Read: Dot-Com Valuation Flashback Doomed Stock Market to Swift Retreat

Equities extended their September selloff as a new investigation by the International Consortium of Investigative Journalists says some big global banks “kept profiting from powerful and dangerous players” in the past two decades even after the U.S. imposed penalties. Meanwhile, the eruption of a partisan battle over replacing Supreme Court Justice Ruth Bader Ginsburg damaged already-slim prospects for another round of fiscal stimulus. Speaker Nancy Pelosi and House Democrats released a stopgap government funding bill without support from the White House or Senate Republicans — raising the risk of a federal shutdown at the end of the month.

As U.S. deaths related to Covid-19 approached 200,000, former Food and Drug Administration Commissioner Scott Gottlieb said he expects the nation to experience “at least one more cycle” of the virus in the fall and winter. Germany’s health minister warned that the trend of cases in Europe is “worrying” amid expectations that restrictions could soon be extended to London.

“Maybe there are worries we will see another wave of lockdowns. We also have U.S. political risk rising,” according to Jeffrey Kleintop, chief global investment strategist at Charles Schwab Corp. “There are some concerns there could be more fines in place on financial-services institutions,” and that could further hit earnings estimates, he said.

Elsewhere, oil slid after Libya signaled the resumption of some crude exports. Silver and gold tumbled.

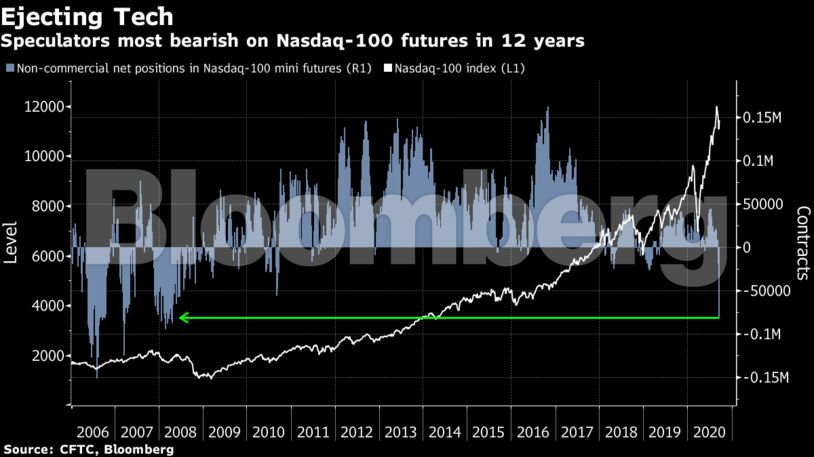

Speculative investors are souring on the outlook for U.S. technology stocks. Positioning in Nasdaq-100 mini futures is the most bearish since April 2008, the latest Commodity Futures Trading Commission data show. High-flying tech shares could remain under pressure until lingering optimism still evident in options bets normalizes, according to Julian Emanuel, a strategist at BTIG LLC.

These are some of the main moves in markets:

Stocks

- The S&P 500 dipped 2.5% as of 2:57 p.m. New York time.

- The Stoxx Europe 600 Index sank 3.2%.

- The MSCI Asia Pacific Index slid 1.1%.

Currencies

- The Bloomberg Dollar Spot Index jumped 0.8%.

- The euro decreased 0.7% to $1.1754.

- The Japanese yen weakened 0.2% to 104.82 per dollar.

Bonds

- The yield on 10-year Treasuries declined three basis points to 0.66%.

- Germany’s 10-year yield fell five basis points to -0.53%.

- Britain’s 10-year yield declined three basis points to 0.157%.

Commodities

- West Texas Intermediate crude dipped 4.3% to $39.33 a barrel.

- Gold depreciated 2.2% to $1,907.47 an ounce.

- Silver sank 9.1% to $24.36 per ounce.

Become an Insider

Become an Insider

Comments - Please login in order to comment.