The inclusion gives foreign investors yet another way to invest in Chinese debt and should prompt inflows into the world’s second-largest bond market. Goldman Sachs estimated it would attract $140 billion over the 12-month phase-in period. FTSE Russell becomes the last of the three main index compilers to add Chinese debt after Bloomberg Barclays and JPMorgan Chase & Co. Bloomberg Barclays is owned by Bloomberg News parent Bloomberg LP.

“This is a new milestone,” said Xing Zhaopeng, an economist at Australia & New Zealand Banking Group Ltd. “It is a new catalyst as well given the huge potential for foreign capital inflows considering FTSE’s weight and influence. Foreign ownership of Chinese assets will increase significantly — I’d say it would at least double.”

Everything China Has Been Doing to Reform Its Bond Markets

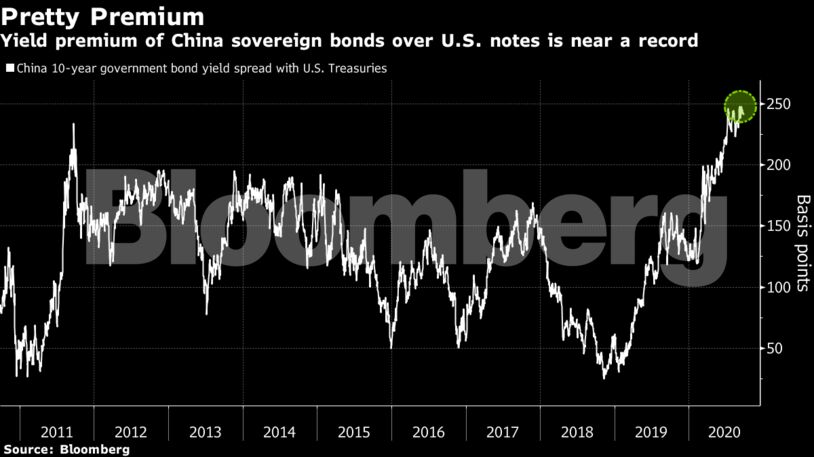

The higher yields on Chinese sovereign bonds have been attractive to investors from around the world given the returns on most notes in developed nations are near zero. China’s rate premium over the U.S. debt is near the highest level on record.

Inflows into the nation’s debt market from abroad have jumped nearly 40% each year since 2017 to a record $383 billion as of the end of June, data from the People’s Bank of China show. Foreigners still account for less than 3% of the $16 trillion market.

When FTSE Russell rejected Chinese debt for inclusion a year ago it cited the need for greater secondary market liquidity, as well as increased flexibility in foreign exchange execution and the settlement of transactions. China has made a number of reforms to its bond market since then, some of them touching on those issues. In April, the index compiler acknowledged that China had addressed calls to increase market accessibility and provided investors with greater currency trading options and improvements to liquidity.

The main takeaway from FTSE Russell inclusion is that China will be thought of more as a developed market rather than an emerging one, Goldman Sachs analysts including Danny Suwanapruti wrote in a note Friday. Inflows to China sovereigns would mostly come from U.S. Treasuries, European markets and Japanese notes, the bank said. It estimated China would have the sixth-largest weighting in the government measure at 5.7% once phase-in was completed.

Chinese government bonds have retreated for five straight months, with the yield climbing 1 basis point to 3.10% as of 10:17 a.m. in Shanghai. The notes have been under pressure amid concern about tighter liquidity, a central bank that has avoided cutting interest rates and growing appetite for riskier assets as an economic recovery from the virus pandemic accelerates. The nation’s benchmark CSI 300 Index is trading near the five-year high it reached in July.

Expectations that FTSE Russell would add Chinese bonds to its indexes have helped sentiment for the yuan. The currency has surged about 3.7% this quarter, the most in Asia. The yuan was last up 0.21% at 6.8132 a dollar.

Become an Insider

Become an Insider

Comments - Please login in order to comment.