The company is expected to start trading on the Nasdaq Stock Market on July 29, according to people with knowledge of the matter. A representative for Robinhood declined to comment.

As a publicly traded brokerage, Robinhood will join the ranks of Coinbase Global Inc., a cryptocurrency trading platform that debuted this year and is currently worth almost $47 billion, and industry heavyweight Charles Schwab Corp., which bought competitor TD Ameritrade last year and has a market value of about $130 billion.

With plans to raise more than $2.2 billion, Robinhood’s IPO would be the fifth-biggest on a U.S. exchange in 2021. This year has already set an all-time record with 648 companies raising a total of about $218 billion, according to data compiled by Bloomberg.

Founders’ Wealth

Robinhood’s co-founders, Chief Executive Officer Vlad Tenev and Chief Creative Officer Baiju Bhatt, own stakes in the company worth about $2.5 billion and $2.8 billion, respectively, at the midpoint price, according to the Bloomberg Billionaires Index. Tenev, 34, will hold about 26% of the company’s voting power, while Bhatt, 36, will command 39%, according to the filing.

Salesforce Ventures, the investment arm of Salesforce.com Inc., expressed interest in purchasing up to $150 million of Robinhood shares at the IPO price, the filing showed.

Robinhood caught on during the coronavirus pandemic as homebound young people turned to online trading to pass the time and make money. Its monthly active users have more than doubled in the past year, with 17.7 million as of the first quarter, up from 8.6 million in the same period in 2020.

The Menlo Park, California-based company has said it will reserve 20% to 35% of its Class A shares for its customers.

Increased Scrutiny

Robinhood’s increased popularity has led to scrutiny from politicians and regulators, who are focused on the so-called gamification of trading and its role in the meme-stock phenomenon. At the height of the volatile late January frenzy over stocks like GameStop Corp., the company had to raise billions of dollars from its backers.

In June, the Financial Industry Regulatory Authority imposed a nearly $70 million fine on Robinhood, a record for the watchdog. Finra alleged Robinhood misled its customers about margin trading and lapsed in its oversight of technology and approvals for options traders. Robinhood neither admitted nor denied the claims.

The company revealed it expects to pay $30 million in a settlement with the New York State Department of Financial Services over allegations that its cybersecurity practices and monitoring of cryptocurrency transactions were insufficient. It had already disclosed the inquiry and said it would likely pay at least $15 million to settle the claims in an earlier filing.

QuickTake: Robinhood, Meme Stocks and Investing as a Game

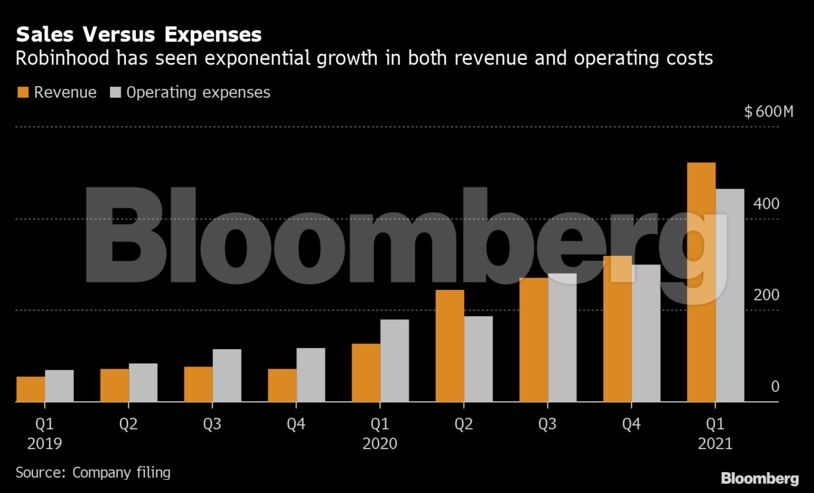

Robinhood announced in March that it had filed confidentially to go public. It disclosed its financials for the first time in its July 1 public filing, which showed the company generated net income of $7.45 million on net revenue of $959 million in 2020, compared with a loss of $107 million on $278 million the previous year.

Robinhood’s top shareholders are venture firms DST Global, Index Ventures, New Enterprise Associates and Ribbit Capital. Each group owns more than 5% of its stock leading into the offering.

Goldman Sachs Group Inc. and JPMorgan Chase & Co. are leading Robinhood’s offering. Its shares are expected to trade under the symbol HOOD.

Become an Insider

Become an Insider

Comments - Please login in order to comment.