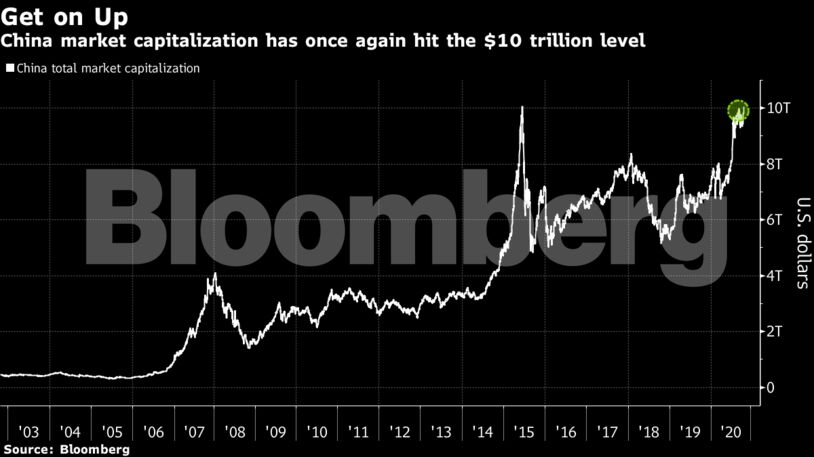

The country’s total market capitalization is now $10.04 trillion and just shy of the all-time high, according to data compiled by Bloomberg as of Monday. The U.S. has the world’s most valuable stock market at $38.3 trillion.

“It’s a meaningful number, especially coming after a pause in the stock rally,” said Hao Hong, chief strategist for Bocom International in Hong Kong. “It’s possible China’s market value can expand faster now that market reforms like the registration-based IPO system are in place.”

Chinese shares rallied after a long holiday break on optimism the government will introduce reforms to turn the region around Shenzhen into a global technology hub and that the ruling Communist Party will introduce policies to stimulate demand when it holds a major meeting later this month. Equities surged over the summer as margin debt climbed at the fastest pace since 2015 and turnover soared.

The CSI 300 Index of key stocks listed in Shanghai and Shenzhen slipped 0.2% as of 10:17 a.m. on Tuesday, paring its gain in 2020 to 17%. That rally tops the world’s major benchmarks.

China has added a new stock venue since 2015, with the Nasdaq-style Star market launching in Shanghai in July last year. Regulators waived rules on valuations and debut-day price limits for shares on the board. In August this year, a batch of 18 firms traded for the first time on the ChiNext Index under so-called registration-based initial public offerings, surging by an average 212% by the close.

A stronger yuan has also helped equities. China’s currency rose 3.9% last quarter, the most in 12 years. That advance has prompted the central bank to restrain the yuan’s rally while stopping short of encouraging declines.

Become an Insider

Become an Insider

Comments - Please login in order to comment.