“If the medium-term inflation outlook persists or deteriorates, a larger increment will be appropriate at the September meeting,” the ECB said in a statement. Beyond that, “based on its current assessment, the Governing Council anticipates that a gradual but sustained path of further increases in interest rates will be appropriate.”

That would bring the deposit rate to at least zero by the end of the third quarter, from -0.5% at present, concluding an eight-year stint of negative borrowing costs and affirming a plan laid out last month by President Christine Lagarde.

“It is good practice and it is actually often done by most central banks around the world to start with an incremental increase that is sizable, not excessive, and that indicates a path,” Lagarde told a news conference.

“The decisions that we have made today are not just one intention of one single month of July — it’s a whole journey,” she said in Amsterdam, as the ECB returned to holding one policy meeting a year outside its Frankfurt base following the pandemic.

What Bloomberg Economics Says…

“The ECB has brought more clarity to the outlook than expected, signaling it will raise its main policy rates in July and September. The monetary policy decisions statement confirms the first move will be a 25-basis-point hike and has left open the possibility of a 50-bp increase in September. Bloomberg Economics thinks gradual moves of 25 bps in September and October are more likely to avoid creating panic in the peripheral bond markets.”

–David Powell and Jamie Rush. For full React, click here

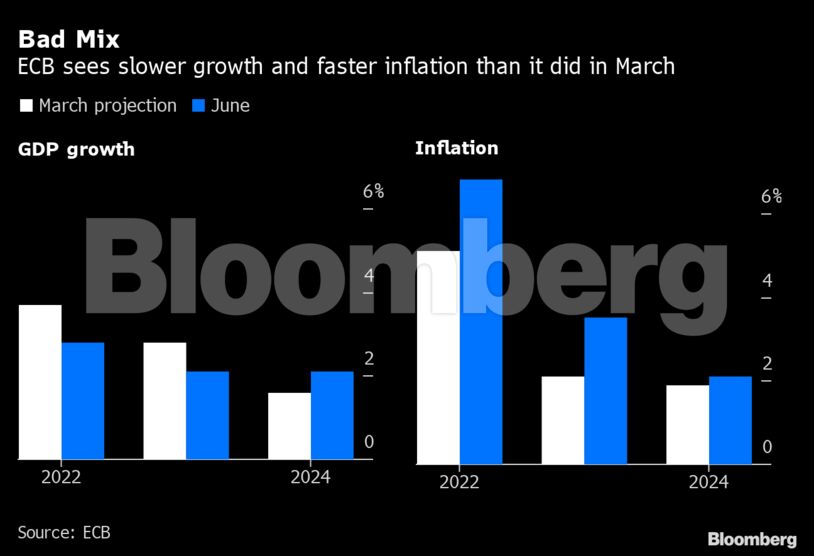

She described risks to inflation as “primarily on the upside.” The ECB now sees price growth averaging 2.1% in 2024 — exceeding the 2% medium-term target. It reached 8.1% in May and may top 7% for this year as a whole.

The euro slipped 0.2% against the dollar to $1.0693 after earlier climbing to the highest since May. Traders increased bets on rate hikes, predicting 150 basis points of increases by December.

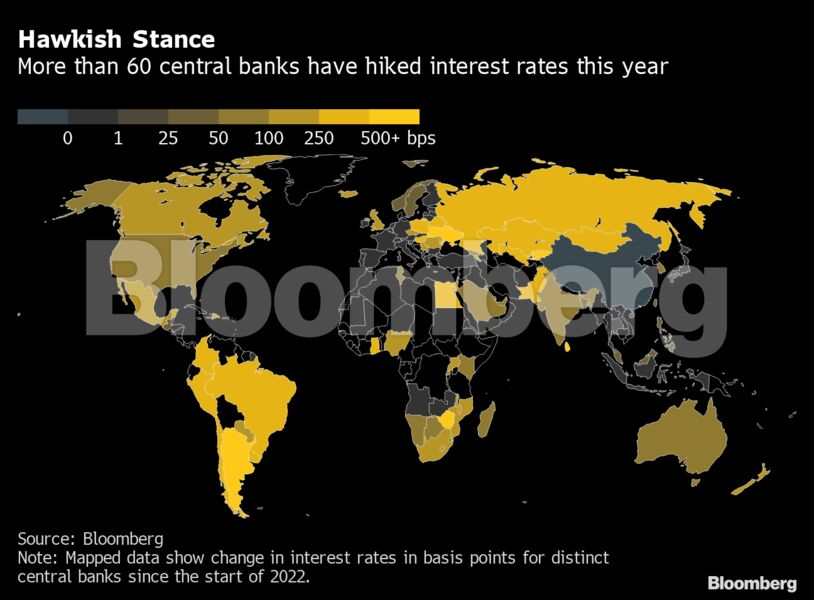

While Thursday’s decisions crystallize the exit from stimulus, the ECB is lagging behind its peers. More than 60 other global central banks have already raised rates this year to tackle soaring inflation that’s squeezing households and prompting large-scale government support as Russia’s invasion of Ukraine drives energy costs higher.

“This generally reads as the ECB finally realizing they need to be in ‘catch-up’ mode with rate hikes, at least out the gate,” economists led by James Rossiter at TD Securities said in a report. “Once rates have reached positive territory, the pace of tightening can slow.”

Relentless inflation had fed a fierce debate among ECB officials over how aggressive the response should be, with a sizable contingent pushing to consider a half-point hike matching the most recent move by the Federal Reserve.

Even as price pressures persist and the economy loses steam, the ECB’s new outlook was somewhat more optimistic than others released this week. Forecasts from the World Bank and OECD reinforced stagflation fears as the Ukraine war saps confidence and supply-chain disruptions in Asia restrain factories.

While peak global inflation may have passed, Barclays predicts a mild euro-area recession after a splurge on summer vacations fades.

There are concerns beyond the real economy too. Lagarde reiterated the ECB’s readiness to address any potential bond-market panic as borrowing costs rise, though didn’t offer details on how exactly policy makers would react in such a scenario.

Her comments didn’t stop yields on Italian debt jumping by about 20 basis points, widening the spread over German bonds to the most since the early days of the pandemic.

“If it’s necessary, as we have amply demonstrated in the past, we will deploy either existing, adjusted instruments or new instruments that will be made available,” she said. The ECB is “committed to proper transmission of our monetary policy and as a result, fragmentation will indeed be avoided.”

Become an Insider

Become an Insider

Comments - Please login in order to comment.