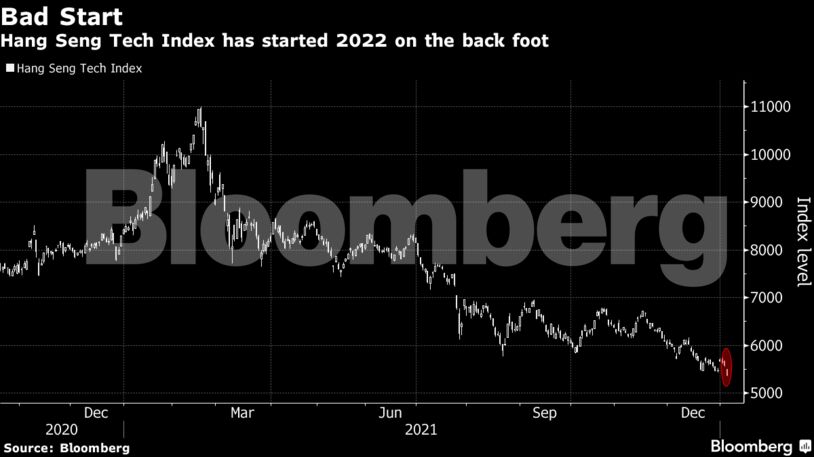

The Chinese tech giant cut its stake in Singapore’s Sea Ltd. on Tuesday — selling $3 billion of shares — sparking concerns of similar actions at other firms amid Beijing’s regulatory crackdown. China’s U.S.-listed tech shares fell overnight amid a broad selloff in the sector, with traders worried about the rise in Treasury yields putting pressure on stocks with extended valuations.

Drubbing in Tech Marks Biggest New-Year Stock Rotation Since ’95

Tencent’s move is aiding expectations that the firm and its rivals may pare holdings as Beijing punishes the country’s tech giants for anti-competitive behavior, including maintaining closed ecosystems that favor certain firms at the expense of others. Last month the company said it plans to distribute more than $16 billion of JD.com’s shares as a one-time dividend.

“China’s anti-monopoly rules and regulators’ concerns about data privacy as well as Web security may lead to more divestment in the country’s internet space in the coming months,” Bloomberg Intelligence analyst Cecilia Chan wrote in a note.

Tencent Sells $3 Billion in Shares of Singapore’s Sea

Tencent controlled a portfolio of investments worth $185 billion at the end of September, Bloomberg Intelligence estimates.

Online Pressure

Among Tencent-backed companies, live-streaming platform operator Bilibili dropped as much as 9.4% while food delivery giant Meituan dropped as much as 8.6%. China’s No. 2 online retailer JD.com fell as much as 7.2% and Tencent declined as much as 4.2%.

“China is at the stage of implementing many tightened policies and rules that the government announced last year on the technology sector,” said Linus Yip, a strategist at First Shanghai Securities. “The range-bound trading and heightened volatility may last through the first quarter.”

The recent spike in U.S. Treasury yields has also weighed on tech stocks across Asia. The MSCI AC Asia Pacific Communication Services Index dropped as much as 2%, the most since Dec. 20. SoftBank Group Corp.-backed search engine operator Z Holdings Corp. fell as much as 4.1% while chipmaker Samsung Electronics Co. declined as much as 2.5%.

On a more positive note, Alibaba Group Holding Ltd. outperformed after Daily Journal Corp., a newspaper and software business that counts Charlie Munger as chairman, nearly doubled its holding of the Chinese internet giant in recent months.

Become an Insider

Become an Insider

Comments - Please login in order to comment.