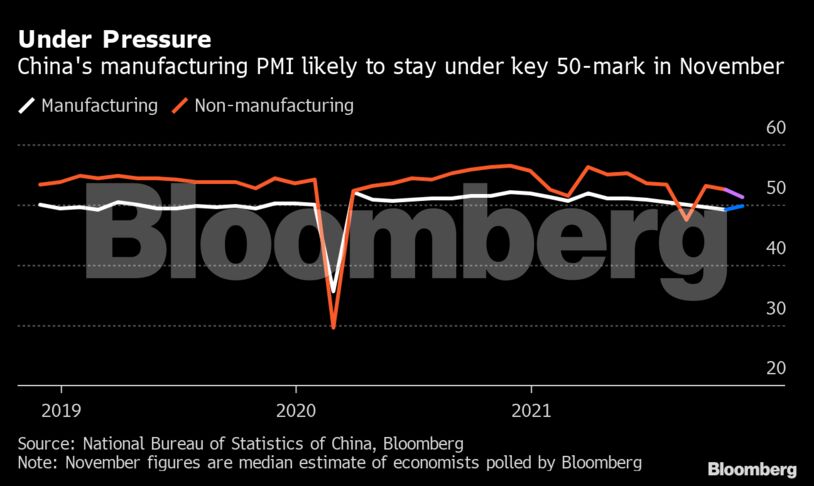

The non-manufacturing gauge, which measures activity in the construction and services sectors, is forecast to fall to 51.5 from 52.4 in the previous month.

China’s energy shortages, which ravaged factory production in September and October, likely eased this month as coal producers boosted output and inventories rose. However, the housing market crisis shows no signs of ending, and frequent Covid-19 outbreaks continue to curb consumption.

“Supply-side restrictions have improved marginally, so production likely rebounded somewhat,” said Xing Zhaopeng, senior China strategist at Australia & New Zealand Banking Group Ltd. But there’s “not much positive signal on domestic demand,” which continued to weigh on activities, he said.

Economic growth is forecast to slow to 5.3% next year, according to a Bloomberg survey median, with some economists seeing expansion as low as 4%. Bloomberg Economics forecast growth will come in at 5.7%, as the government will likely target a 5-6% range.

What Bloomberg Economics Says…

“In 2021, policy played a secondary role in setting the growth trajectory. In 2022, it will be pivotal. The extent of the slowdown will hinge largely on what balance China strikes between supporting short-term growth and advancing long-term reforms.

…We see the People’s Bank of China cutting the interest rate on its one-year medium-term lending facility by 20 basis points and the reserve requirement ratio by 100-150 bps by end-2022.”

— Chang Shu and David Qu

For the rull report, click here

Authorities are trying to moderate the sharp downturn in the property market, while providing targeted support to areas such as small businesses and green technology. Officials will reveal more clues on how much policy easing they plan to provide during two key political meetings in December by the Politburo and the Central Economic Work Conference.

China will adopt a more proactive macroeconomic policy next year to respond to the challenges from an uneven recovery of the global economy and instability in containing the pandemic, the Securities Times, run by the People’s Daily, said in a front-page commentary Monday.

Authorities have exercised restraint in using monetary and fiscal tools amid an economic slowdown this year, thus creating sufficient space for policy maneuvering next year, according to the commentary.

The slowdown is being cushioned by strong export demand, which likely remained solid in November, judging by latest shipment figures from South Korea.

Consumption and travel continues to be affected by a resurgence in virus cases and the country’s growing determination to stick to its strict Covid Zero strategy. Subway passenger traffic in six major cities of China declined less than 10% in November from October, though the plunge is smaller than that over the August outbreak, according to Xing.

Become an Insider

Become an Insider

Comments - Please login in order to comment.