OPEN SECRETS

Follow the money: The directors who flushed Transnet’s cash

Transnet is struggling. The embattled freight railway and ports company — owned by the South African state — has faced corruption, setbacks and delays that have cost the public billions. But while some key figures have been criminally charged, others at the centre of Transnet’s capture and near-collapse have walked away almost unscathed.

New information seen by Open Secrets sheds light on how one company and its directors made payments seemingly to various companies and individuals to flush Transnet money out of sight.

The details are contained in bank statements of Integrated Capital Management (ICM), whose directors — Stanley Shane, Marc Chipkin and Clive Angel — have largely evaded public scrutiny despite the role they played in the Guptas’ capture of Transnet.

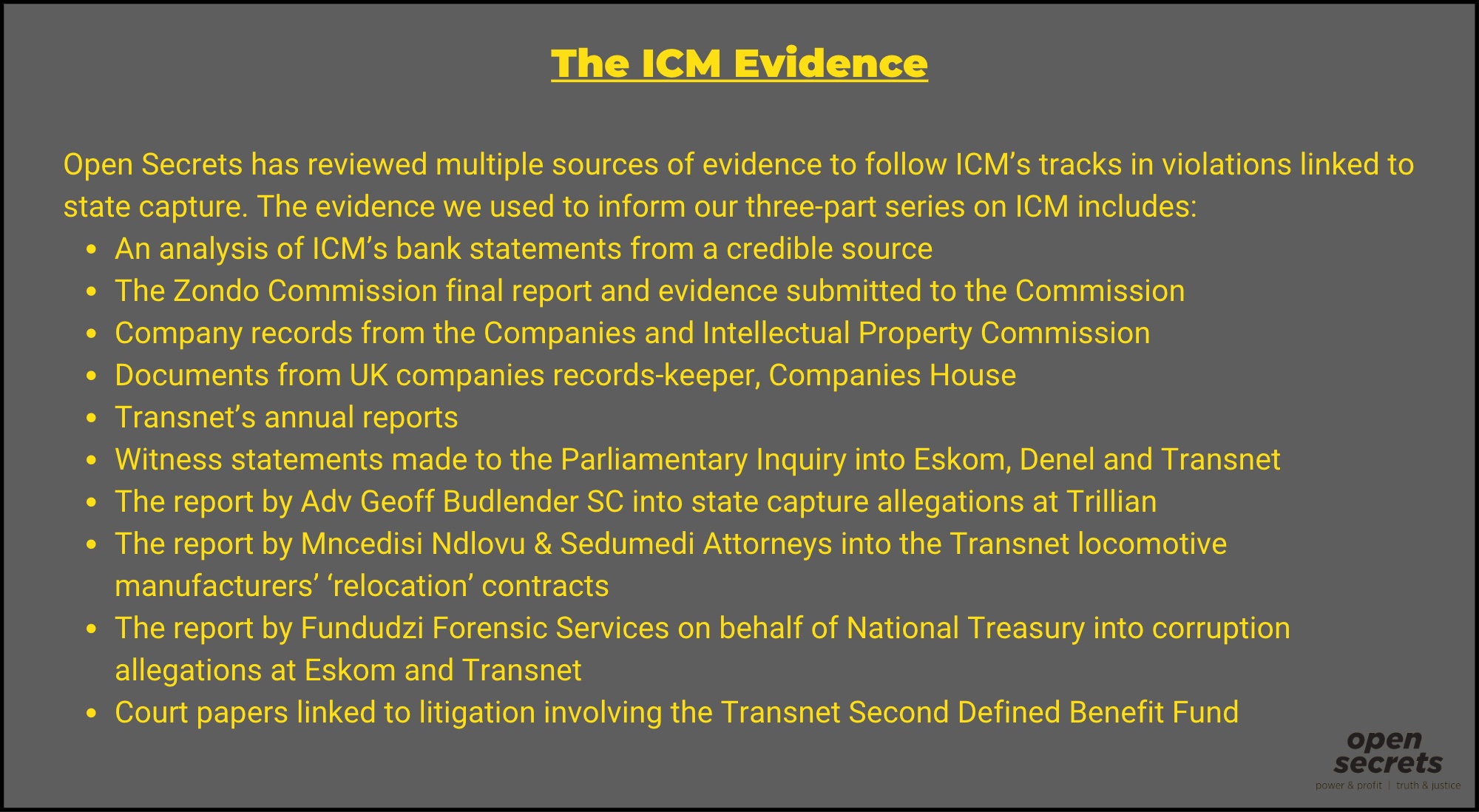

Open Secrets has seen an analysis of ICM’s bank statements prepared by a reliable source who has access to the documents. The source cannot be named due to the sensitive nature of this information.

The analysis reveals how payments of around R5.7-million were made by the company, with the payment references suggesting these were to ICM’s directors and various companies linked to them.

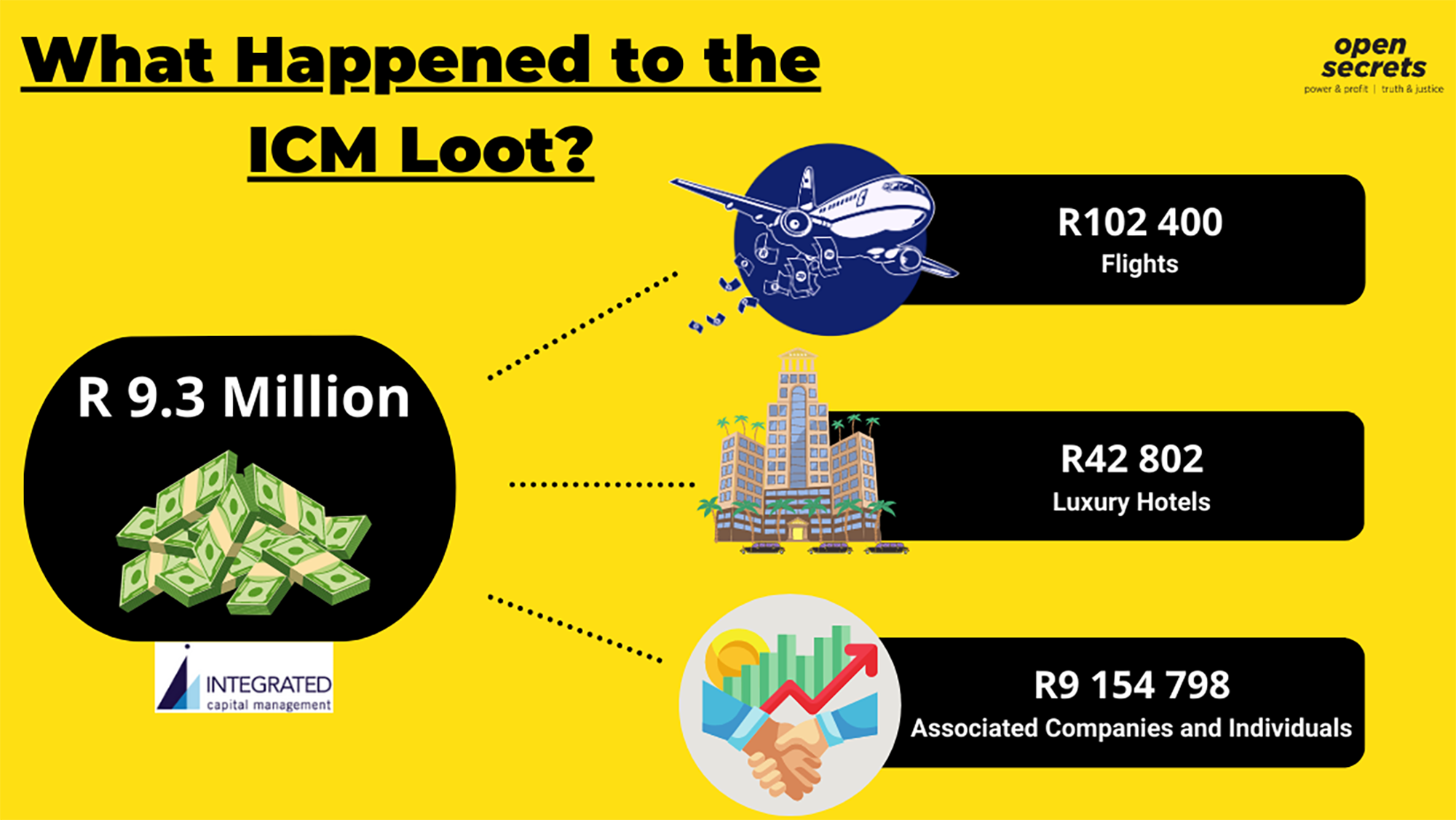

The payments were made between November 2015 and March 2016, shortly after R9.3-million was laundered to ICM through an elaborate scheme linked to Transnet’s deal with China North Rail’s (CNR) South African consortium. At the time, the consortium was contracted to provide services to Transnet, and Stanley Shane was a director on Transnet’s board.

The bank statements of the parties who allegedly received these funds have not been seen by Open Secrets, and there is no direct evidence of wrongdoing involving the companies. It is significant, however, that five of the six companies which are referenced in transactions in ICM’s bank statement shortly after the R9.3-million was laundered have direct links to either Shane, Chipkin or Angel.

The three directors chose not to respond to detailed questions sent by Open Secrets.

There is another startling revelation contained in the analysis which shows payments Transnet made to ICM. Open Secrets has confirmed that between May 2015 and August 2017, Transnet directly paid ICM R2.2-million. According to Transnet’s annual reports, Shane was paid R1.6-million between the 2015 and 2018 financial years during his tenure as a Transnet board director.

The annual reports disclose that Shane’s director’s fees were paid to ICM. However, the payments from Transnet in the analysis exceed the amounts Shane would have received in director’s fees. The payments are suspicious: ICM was never contracted to do work for Transnet and there was no legitimate reason for it to be paid more than what the SOE disclosed.

This is the first in a series of three articles by Open Secrets on ICM, its directors and where some of the Transnet money went.

Integrated Capital Management (ICM)

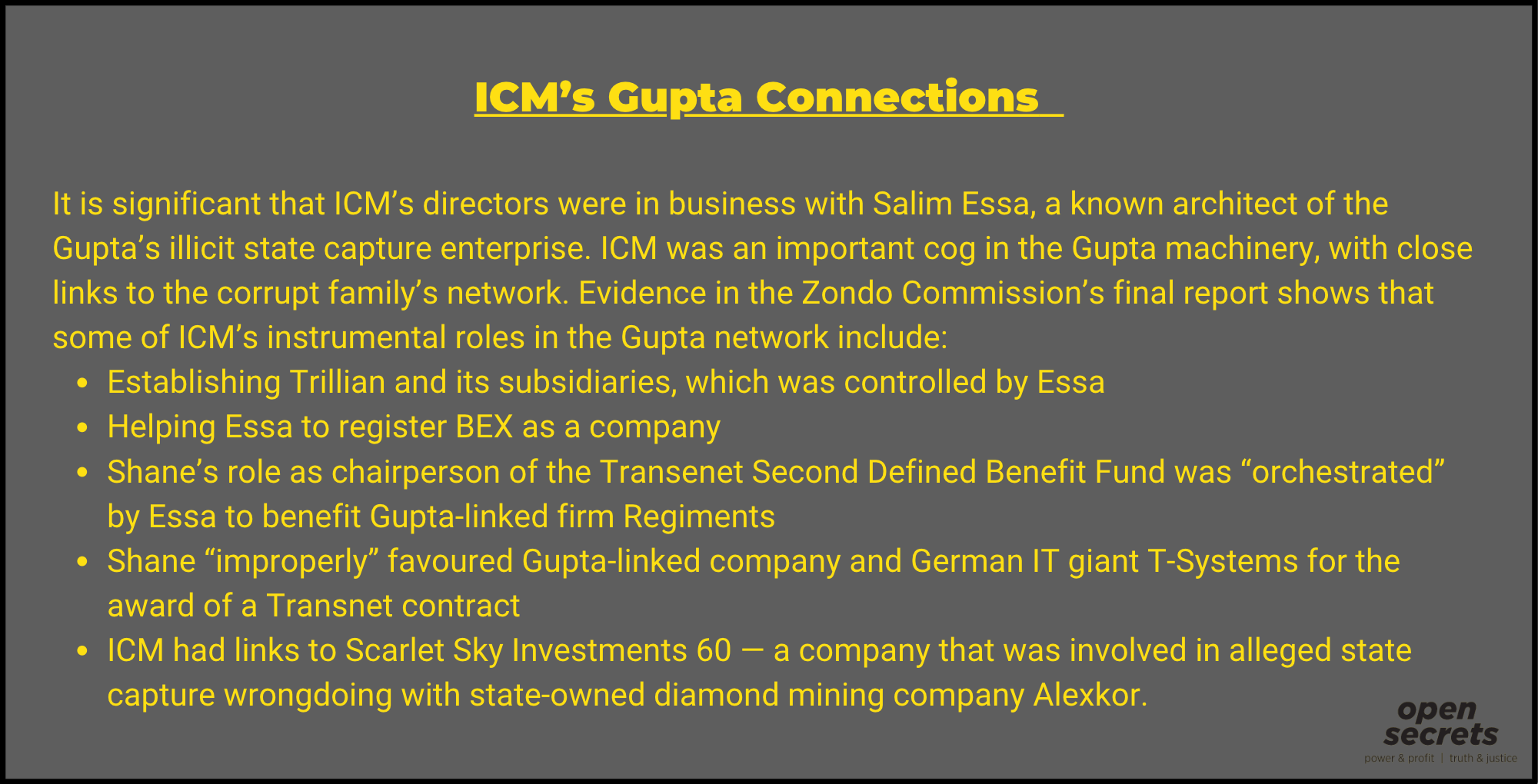

ICM was a key player in State Capture. The Zondo Commission states that it helped to establish Trillian — the infamous Gupta consulting firm — in 2015 and it reportedly helped to register a shelf company called Business Expansion Structured Products (BEX) around 2009.

BEX would become a key player in a 2014 Transnet deal involving CNR. In 2014, CNR was contracted by Transnet to provide 232 diesel locomotives as part of the corrupt 1,064 locomotives deal. But the cost of the contract became inflated when a decision was made that CNR would relocate its manufacturing plant from Pretoria to Durban at an inflated cost. BEX acted as a consultant on the relocation and received R76-million in kickbacks from the deal in September 2015.

The Zondo Commission said that BEX laundered R9.3-million of the kickbacks it received to ICM in November 2015 through two shelf companies: Block Mania and Green Blossom. BEX paid Block Mania R10-million in early November 2015. Days later, Block Mania paid Green Blossom R9.9-million. From there, ICM received seven tranches of payments from Green Blossom totalling R9.3-million in November 2015.

At the time, ICM’s directors were Stanley Shane, Clive Angel and Marc Chipkin. While R9.3-million may seem like small fry in the billions that were looted from Transnet, much of the public funds stolen in corrupt State Capture crimes remain untraceable.

This is why R9.3-million matters: it may be possible that law enforcement agencies can still follow the money, and begin criminal prosecutions against those who looted SOEs like Transnet.

Transnet is aware that R9.3-million of its funds was laundered to ICM. But its hands are tied: Transnet’s Group CEO Portia Derby told Open Secrets that the costs of civil litigation to recover the R9.3-million would exceed what the SOE might recuperate. This makes it more important for the Hawks and NPA to investigate allegations of criminality.

The Hawks and NPA declined to answer detailed questions by Open Secrets on the status of the ICM investigation, saying only that the NPA’s Investigating Directorate is “seized with the matter”. But if the NPA and Hawks don’t act, directors like Shane, Chipkin and Angel may never be held to account.

Finding the money: Stanley Shane’s piggy bank

A key figure in the web of corruption at Transnet is Stanley Shane.

Shane — who was a director at ICM — was significantly also a board member of Transnet from December 2014 to June 2017 and served as the chairperson of the Transnet Second Defined Benefit Fund over the same period.

He also succeeded Gupta associate Iqbal Sharma as chairperson of Transnet’s notorious Board Acquisitions and Disposals Committee (BADC) in that time, and has been accused of making it easy for Gupta-linked companies to gain access to Transnet’s funds. The BADC was established in 2011 to allow the Transnet board to have input on procurement matters, and rapidly became empowered to conclude huge procurement deals.

Shane’s directorship at Transnet overlapped the period in which he was director of ICM when the company received BEX’s laundered cash, indicating a troubling conflict of interest.

Shane declared his position at ICM to Transnet, but there is no indication that he disclosed ICM’s interest in BEX or the R9.3-million payment. It is also unclear why Transnet paid ICM R2.2-million and if Shane’s role at ICM was ever considered a conflict of interest by Transnet when these payments were made.

While Shane may have declared his interest in ICM to Transnet, it appears he obscured his role in another company from the state railway provider.

The Transnet 2016 annual report makes no mention of Shane’s directorship at a company called Antares Capital. The annual report discloses the directorships held by board members, but Antares Capital is notably absent from the list of 22 directorships Shane declares in the report. The company is important because Shane served as co-director with Gupta lieutenant Salim Essa. ICM’s bank statement shows that two payments totalling R80,000 were made by ICM with reference to Antares Capital.

According to company records, Antares Capital — a corporate finance firm based in Centurion — was registered in 2013, with Shane and ICM director Clive Angel coming on as directors in 2014. According to the Companies and Intellectual Property Commission’s (CIPC) records, Essa became a director in June 2015. Essa’s lawyer, David Swartz, did not respond to questions at the time of publishing.

Businessman Emanuel Arbib joined the company as a non-executive director in 2015 and resigned in 2016. Arbib’s lawyer told Open Secrets that he “was not involved with any business of Antares Capital, nor was he a signatory on any of its bank accounts, nor was he aware of payments (if any) made from or received by or into Antares or any other company connected to it”. Arbib is also currently a director of a company, with Shane, in the United Kingdom called Sweet Stay Holdings — a luxury accommodation rental brokerage. ICM director Marc Chipkin was a director at Antares but resigned in 2014.

Antares isn’t the only company linked to Shane which was referenced in ICM’s bank statement. Another company, Aerton Investments, was referenced in relation to payments totalling R615,000 from ICM. The payments were made in eight transactions between November 2015 and March 2016.

Aerton Investments was registered in 2014 and Shane was the sole director. According to CIPC records, the company is in the process of being deregistered.

Shane’s involvement in Aerton Investments is disclosed in the 2016 Transnet annual report and the SOE is aware that the company — with Shane as its sole director — is linked to the possible proceeds of corruption.

Transnet GCEO Derby told Open Secrets that Transnet and the Department of Public Enterprises have approached the CIPC with evidence from the Zondo Commission to “to act against directors, such as Mr Shane, so that their actions are sanctioned”.

The payments referencing Aerton are noteworthy. Details in ICM’s bank statements indicate that some payments referencing companies related to ICM’s directors were made on the same dates each month over five months between November 2015 and March 2016. The occurrence of the payments on the same day each month suggests that they were coordinated. ICM’s directors, Aerton Investments and three other companies were referenced in payments from ICM’s bank account on these dates.

In total, Shane is referenced in payments totalling R399,300 in this period. Significantly, the transactions begin nine days after Green Blossom laundered R9.3-million to ICM in November 2015. This suggests that a sitting Transnet board member was likely the beneficiary of corrupt funds stemming from the SOE.

The other ICM directors and the companies linked to them have also escaped justice, despite being referenced in notable payments at the time BEX laundered funds to ICM. Evidence suggests that in addition to payments referencing companies linked to its directors, ICM also splurged more than R140,000 at British Airways and on luxury accommodation.

A network of looting

Shane’s co-directors at ICM, Clive Angel and Marc Chipkin, are also linked to payments that ICM made nine days after it received the laundered R9.3-million from BEX. Chipkin and Angel were referenced in transactions that were made on the same dates in which payments referencing Shane and other companies were made from ICM’s bank account.

Between November 2015 and March 2016, Chipkin is referenced in payments totalling R219,600, while Angel is referenced in payments of R172,700.

Companies linked to the ICM directors are also named in the bank statement, indicating others within the ICM network likely benefited from public funds. Each of these companies received payments shortly after BEX’s R9.3-million was laundered to ICM.

Almenta 214 and MJG Investments are two other companies referenced in the ICM bank statement with regard to payments which were made on the same dates Chipkin, Angel, Shane and others were referenced. MJG is referenced in relation to R704,600 in payments while Almenta 214 is linked to R612,000.

According to CIPC records, Legal Frontiers (a corporate services company) and Clive Angel are the three principals of Almenta 214. Legal Frontiers resigned from its position in March 2011, and Angel was appointed sole director a month later in April 2011. The involvement of Legal Frontiers should raise red flags, however.

The corporate services firm is known to sell and register shelf companies, which are often used to facilitate illicit financial flows like money laundering. Legal Frontiers purchased BEX — a shelf company — for Essa in 2009. Essa was introduced to Legal Frontiers by ICM and provided the necessary legal documents to register BEX.

Another company, Apple Squash, is also referenced in ICM’s bank statement in relation to a payment made on 25 November 2015 — one of the dates on which the other transactions took place. However, the remaining payments referencing Apple Squash in the ICM bank statement do not follow the same pattern. In total, Apple Squash is linked to R518,110 in payments from ICM’s bank account.

Apple Squash was registered in 2012 and by 2013, Daniel Nathan was appointed director. Selwyn Nathan, a former ICM chairperson, and Marc Chipkin joined as directors in 2017. According to CIPC records, Apple Squash remains in business with both Daniel and Selwyn Nathan as active directors, while Chipkin has since resigned.

Daniel Nathan, through his lawyer, told Open Secrets that Apple Squash owned commercial premises which it leased to ICM. The funds ICM paid to Apple Squash, Nathan’s lawyer said, were for rent. Nathan’s name has, however, been linked to State Capture allegations.

Daniel Nathan was a minority owner of Gupta-linked company Scarlet Sky Investments 60 (SSI), and at the time, Gupta associate Kuben Moodley was a majority shareholder.

Investigative journalism centre, amaBhungane, reported extensively on SSI and Alexkor. SSI was awarded a tender by the Pooling and Sharing Joint Venture (PSJV) in 2014. PSJV is a joint venture between state-owned diamond company Alexkor and the Richtersveld community, which has indigenous roots in regions where Alexkor mines.

The Zondo Commission’s report detailed how SSI was irregularly awarded the PSJV contract without the necessary licensing as per the Diamonds Act. But Nathan said in an affidavit to the Commission that there was nothing untoward. He distanced SSI from links to State Capture.

There is, however, a more direct link between ICM and the Gupta network. ICM were responsible for setting up Trillian Capital Partners for Eric Wood and Essa in 2015. There are four payments ICM made between November 2015 and December 2015 totalling R2.4-million with reference to Trillian. Open Secrets has confirmed that the payments never reached Trillian’s bank accounts, yet the description directly references the crooked Gupta-linked company, indicating a connection.

Taking back the money

Transnet has already begun to recover the billions it lost in State Capture corruption.

Last year, the National Prosecuting Authority also made headlines when former Transnet executives Brian Molefe and Anoj Singh were arrested in relation to corruption charges. They were joined in the dock at Palm Ridge Magistrates’ Court by former Regiments directors Niven Pillay and Litha Nyhonyha.

However, the ICM directors and the companies they are linked to have so far escaped public scrutiny over their involvement in the locomotive contract scandal.

Shane has faced some censure from the Zondo Commission, and yet he lives comfortably in the United Kingdom with no extradition document bearing his name. Angel and Chipkin have faced even less scrutiny.

It’s long past the time that the Hawks and NPA investigated these directors and prosecuted them where necessary. DM

Our next instalment in this series will turn the spotlight on the ICM director who helped the Guptas score big inside Transnet: Stanley Shane.

Open Secrets is a non-profit organisation which exposes and builds accountability for private-sector economic crimes through investigative research, advocacy and the law. To support our work visit Support Open Secrets.

Become an Insider

Become an Insider

The looting cannot happen without the help of people it companies in the private sector. They should all be investigated and prosecuted too. I am sure this is only the tip of the iceberg. As for these three individuals: hopefully someone at SARS is opening an investigation, and questions about how Shane got residence in the UK. Authorities there should be alerted too as it’s unlikely that he has changed his ways. Where ard the Hawks and SIU?

Aloota continua! The rot just runs deeper and deeper. One of the saddest – and most infuriating – things about all these revelations, is that most of the people involved in these intricate scams are intelligent people, already earning very good money, who could have contributed enormously to creating a thriving, robust and rapidly developing economy, employing millions more people, who in turn would (hopefully) pay for electricity, water and other services, thus allowing these utilities to deliver decent services to all South Africans.

But instead, they looted and the knock on effects are clear for all to see. Just in terms of Transnet’s direct business, Zimbabwean farmers organisations yesterday announced they were rerouting traffic from Durban to Beira for exports of produce, whilst our own exporters in Mpumalanga, Gauteng and Limpopo are increasingly using Maputo as an alternative to Durban. Copper producers in Zambia and the DR-Congo are shifting exports of their production and imports of their needs to Dar es Salaam – all of this to the detriment of not only Transnet, but the broader South African business community. Throw the book at these charlatans, if they’re guilty and lock them up for decades!

so why are they walking free?

Only way to find out the depth of this corruption is to follow the money further – a SARS audit of these three individuals should divulge their part…perhaps SARS could get them on tax evasion! A la’ Al Capone!

This is all small change in the context of the real plunder at Transnet. It shouldn’t be condoned or ignored, but I think the real larcenists are sniggering behind their hands. It’s also possible that these fine gentlemen actually fleeced them for much more, but you’ve discovered a little loose end they forgot to tie up. If state capture had been on this scale, we wouldn’t be in the dwang right now.

This deliberate theft has a serious knock on effect in the fruit export market. The farmers are losing millions due to dilapidated and faulty harbor equipment. I hope they will have their day in court.

“Transnet’s Group CEO Portia Derby told Open Secrets that the costs of civil litigation to recover the R9.3-million would exceed what the SOE might recuperate”

This is because the legal practitioners on Transnet’s panel milk the absolute living hell out them through the ridiculously inflated fees they charge. If the amount involved were a tenth of what it is, perhaps, but there’s no ways fees in a classroom like that should get anywhere even close to that amount.