South African Reserve Bank (Sarb) Governor Lesetja Kganyago said on Wednesday that the end of the prime lending rate — which stands at 350 basis points above the central bank’s key repo rate — may be nigh.

Bloomberg recently reported that the Sarb was reviewing the prime rate, and Kganyago said in an interview with NewzRoom Afrika at the World Economic Forum in Davos that “the most natural outcome would be that we just get rid of prime”.

“We would like to have much more transparency, so that consumers know what is actually going on,” Kganyago told the news channel.

The 350 basis point gap between the repo or monetary policy rate and the prime rate has been fixed since 2001. Currently, the repo rate is 6.75% and the prime rate is 10.25%. Lenders use it as a baseline depending on the credit record of borrowers and their perceived ability to repay.

With South Africa’s inflation rate on a downward trajectory and the Sarb’s mandated inflation target reduced to an effective 2-4% from 3-6% previously, the central bank seems to be in full-on reform mode.

And when Kganyago signals a preference — as he did with the inflation target — the prospects of it becoming policy are good. DM

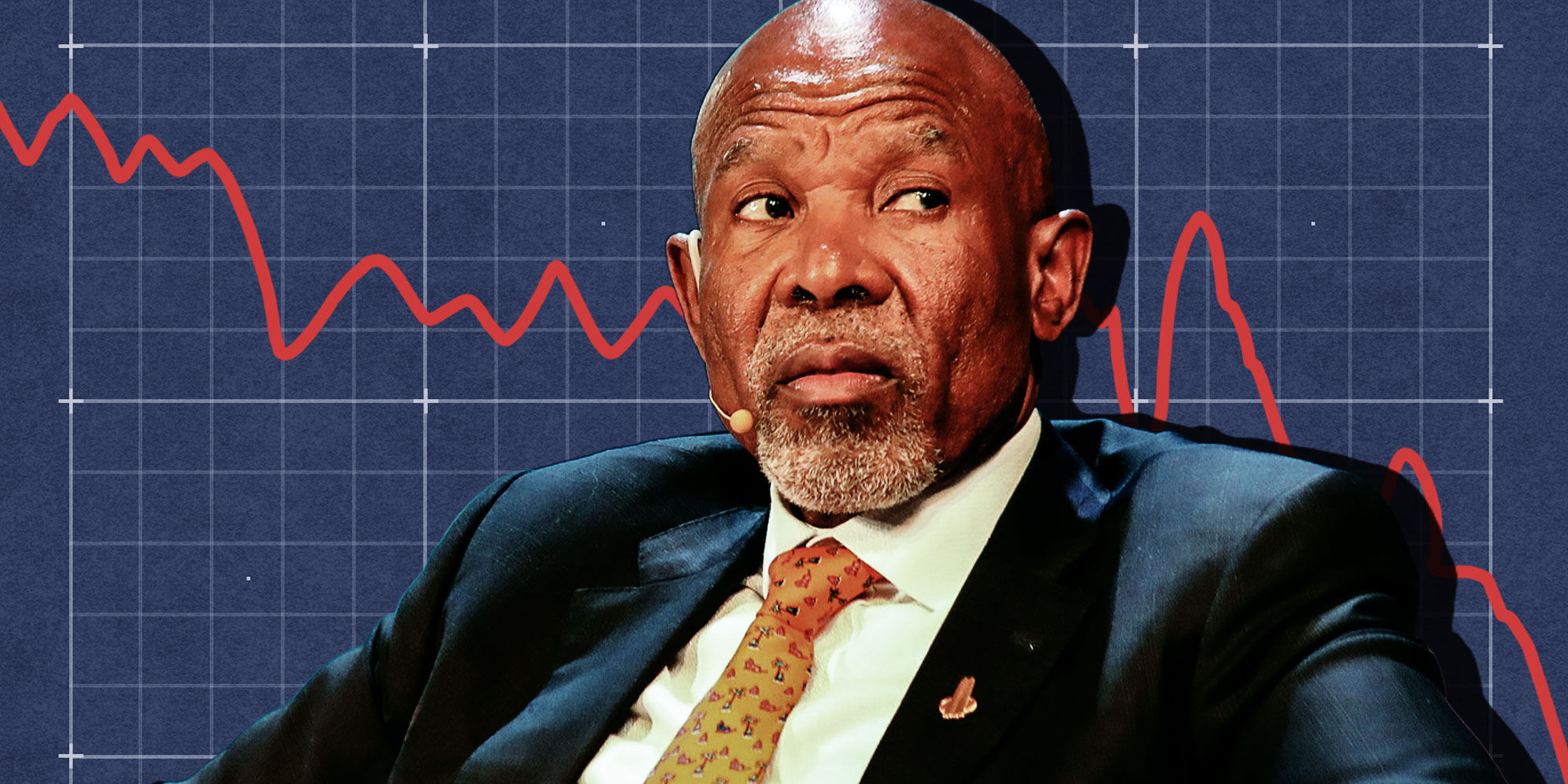

Illustrative Image: SA Reserve Bank Governor Lesetja Kganyago. (Photo: Fani Mahuntsi / Gallo Images | Graph. (Image: Freepik)

Illustrative Image: SA Reserve Bank Governor Lesetja Kganyago. (Photo: Fani Mahuntsi / Gallo Images | Graph. (Image: Freepik)