The situation is fluid and negotiations may be reactivated in time to add more output in August. However, the breakdown has damaged the group’s image as a responsible steward of the market and raised the specter of a repeat of last year’s destructive price war that sent oil crashing.

| Related news |

|---|

|

“In theory, if the group keeps output unchanged in August that should be bullish for the market,” said Warren Patterson, the head of commodities strategy at ING Group NV. “However, in reality, what is the likelihood that members actually keep output unchanged? I don’t think it’s very high.”

The global market has tightened significantly over the past few months amid a robust rebound in fuel demand in the U.S., China and parts of Europe, draining stockpiles built up during the pandemic. The International Energy Agency last month urged the OPEC+ alliance to keep markets balanced as worldwide demand accelerated toward pre-virus levels.

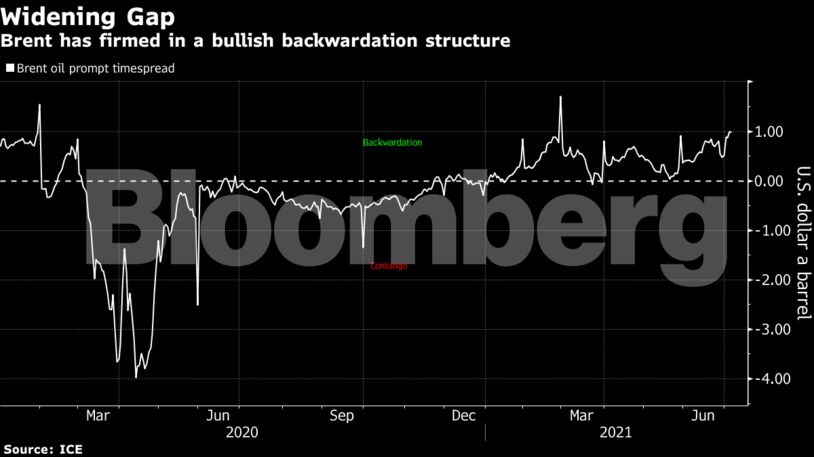

The market has moved further into a bullish structure after the breakdown of talks. The prompt timespread for Brent was 99 cents a barrel in backwardation — where near-dated contracts are more expensive than later-dated ones — compared with 87 cents on Friday.

OPEC+ had restored about 2 million barrels a day halted during the pandemic from May to July. The alliance was close to a deal to raise daily output by a further 400,000 barrels in each month from August through December, as well as extend the supply pact beyond April 2022. The UAE, however, said it would only accept the proposal if it was given better terms for calculating its quota.

The UAE said throughout that it would accept the output increase without the deal extension, but the Saudis argued that the two elements must go together.

| Prices |

|---|

|

With no imminent boost to OPEC+ supply, the market is likely to tighten further and could result in Brent climbing to $80 a barrel by September, according to UBS Group AG. It’s unclear if the no deal will translate into lower compliance rates next month, although the the release of Saudi Aramco’s official selling prices for August should provide more clarity, the bank said.

Become an Insider

Become an Insider

Comments - Please login in order to comment.