ONLINE LEARNING BUSINESS

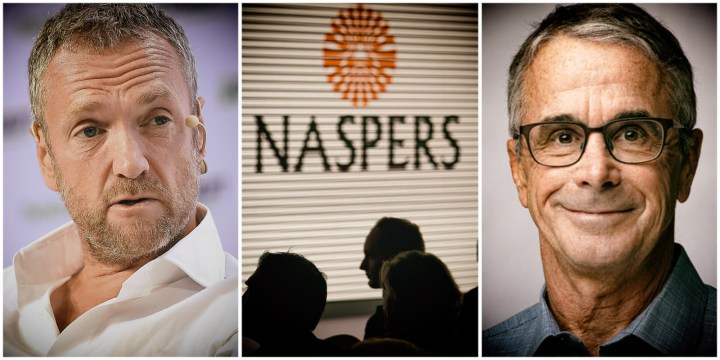

News of Udemy Nasdaq IPO shows that Naspers/Prosus still has the Midas touch

With online learning company Udemy announcing on Wednesday it intends to go public, Naspers/Prosus is heading for another boost, following an astounding six-year-old investment with returns that are just fall-on-your-back extraordinary.

The Nasdaq listing price for Udemy has not been announced yet, but the speculation is that Udemy is targeting an IPO value of between $6-billion and $8-billion.

This will be music to the ears of Naspers/Prosus investors, who have seen the company drop by 25% year-to-date, and its management, which started investing in Udemy in 2016.

Naspers/Prosus has invested $121-million into Udemy, and currently has a 13.98% stake. Even at the low end of listing expectations, that would be a return of around 600%.

Even though in percentage terms, this is thumping, compared to Prosus’s market cap of €141-billion it’s pretty small potatoes. But it does demonstrate that the company can still pick ’em.

And, of course, it’s hard to know how the listing will go. The company’s revenue grew by 55.6% to $429.9-million in 2020 from a year earlier, according to its IPO filing. Not that anyone cares, it did lose money in that period, incurring a net loss of $77.6-million.

But clearly, the coronavirus period has been a game-changer, and consequently it’s keen to list. It was valued at $3.3-billion less than a year ago. The company provides more than 183,000 courses in 75 languages across more than 180 countries.

It has 44 million learners on its platform, and confidently expects its estimated addressable market to grow in multiples because of the transition to online learning.

On the other hand, competition is strong. In the same sort of area but with a slightly different business approach is Coursera, which has an academic bent.

Its platform is open only to trained university academics, and it aims at providing something comparable to certificate courses. The company went public in March this year, exploded on listing, but has subsequently come off badly and is down about 35% year-to-date.

Udemy is a more open platform, and one of its focuses is on corporate learning. An extraordinary 42% of Fortune 100 companies have used Udemy Business, the company’s corporate learning service.

But others are entering the space fast, notably, the similarly named but very different Udacity, edX and many others. Universities around the world are also rushing into the space, sometimes called Massive Open Online Courses (Moocs), often with a public service agenda.

In connection with the IPO filing, a Prosus spokesperson said: “We support our companies when it is time for them to go public for the company’s own benefit and are supportive of the Udemy IPO. We do not have plans to sell any shares of Udemy as we believe there is significant growth opportunity ahead for the company.” DM/BM

Become an Insider

Become an Insider

they could have earned not far from the same comparatively risk-free, fully liquid and while banking dividends in several listed US technology stocks. An equally weighted basked of Apple, Alphabet, Amazon, Facebook, Google, Microsoft and Paypal would have returned 435% not counting dividends over 5 years.

As an investor, the risk profile of their actual investment (a minority illiquid stake in a private company where you have no say) was infinitely worse than that basket of listed tech shares. One suspects that when the prosus hired help bonuses are worked out, their performance will not be measured against a risk free return of 30%

To their credit they didn’t invest that money in their own shares