Answer: I usually use a structure called a preferred compensation plan for business owners who are in a similar position to you.

This needs to be carefully constructed so that it does not fall foul of any tax and labour laws. If done well, it will:

- Help you retain key staff; and

- Enable you to extract value from your business by selling part of it.

You need to do the following:

- Ensure that the business is structured as a company and not a close corporation. If it is not a business, you should convert it as this will make the next steps much easier.

- The business must enter into an agreement with each employee and grant them salary increases on condition that these increases, less tax, are used to fund an endowment policy.

- Each employee must sign a collateral cession, which allows the employer to call up the cession and the funds should the employee leave the employ of the company before the agreed timeframe.

- When the policy matures in five to 10 years’ time, the cession will be cancelled and a lump sum will be paid across to the employee to buy shares in the company.

There are a couple of controls that you should put into the agreement.

For example, you can state that should the employee resign before the maturity date, the company may surrender the policy and keep the proceeds. You can also link the payment to certain short- and long-term goals being achieved.

There are tax benefits:

- The company will be able to deduct the entire contribution as employee earnings.

- On maturity, there is no additional tax payable on the maturity proceeds.

This type of structure is a great way to retain top people in the company and align their goals with yours. It also provides you with a nice vehicle to extract some capital from the business.

These are specialised products and you do need the right legal agreements in place to ensure that it is legally robust. Speak to a financial planner who is familiar with these structures. DM168

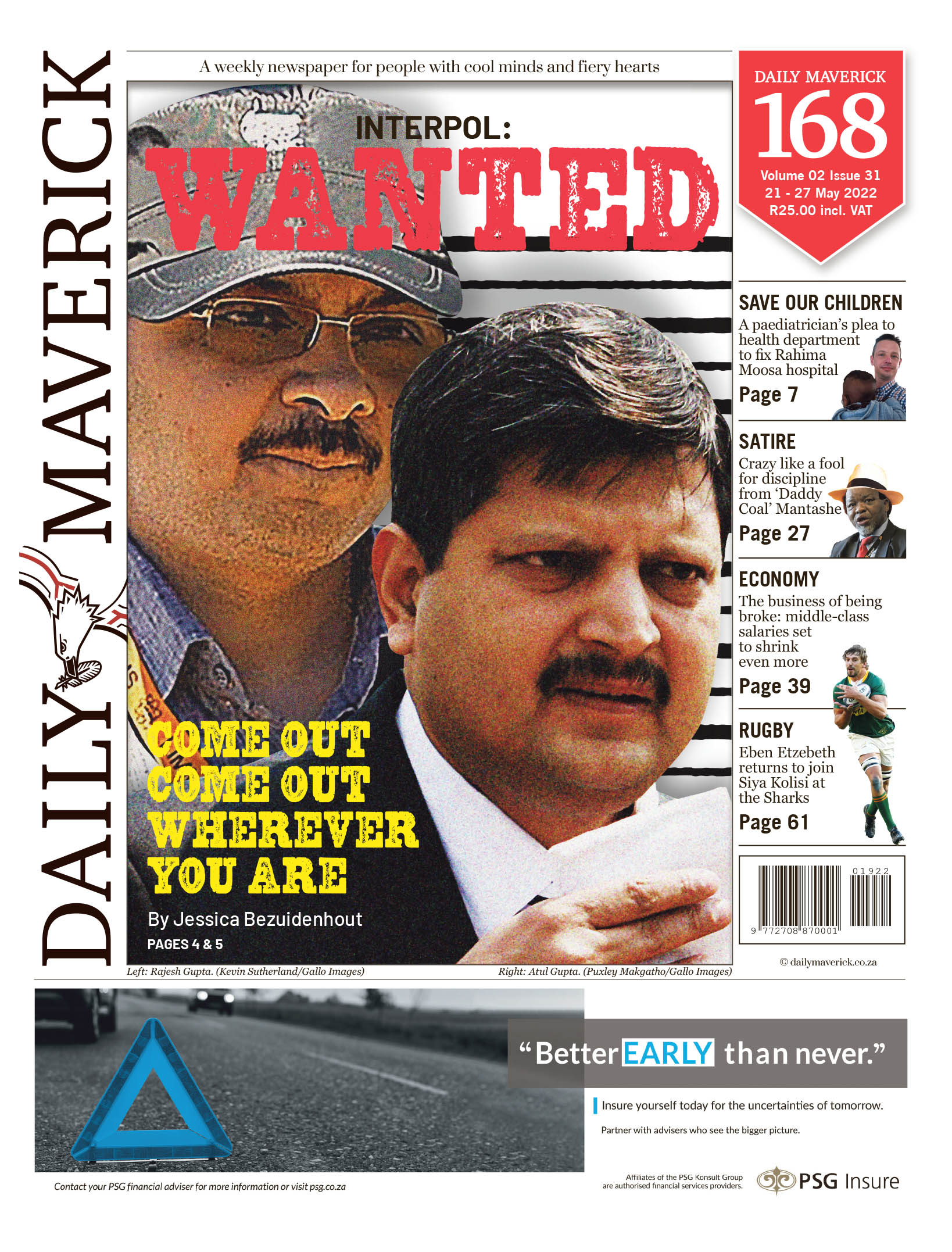

This story first appeared in our weekly Daily Maverick 168 newspaper, which is available countrywide for R25.

Become an Insider

Become an Insider

Comments - Please login in order to comment.