The losses mirrored the concerns in the broader market as investors weighed the risks coming from Evergrande debt crisis and this week’s Federal Reserve meeting. The S&P 500 fell 1.7% in its worst session since May overnight, and the stock selloff continued in Asia on Tuesday.

“Some have attributed the sudden dip to the currently ongoing Evergrande situation in China which has already caused turmoil in traditional markets,” wrote Jonas Luethy, a sales trader at GlobalBlock, the U.K.-based digital asset broker. “Analysts have suggested a choppy week is ahead, with a potential pullback to as low as $41,000.”

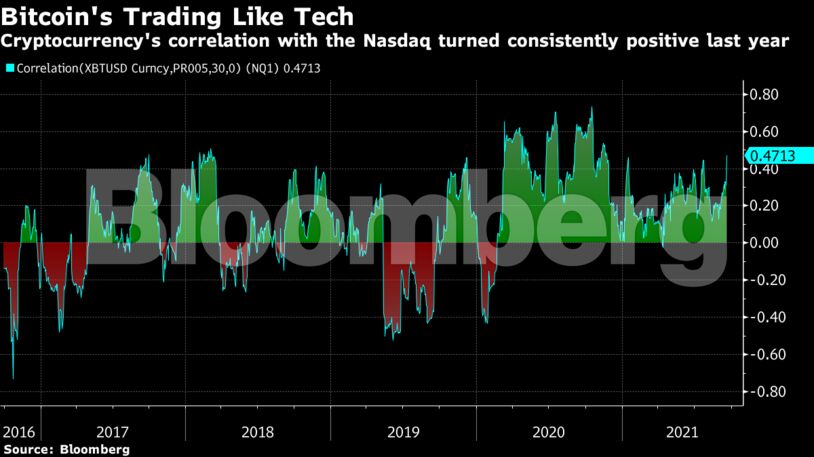

Although Bitcoin doesn’t always trade in tandem with financial markets — a characteristic that made it a tempting proposition from a portfolio-diversification point of view — its correlation on a 30-day basis to futures on the Nasdaq 100 has been consistently positive since February last year. As Bitcoin becomes more integrated in global financial markets, it may respond more to the changes in risk appetite that drive global sentiment.

Meanwhile, El Salvador’s President Nayib Bukele said the country had “bought the dip,” in Bitcoin, adding 150 tokens to raise its total holdings to 700 — about $32 million based on current pricing. The nation recently adopted Bitcoin as legal tender in a controversial move that met with technical glitches and protests.

“This is part of a well-established pattern where it sells off as traders cash in their riskier assets to cover margin calls and/or sit on the sidelines until markets calm down and they feel more comfortable going back into riskier positions,” said Leah Wald, chief executive officer at Valkyrie Investments.

Become an Insider

Become an Insider

Comments - Please login in order to comment.