The remarks continue a softer message since Lagarde’s surprise pivot last week where she no longer excluded a rate hike this year, a shift toward the stance of global peers that prompted bets on faster tightening. That followed a run of surging inflation including the highest readings since the euro was created.

Lagarde stressed that the euro zone can’t be compared to other major jurisdictions.

“The U.S. economy is overheated, whereas our economy is far from being that,” she said. “That’s why we can — and must — proceed more cautiously. We don’t want to choke off the recovery.”

Policy makers privately see a change in formal guidance materializing as soon as next month, when they’ll get new economic forecasts and reassess their bond-buying.

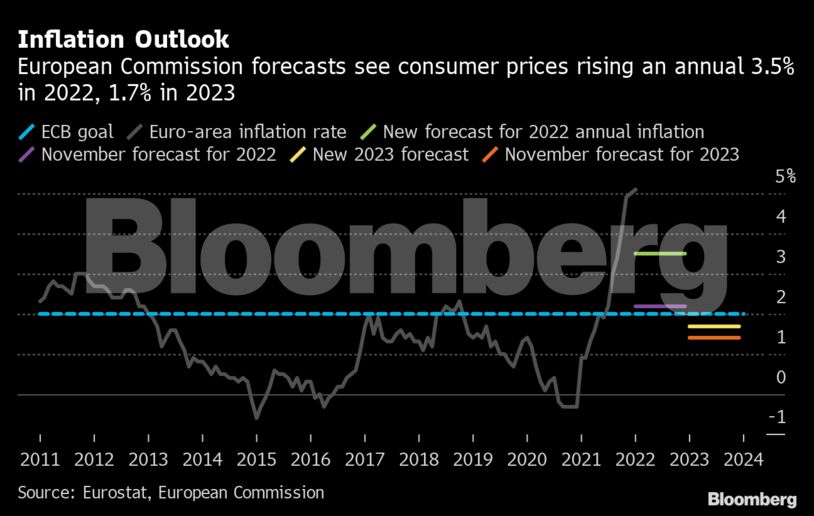

“Inflation may turn out to be higher than we projected in December,” Lagarde said. “We will analyze that in March, and then take it from there.”

A growing number of ECB policy makers are losing faith in the institution’s current inflation forecasting, emboldening their shift toward hiking rates, officials with knowledge of the matter have told Bloomberg.

Lagarde cautioned that inflation is only likely to exceed the 2% goal in the medium term if wages were to “significantly and persistently” breach that level.

“We are not seeing that at the moment at all,” she said. “In most euro-area countries, including Germany, wage demands are very moderate.”

Become an Insider

Become an Insider

Comments - Please login in order to comment.