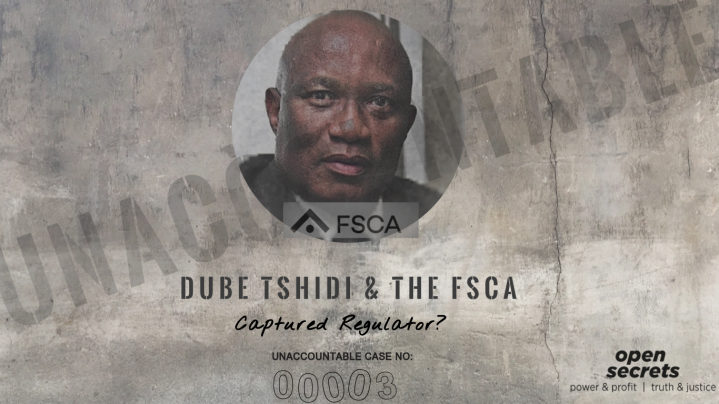

Dube Tshidi & The FSCA: Captured Regulator?

In Part 2, we profiled the conduct of the Liberty Group in the incorrect cancellation of hundreds of pension funds when they still held more than R100m owed to thousands of people. This is part of a far bigger scandal of unpaid pensions due to more than four million southern Africans. This week we look at Dube Tshidi, a regulator who not only effected the erroneous cancellations, but also failed to hold Liberty or any implicated financial sector actors to account. When the public needed effective regulation, the Financial Services Board (FSB) and its long-standing head failed them.

See Part 2 in this series here: Liberty — Profit over Pensioners and Part 1 here: Dame Margaret Hodge MP — a very British apartheid profiteer.

The Financial Sector Conduct Authority (FSCA) succeeded the Financial Services Board (FSB) and came into operation as South Africa’s regulator of financial corporations in April 2018. Its success is vital for the public interest, and it already finds itself at the centre of much controversy and public pressure related to high profile cases involving alleged major cases of economic crime.

These investigations, signs of green shoots at the FSCA, include its investigation of Markus Jooste’s alleged insider trading at Steinhoff and its public raid of Sekunjalo – the controversial company linked to Iqbal Survé, who is now threatening to sue the regulator. There is also its ongoing legal battle against the public protector who made adverse findings regarding the conduct of FSB head Dube Tshidi in a separate matter regarding the appointment of curators to pension funds.

While politicians with skin in the game are using these cases to attack the regulator for partisan political gain, it is easy to lose sight of a defining scandal of the FSCA’s predecessor, the FSB, and its then-chief executive Tshidi. Tshidi and the FSB oversaw the cancellation of thousands of pension funds, many in error, putting many vulnerable pensioners at risk. They have never been held to account for these failures.

The failure to thoroughly investigate and address these failures, or to hold the FSCA’s leadership accountable, haunts an institution which plays a crucial role guarding the public interest. The transition from the FSB to the FSCA is part of Treasury’s much-touted “twin-peaks” approach to financial sector regulation which includes the FSCA as a dedicated “market conduct regulator” to hold corporations accountable for their conduct. The success of the FSCA is essential in ensuring accountability for corporations that abuse their power for profit. Yet this will require a fundamental break from its predecessor’s haphazard approach to regulation.

Between 2007 and 2013, the Financial Services Board (FSB – now the FSCA) and its CEO and registrar of pension funds, Tshidi, oversaw the cancellation of the registrations of 6,757 pension funds. It did so with the active assistance of large private fund administrators such as Liberty and Alexander Forbes. The process was riddled with systemic errors and unlawful conduct, leading to (at least) hundreds of funds being cancelled in error. The errors meant that the funds were left with hundreds of millions of rand in assets, and members, but unable to pay these members out.

When Rosemary Hunter, then deputy executive officer for pension funds at the FSB, blew the whistle on the glaring deficiencies in the “cancellations project”, Tshidi and the FSB board, led by Abel Sithole, tried to push her out in a disgraceful manner which smacks of a cover-up. Subsequently, Tshidi and Sithole opposed litigation by Hunter that attempted to compel a full investigation of all funds cancelled in the course of the project.

Open Secrets’ recent investigation into the cancellations project – The Bottom Line – reveals that for the duration of the project, Tshidi (as CEO of the FSB and thus registrar of pension funds) appointed employees of private fund administrators to be “sole trustees” or “authorised representatives” of dormant pension funds in order to ensure their cancellation. These appointments were often unlawful and beyond Tshidi’s powers – he should have ensured the funds had fully functioning boards to make sure they were wound up properly. These single trustees were often solely responsible for many hundreds of funds. One Liberty employee was the sole trustee of more than 900 funds – which were all eventually cancelled. It appears that the fund administrators were happy enough to go along with the process despite its unlawfulness.

The law is unambiguous on the requirements for cancelling the registration of a pension fund. It required Tshidi to be satisfied that a fund had “ceased to exist” before ordering its cancellation. This means that Tshidi needed the sole trustees he had appointed to provide him with enough information to show that the fund had no more assets or members before he proceeded with the cancellations. An investigation by KPMG in 2015 concluded that in the sample of 510 cancelled funds, Tshidi did not have sufficient information for the purposes of cancellation for a staggering 98%. It is thus not surprising that firms like Liberty have since admitted that they had more than 100 funds holding over R100-million cancelled in error. They have not accounted for any fee income and other profits they might have gained from controlling the assets while the funds were cancelled.

This was not a regulator who acted in the public interest. Rather, this was a case of the regulator prioritising the interests of the private fund administrators over pensioners and ordinary fund members. They chose a process that was quick and easy for the companies and turned a blind eye when those companies cut corners, regardless of the harm caused.

Following this series of errors, Tshidi not only remains an executive of the FSCA but is rewarded handsomely from the public purse. In 2017/18, he had the highest base salary of any executive at a public body – R5.6-million. After further – somewhat inexplicable – bonuses of R1.7-million, he took home a handsome sum of R7.3-million. This is the equivalent of R20,000 per day. For perspective, a South African earning the new national minimum wage would have to work for 174 years to earn what Tshidi earned in one year.

Given the failure of the FSCA and Tshidi to act in the interest of indigent pensioners, it is hard to fathom how either Parliament or the National Treasury can allow such poor performance to be rewarded with such a salary.

Neither the private pension administrators nor the FSB leadership has ever been thoroughly investigated or held accountable for these failures to uphold the law. Responding to an access to information request from Open Secrets, the FSCA confirmed that despite the fact that Liberty accounted for 80% of funds cancelled in the cancellations project and had admitted to hundreds of errors, it had undertaken “no investigation” into Liberty’s conduct related to the cancellations project. This represents a continuity of the kind of “soft-touch” regulation that permitted the errors in the cancellations project to begin with.

The leadership of the FSB in large part became the “Transitional Management Committee” of the FSCA on 1 April 2018. This included Tshidi and Abel Sithole. At this time, Treasury indicated that a hiring process would ensure that a new commissioner and deputy commissioner would be appointed within six months, before the end of 2018. In April 2019, Open Secrets wrote to the Minister of Finance, Tito Mboweni, to ask why the process was already six months delayed, and to express concern that those implicated in wrongdoing in the cancellations project – including Tshidi – remained in the transitional leadership team of the FSCA. The letter also urged the Finance Minister to ensure that the appointment of these positions was a completely public and transparent process.

Open Secrets hasn’t received any substantive response from Mboweni’s office despite promises to do so and a follow-up letter in October. There has not even been an indication of the status of the appointment process. The appointment of a new commissioner to lead the FSCA and ensure that it fulfils its mandate is now more than a year overdue and speaks to the disregard with which this important financial regulatory position is viewed. We need an open public process, similar to that which we saw in the most recent appointment of the head of the National Prosecuting Authority.

The South African public needs a financial sector conduct regulator that will stand up to the powerful and hold them accountable for wrongdoing and abuse. The FSCA’s pursuit of cases against individuals like Jooste and Survé should be encouraged despite those who push back because of a political agenda. An intrusive and energetic regulator will always be the target of this kind of partisan attack.

Yet it is important that the FSCA shows equal rigour in investigating the conduct of the large financial sector corporations that dominate South Africa’s financial sector. It is these corporations whose conduct affects millions of people. Nowhere is this more obvious than in the pensions industry, where millions rely on private companies to handle their money responsibly. Yet the FSB’s deference to private players in this industry was an important factor leading to systemic errors in the pension fund cancellations project.

The mere introduction of the “twin peaks” model and promises of more intrusive regulation of financial corporations are not enough. It is also essential that the FSCA cracks down on the culture of impunity for financial sector actors. The FSCA leadership, including Tshidi, should be held accountable for failing to adequately regulate the wealthy and powerful. This, in turn, requires that new permanent leadership of the FSCA is appointed urgently in a fully open and transparent process.

The capture of regulators like the FSCA by corporate players is commonplace around the world. South Africa needs an independent and fearless FSCA that pursues accountability for powerful corporations without fear, favour, or deference to those companies’ interests. DM

Unaccountable is an Open Secrets series published in Daily Maverick and in other news media. The series highlights the profiles of large corporations and private individuals who are all implicated in economic crime and other malfeasance but have never been held to account for these – or at best escaped substantive justice. This series is a reminder to these corporations and individuals that we have not forgotten.

Should you have any information to share with us please consult our website for the Open Secrets contact details.

Become an Insider

Become an Insider