Business Maverick

Cryptocurrencies stabilise after plunging on Terra, DeFi exodus

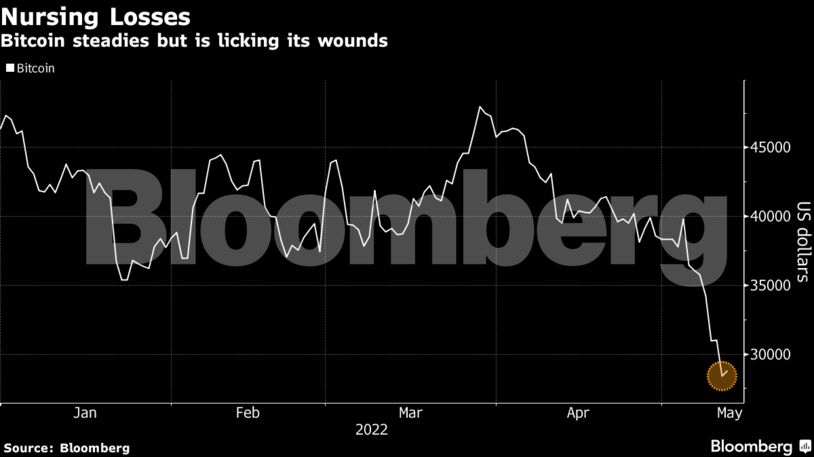

Cryptocurrencies steadied after the woes of the TerraUSD stablecoin triggered a flight from many popular digital tokens. Bitcoin climbed back to about $29,000 on Thursday from the lowest since 2020. Tokens like Avalanche and Solana that underpin some key decentralised finance protocols posted double-digit percentage gains.

“Is the market getting spooked by what’s happening with Terra? The answer is yes,” Craig W. Johnson, chief market technician at Piper Sandler, said by phone. “Money-market funds are important to investors and right now we’re questioning the third-largest money-market fund in crypto land. People did not think we were going to break the buck on that and that’s clearly happened.”

Crypto sentiment was also hurt by elevated US inflation, which points to aggressive interest-rate hikes — an unfavorable environment for risk assets. “There is extreme fear across the crypto market,” said Marcus Sotiriou, an analyst at the UK-based digital-asset broker GlobalBlock.

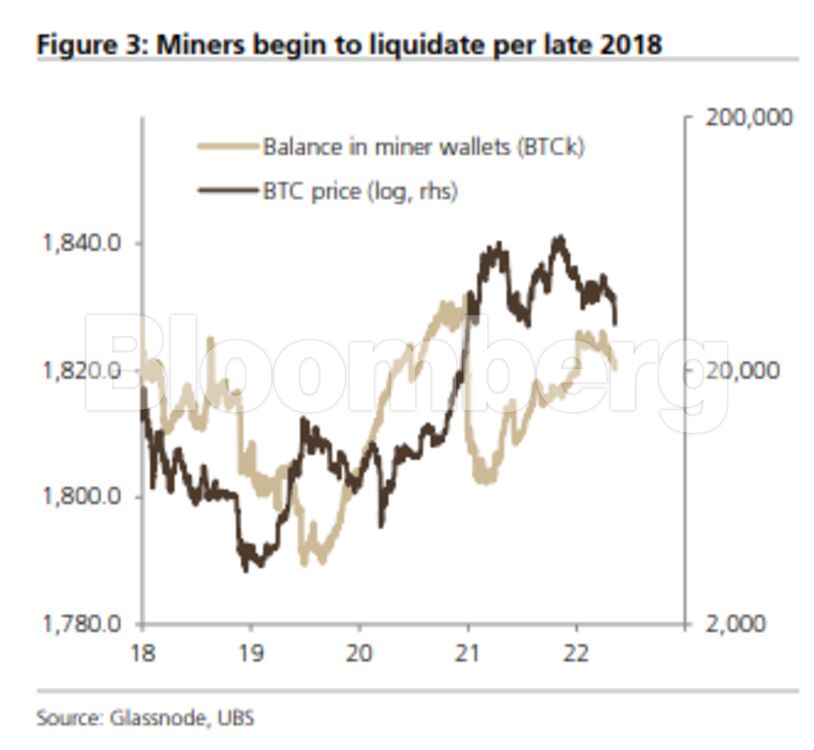

The area around $30,000 had been an “especially sensitive zone,” for Bitcoin, wrote James Malcolm, head of foreign exchange and crypto research at UBS. That’s where mining economics turn negative, “which could potentially lead to increased coin sales by this key cohort,” he said.

Meanwhile, Coinbase Global Inc. shares and bonds fell to new lows Wednesday, signaling investor skepticism about the prospects of the crypto exchange in a bear-market. The company reported lower-than-expected revenues yesterday, and warned trading volume and monthly transacting users in the second quarter is expected to be lower than in the first.

Piper Sandler‘s Johnson says that’s another concern for crypto investors right now. “It’s the largest exchange here in the United States and they just turned a loss,” he said, adding that Terra’s troubles are all “snowballing in crypto land.”

Still, a lot of crypto investors, cognizant of the fact that Bitcoin has gone through a boom-and-bust cycle before only to recoup losses over and over again, are preaching patience.

“Ultimately every investor needs to size positions based on their risk level and time horizon,” said Alex Tapscott, managing director of the digital asset group at Ninepoint Partners. “We believe Bitcoin will recover and that we’re still in the early stages of this new internet of value. Keep calm and HODL.” BM

Become an Insider

Become an Insider

Comments - Please login in order to comment.