BUSINESS MAVERICK

Hybrid annuities: Retirement fund defaults may be the cheaper options

Those retirement funds offering default annuities, which include the hybrid option, are probably offering you the best retirement option, particularly if you have not saved enough for retirement.

A hybrid annuity attempts to mix the best outcomes from an investment-linked living annuity (living annuity), where you take the risks, and a with-profit smoothed guaranteed annuity where a life assurance company takes most of the risks. Hybrids can use inflation, fixed or with profit annuities. Research has, however, shown that new with-profit options, targeting inflationary increases, are more optimal for use in hybrids.

John Anderson, who heads research at Alexander Forbes, says that if an annuity (living, guaranteed or hybrid) is offered by your employer-sponsored retirement fund as default, your costs will definitely be lower.

And depending on the composition of your living annuity and the underlying guaranteed with-profits annuity you can reduce costs significantly.

Anderson says the lower costs are a result of government intervention and retirement funds being able to use their group purchasing power to negotiate better fees to benefit you.

One example is the Alexander Forbes default living annuity options. The passive funds cost a lot less than active funds. Alexander Forbes also uses an institutionally priced unit trust for the funds underlying the with-profit annuity in their hybrid. Other examples are where PPS and Sygnia use passively managed funds underlying the with-profit annuity in their hybrids, reducing the costs further. Typically, charges, as set out in a document by National Treasury overall, could be around 2.5% a year – and in some cases, costs can be even more than this.

With the new default options, the overall costs are far lower than this, with savings of up to 2% per annum. This could translate to pensioners extending their income for up to four years more before reaching a “point of ruin”.

On March 1, 2019 was the last year a number of defaults for retirement funds were put into place by National Treasury. One of these defaults was on an annuity (pension) strategy.

The government has said your retirement fund may select a pension for you. It is what is called a “soft” option. You do not have to take it up. You must agree to the default by selecting it in writing from the full range of available pensions from an outside commercial provider or any other annuity provided by your fund.

With the default, you are allowed to take up any option you like from the range of investment-linked living annuity (living annuity); or a guaranteed annuity of any type, from a level annuity to one linked to inflation, or a with-profit annuity.

Retirement fund members need to receive retirement benefit counselling on annuity choices before they retire.

You will not be charged for this counselling, which is paid for by your fund and at a minimum takes place six months before you retire. The benefit counselling is provided by your fund or a retirement fund administrator.

The annuity can be offered by your fund (an in-fund annuity) or by an assurance company or a Linked Investment Services Provider (Lisp) (an out-of-fund annuity).

The government wants pensions to offer reduced costs and make the choices appropriate and transparent. The pension funds regulator, the Financial Standards Conduct Authority (FSCA), is about to finalise a draft Code of Standards for Defaults on both living annuities and with-profit guaranteed annuity policies. Many of the standards have already been accepted and introduced in default portfolios.

The main requirements of the current draft Standard for a Default Strategy are:

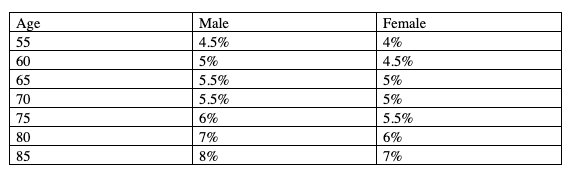

- A default living annuity must have at least a 90% chance of success before meeting the point of ruin, where your annuity starts reducing in nominal as well as real after-inflation return. FSCA has recommended the following drawdown rates:

The current Regulation 39 for Default Annuity Strategies, Draft Standard of Living Annuities and Criteria for Smooth Bonus products to be included in Regulation 39 says that for both living and guaranteed annuities:

- The sustainability of income must be regularly measured and communicated to a pensioner at inception and on a regular basis. This must include warnings that they may be drawing down too much.

- You must be told if your required pension is lower than the amount you require as an income, the risks and sustainability of the pension, and that there is no guarantee of an alternative pension (apart from a social old-age grant) if the plan is not sustainable. With guaranteed annuities there must be a clear and understandable approach to awarding bonuses and non-vesting bonuses, and the triggers that will require investment companies to come to a pensioner’s aid if the value of their annuity drops below a certain level because of falling investment markets. The lack of transparency in the past has been one of the main points of opposition to guaranteed annuities.

- With guaranteed annuities, the spread of the maximum and minimum bonus reserves must be defined, as well as what action will be taken if they are broken, with the proviso that the excess bonus reserve must be limited to a long-term funding level that must not exceed 105% of the portfolio, and the spread of the reserve should not exceed two years. Again, another problem as most of the pension increases were done at the secretive whim of the chief actuary of the company supplying the guaranteed annuity.

- The charge for any guaranteed fee must be similar to the investment risk taken. You must be provided with the guaranteed fee, and it should be separate from other charges. In the past, most guarantees have been based on the risk taken by the company and not on the underlying investment portfolio.

- All assets must be invested in terms of Regulation 28, which limits how much may be invested in each asset and sub-asset class. Previously this did not apply to pensions, only to the contributing members. If a life company deviates from these standards, it must be reported to the FSCA. This is a problem underscored by Covid-19. The pensioners who have done well are those invested in a living annuity that had large amounts invested offshore.

- It is the responsibility of your retirement fund to ensure that any such policies meet the requirements of the Treating Customers Fairly regulation, in that they should not appoint a life assurance company that does not meet all the principles. The requirements specify that:

- Products and services be designed to meet the needs of funds and members;

- The funds be given clear information and be kept informed of any changes, with this information being passed on to their members;

- Portfolios perform as they have led investors to expect; and

- The funds face no unreasonable post-sale barriers to change a product, submit a claim or make a complaint.

Top of the class of recommended default annuity strategies is the hybrid annuity structure. This is the favoured structure of the country’s biggest retirement fund administrator, Alexander Forbes, because individuals are able to blend traditional portfolios with a with-profit annuity within a single solution.

Deane Moore, chief executive of a company, Just SA, and whose lifetime income portfolios are being chosen by many hybrid annuity providers, says that the pension product is designed for most pensioners, particularly for those who retire with too little savings for their lifestyle.

It is critical that this group of pensioners optimise their income, using their savings to secure their essential expenditure over their full lifetime.

It will ensure people live with a certain level of income until they, or their partners, die using sound investments and not enriching other people while they go without.

However, he warns that if you have retired with too little money it will not necessarily make up for this, but it will ensure you live within your means and don’t run out very quickly in the future. BM/DM

A series of reports written by Bruce Cameron, the semi-retired founding editor of Personal Finance of Independent Newspapers, that cover the effects of Covid-19 on pensioners including research undertaken by Alexander Forbes on retirement income in South Africa. Bruce Cameron is co-author of the best-selling book, The Ultimate Guide to Retirement in South Africa.

Become an Insider

Become an Insider