The Guptas’ pillage of Transnet in cahoots with CRRC, the Beijing-based rail conglomerate, spanned four locomotive procurement contracts and add-ons for locomotive maintenance and the relocation of a manufacturing facility.

On Transnet contracts worth R41.9-billion, companies in the CRRC stable pledged R9-billion in kickbacks to the Guptas. By the time our banking data ends in October 2016, the Guptas had already received at least R3.69-billion.

* See our evidence docket for all the kickback contracts and a full spreadsheet analysis of Transnet payments, contracts and banking data.

On 19 January 2012, Wang Pan sent Brian Molefe an email titled “Visit in SA for 95 New Electric Locomotives”. Precisely 88 seconds later he copied it to a director of an Indian scrap metal group, setting off a cascade of forwarding that ended with a Gupta son.

Wang was deputy director in the overseas business division of CSR Zhuzhou Electric Locomotive Co, where he spearheaded the Chinese manufacturer’s attempts to penetrate the African market.

Molefe was group chief executive at Transnet, which had issued a tender for 95 electric locomotives six weeks earlier.

That Molefe met CSR officials shortly before the tender was issued, and now failed to put Wang on terms about the contents of his email, was criticised in forensic investigations commissioned by Transnet and the national treasury.

Though bidders are not supposed to contact officials once a tender process has started, Wang had asked for meetings between a CSR delegation, Molefe and Transnet technical staff “for the discussion of co-operation” and to “optimise technical specifications”. Wang also wanted introductions to “preferred” local partners.

Molefe did not respond in detail to a request for comment, but said he was “not in ‘cahoots’ with anyone, nor a part of a scheme to loot Transnet”. He denied receiving gratification from the Guptas or having “personal knowledge of any kickback arrangements while I was at Transnet”.

It did not take long for the first kickback contract to be signed.

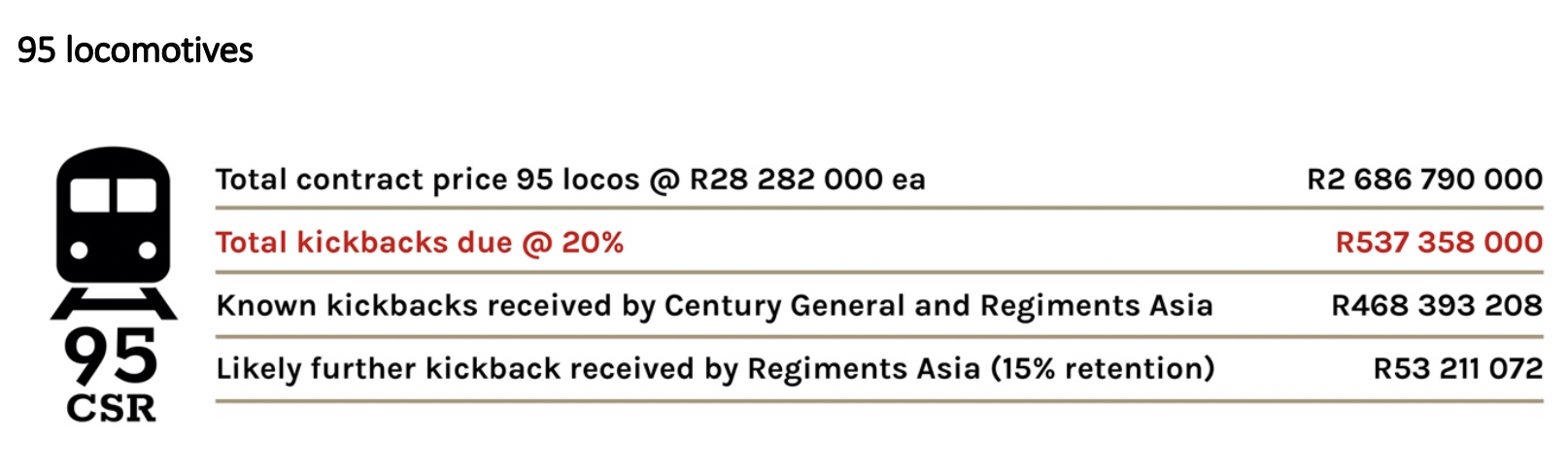

Locomotive manufacturers had until 17 April 2012 to submit their bids to Transnet. In a “consultancy agreement” dated three days before the deadline, CSR promised to pay Century General Trading, a company domiciled in a United Arab Emirates free zone that guarantees corporate anonymity, 20% of the contract price should it be awarded the tender.

Transnet awarded the R2.69-billion contract to CSR six months later – after changing adjudication criteria to reverse CSR’s disqualification for not meeting BEE criteria according to the national treasury report.

Century General, the would-be recipient of CSR’s munificence, was associated with Worlds Window, the same Indian scrap metal group to where Wang had hastily forwarded his Molefe email. Worlds Window happened to be in business with the Guptas. AmaBhungane reported previously on these connections and that Century General laundered money for the Guptas.

Though a copy of the CSR-Century General kickback agreement has yet to surface, we know of its existence from an addendum to a successor agreement and from a spreadsheet titled “Final CSR 2015 workings” that one of Wang’s colleagues later emailed to Gupta lieutenant Salim Essa.

The latter was a reconciliation of kickback payments that CSR and sister companies had made until January 2015 to Century General and an associated company.

The deal, these documents show, was for CSR to pay Century General 20% of each instalment it received from Transnet under the 95 locomotives contract. Of this, Century General was obliged to forward 85% to the Guptas as “expenditures”, presumably for their labour of winning friends and influencing contracts.

Century General could keep the remaining 15% of each kickback for its efforts, which may have consisted largely of acting as a mailbox and laundry service for the Guptas.

But the “final workings” document marked the end of the road for Century General, which by then had received a total of $16.7-million from CSR. The US dollar figure equated to R166.9-million, 20% of the R834.3-million which Transnet had paid CSR up to that point as a 10% advance and instalments for 25 locomotives.

Whether the Guptas had fallen out with Century General or had another reason to change their laundromat remains unclear. But effective 10 February 2015, CSR was to pay its kickbacks under a new “business development services agreement” to Regiments Asia, a Hong Kong company set up by Essa.

(There is no known link between Regiments Asia and the local Regiments Capital, although the Guptas used the latter, too, to extract money from state-owned companies.)

To cover against the risk that Century General would still demand its cut, the agreement permitted CSR to retain 15% of each kickback payment until the contract had run its course and Transnet paid its final instalment.

The arrangement worked like clockwork for the next five months, during which Transnet paid CSR for the remaining 70 locomotives in 14 tranches.

For each instalment it received from Transnet, CSR paid 20%, less the retention, straight into Regiments’s Hong Kong HSBC account. These payments totalled $22.5-million, equivalent to R269.2-million.

When Transnet released a subsequent “mission reliability” instalment of R134.3-million to CSR in June 2016, Regiments acknowledged receipt of R32.3-million, which for reasons unknown was more than the expected 20% less retention.

Now only one Transnet instalment remained due, for “fleet availability”, also at R134.3-million. But this was nearly a year off.

The Guptas seemingly needed cash and contracts were renegotiated with CSR, now renamed CRRC.

This resulted in the addendum, under which CRRC Zhuzhou would release the accumulated 15% retentions to Regiments prematurely – provided that Transnet awarded a separate multi-billion-rand contract, this time for maintenance services, to CSR. (Transnet did – see Maintenance services below.)

From the available banking data we cannot see if the retention – R53.2-million – or the R26.9-million kickback due on the fleet availability instalment were released to the Guptas.

But there is circumstantial evidence the retention was released: An incomplete set of statements from a separate account in Dubai shows that in October 2016, Regiments had a balance consistent with having received a payment of that magnitude. And in September 2016, CRRC released a similar retention on another kickback contract (see 100 locomotives below).

We have previously written about the “choo-choo swithcheroo”. Molefe, then Transnet’s chief executive, and Iqbal Sharma, who chaired its board tender committee, helped turn a proposal to buy 100 coal-line locomotives from Japanese manufacturer Mitsui into a proposal to buy 100 more locomotives from CSR Zhuzhou.

The contract was awarded on confinement – Transnet-speak for without a competitive tender – because of its supposed urgency. Both Molefe and Sharma, who has denied impropriety, were close to the Guptas.

Transnet’s board approved the award before CSR had even quoted. Molefe signed the contract with CSR in March 2014 at a total price of R4.4-billion – some R1.2-billion more than what Mitsui reportedly quoted.

Which left room for the bonanza that was to follow.

As with the 95 locomotives order, CSR signed a kickback agreement with a company associated with Worlds Window, the scrap metal group that was in business with the Guptas.

The basics were the same, except that this time it was a different Emirati free zone company, JJ Trading, and the kickback would be 21%, not 20%. The 21% would be broken down into a 2% initial “success fee” and 19% of each Transnet instalment.

As with Century General Trading in respect of the 95 contract, JJ had to pass 85% of each kickback on to the Guptas while it could keep 15% as its fee.

Though no copy of the CSR-JJ agreement has surfaced, we know about it from a successor contract and the “Final CSR 2015 workings” spreadsheet.

The successor contract, dated 2 January 2015, sidelined JJ in favour of Regiments Asia, the same Hong Kong company the Guptas ended up using to receive the 95 locomotive kickbacks. And again, CSR would retain 15% of each kickback until Transnet’s final instalment in case JJ challenged CSR for its cut.

By this stage, Transnet had paid R2.64-billion in advances to CSR: a very unusual 60% of the total contract price before the delivery of a single locomotive. Based on the 2% success fee and 19% instalment fee, more than half a billion rands – R589.6-million – was due in kickbacks.

The successor contract recorded that of this amount, a total of R448.5-million had already been transferred to JJ and that the balance, which it calculated as $12-million, was now due to Regiments. The banking data shows that $10.2-million (R119.9-million), which is the $12-million less 15% retention, was duly paid into Regiments’ Hong Kong HSBC account in three chunks early the following month, February 2015.

Between July and December 2015, Transnet accepted delivery of all 100 locomotives from CSR, paying for them in eight instalments totalling R1.63-billion. The banking data shows the expected 19% less retention, a total of $19.2-million (R262.9-million), faithfully hitting Regiments’ account in six tranches.

Now Transnet had only to release “mission reliability” and “fleet availability” instalments of R66-million each to CSR, but this would be more than a year later, and the Guptas seemed desperate for cash.

As with the 95 locomotives contract, they negotiated for the early release of the accumulated 15% retentions via an addendum dated August 2016.

The banking data shows that the expected retained total of $5.2-million (R67.6-million then) hit Regiments’ account less than a month later, on 1 September 2016.

The available evidence does not show whether the Guptas got their kickbacks on Transnet’s final instalments in May and June 2017.

The 95 locomotives were a curtain-raiser and the 100 locomotives a stand-in while Transnet prepared to procure 1 064 locomotives, the main act in its ambitious fleet renewal strategy.

The 1 064 tender, issued in July 2012, requested bids for 599 electric and 465 diesel locomotives.

Much has been said about Transnet’s subsequent contortions, which included changing adjudication criteria mid-stream and splitting both the electric and diesel bids in two, ensuring that CSR Zhuzhou and its cousin from China, the CNR group, each got a slice despite not getting the highest scores.

Also, Transnet negotiated in reverse, finally to conclude the four contracts in March 2014 at a total R54.5-billion including contingencies after initially budgeting R38.6-billion.

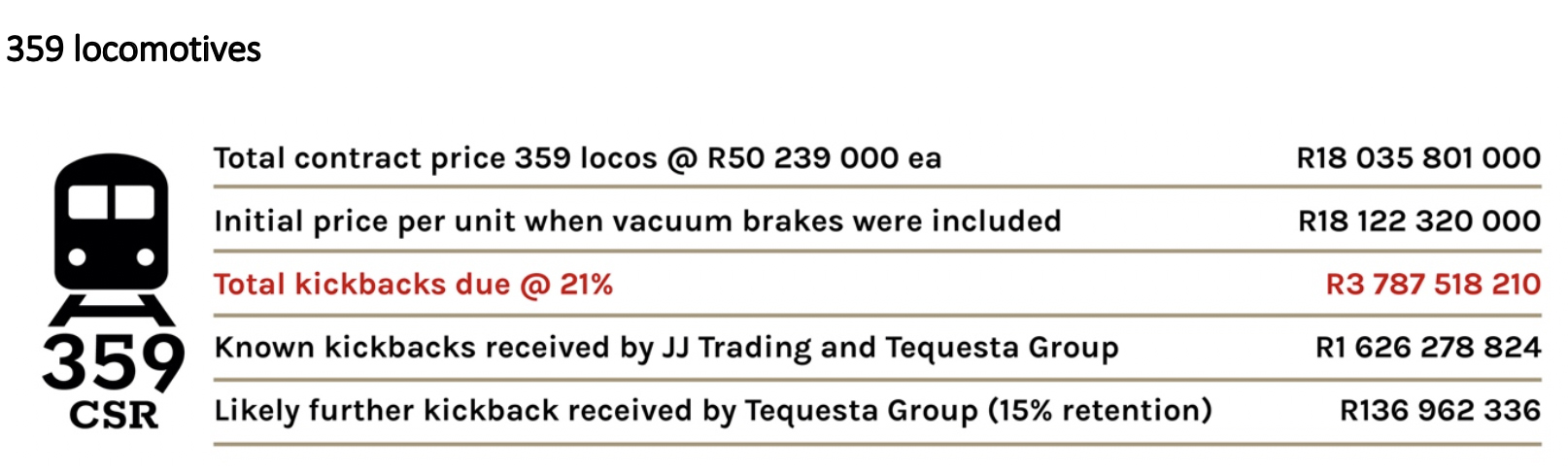

Of this, CSR got the single biggest slice: 359, or 60%, of the electric locomotives at a wallet-rending R18.04-billion.

Then the money started raining on the Guptas and their associates. As evidenced by the “Final CSR 2015 workings” spreadsheet, there was an initial 21% kickback contract between CSR and JJ Trading, one of the two Emirati companies that received kickbacks on behalf of the Guptas.

When Transnet paid CSR a 10% advance of R1.81-billion in late March 2014, R706.8-million – 2% of the entire deal and 19% of the instalment – flowed to JJ, according to a subsequent “business services development agreement”.

But following the by-now established pattern, the agreement cut JJ out in favour of a Hong Kong company set up by Gupta lieutenant Essa, this time Tequesta Group.

The agreement provided that a CSR Hong Kong subsidiary would pay Tequesta the 19% kickback due on each Transnet instalment, although again it could retain 15% (of the kickback, not the Transnet instalment) until the contract had run its course, in case JJ made trouble.

The banking data shows that after Transnet made a second advance payment – R3.62-billion, 20% of the 359 locomotives contract price – to CSR in June 2015, CSR (Hong Kong) paid a total of $43.5-million – the expected R585.4-million – to Tequesta’s Hong Kong HSBC account in 10 instalments spread out over three months.

When in May 2016, more than two years after contracting with CSR, Transnet finally accepted delivery of the first eight locomotives and paid CSR R262.5-million, the expected R42.4-million dropped into Tequesta’s account.

After that our Hong Kong banking data goes dark, but a subsequent addendum – again providing for the early release of the 15% retentions if Transnet also gave CSR the maintenance contract – acknowledged that Tequesta had received the total expected equivalent of R148.4-million from CSR in respect of the next 28 locomotives delivered to Transnet.

After that, a switch: Tequesta had in the meantime opened an account with Habib Bank in Dubai. This is where two amounts, $2.2-million and $8.2-million, plopped on two days in late October 2016 from CRRC (Hong Kong), as the CSR Hong Kong subsidiary was now called.

They were the expected R31.2-million and R112.2-million 19% kickbacks, now unencumbered by retentions, on Transnet’s instalments for the next 23 locomotives.

Though our banking data does not contain direct evidence, CRRC probably released the accumulated 15% retentions to the Guptas too.

Tequesta’s Dubai account shows a balance on 3 September 2016 consistent with a deposit of at least $8-million on 1 or 2 September 2016, which is exactly when CRRC released the retention on the separate 100 locomotives contract (see 100 locomotives above).

Accounting for possible outflows, of which there were many around that time, this was likely the cumulative $10-million (R137-million) that the locomotive manufacturer had previously retained.

That is the end of our Dubai banking data too. At that stage, Transnet had accepted delivery of only 59 of the 359 locomotives and had yet to pay CRRC R10.7-billion. One can only assume the kickbacks continued apace, in the dark.

The CNR group, as it was then called, can thank its lucky stars – or the Guptas – for getting a sizeable chunk of the 1 064 locomotives tender.

According to the national treasury report, CNR’s price trailed a distant fourth for the diesel locomotives. But then Molefe and his chief financial officer at Transnet, Anoj Singh, authorised bid evaluators to request best and final offers from all four diesel bidders – though for the electric locomotives only the two top bidders were granted the same privilege.

Singh declined to comment.

As if armed with inside knowledge, CNR dropped its quote by R13.8-million per locomotive, while its competitors dropped R2.9-million or less. CNR was in by the skin of its teeth.

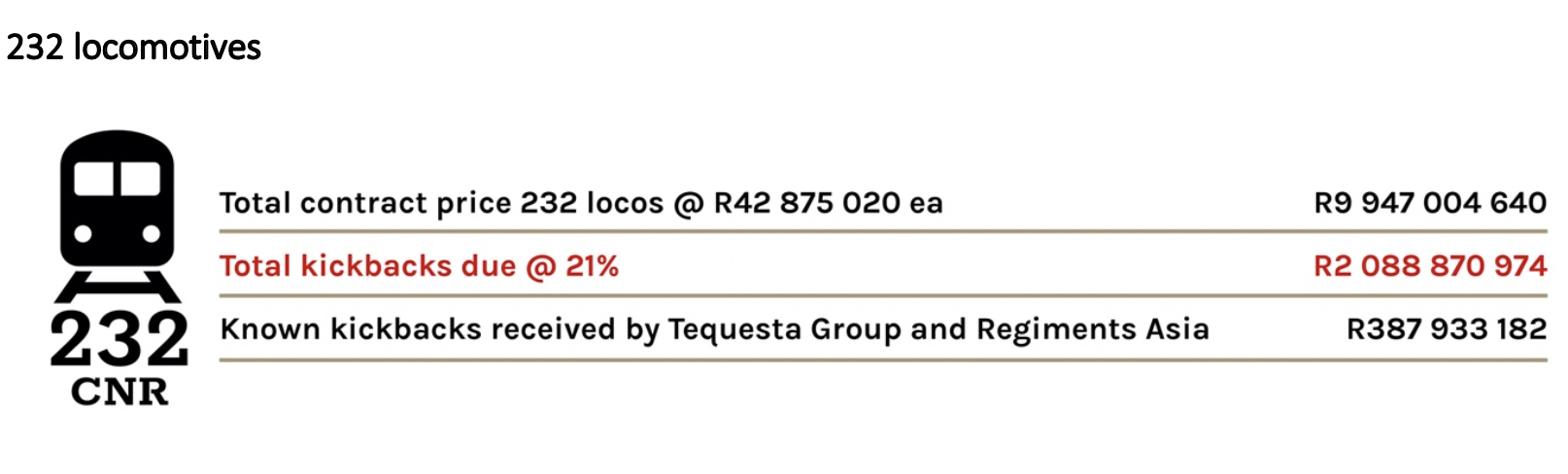

On 17 March 2014, Transnet contracted with CNR for half of the diesel locomotives required, 232, at R9.95-billion, even though Transnet’s board had yet to approve the prices negotiated with CNR and other successful bidders.

Eleven days later Transnet wired a 10% advance, at R994.7-million just short of a billion rands, to CNR.

Over five consecutive days in December 2014, CNR Dalian Locomotive and Rolling Stock Co, the CNR subsidiary whose locomotives were to be supplied to Transnet, wired five bite-sized chunks totalling $18.1-million to the Hong Kong HSBC account of Regiments Asia, the company where the Guptas also received kickbacks on the 95 and 100 locomotive contracts.

Two kickback contracts explain this figure and the hundreds of millions from CNR that were yet to engorge Gupta coffers.

The first kickback contract is between CNR (Hong Kong) and Tequesta Group, the second Hong Kong company that Essa set up.

The contract appears to be a cut-and-paste from an earlier agreement between CNR and Century General Trading, one of the two Emirati companies that originally laundered kickbacks for the Guptas. In an apparent error, the contract refers in one instance to Century General instead of Tequesta.

It also gives two different contracting dates: The first, 8 July 2013, was presumably a copy-and-paste remnant from when an original agreement between CNR and Century General was drafted. This was right in the middle of the tender adjudication, when CNR must have needed all the help it could get.

The later date, 20 May 2014, would have been when Tequesta was installed to receive CNR’s kickbacks. It may not be coincidence that three days later Transnet management finalised a memorandum seeking belated board approval for the increased prices negotiated with CNR and the other successful bidders.

The kickback contract specified that Tequesta would get 21% of CNR’s R9.95-billion total Transnet contract: a success fee of 2% upfront and 19% of each Transnet instalment, although the first 19% would be deferred and split between Transnet’s second and third instalments.

Transnet paid CNR its 10% advance in March 2014. The $18.1-million onward flow to the Guptas that we have already recounted came that December only. Perhaps a tug-of-war between the Guptas and their erstwhile launderers at Century General and the sloppiness of the cut-and-paste contract gave CNR reason to delay.

A second kickback contract, dated 20 May 2014 like the first but signed on 25 November only, unblocked the flow.

It provided simply that CNR would pay Regiments (not Tequesta, the recipient in the first contract) $18.1-million, without expressing it as a percentage of the Transnet contract price. But $18.1-million was the equivalent of R198.9-million at the exchange rate around the 25 November signature date – in other words the expected success fee of 2% of the R9.95-billion total contract price.

In June 2015, Transnet made a second advance payment to CNR: R497.4-million, 5% of the total contract price. Under the first kickback contract, this should have triggered payment to Tequesta of half of the 19% kickback due on Transnet’s first advance plus the 19% due on this advance.

And that is precisely what happened: $15.2-million, the dollar equivalent of the expected R189-million, landed in Tequesta’s Hong Kong HSBC account in two chunks in August and September 2015.

That this payment occurred appears to confirm the validity of the first contract despite a second contract having been signed to unblock the 2% success fee, meaning CNR remained on course to pay the Guptas 21% of the total contract price, or R2.09-billion in total.

We do not know for certain if there were further kickbacks – other than on a Transnet relocation fee discussed below – as Transnet’s next instalment to CNR was to be paid in October 2017 only, by which time our banking data is dark.

In the meantime, Essa and some associates were scheming to extract more from Transnet for CNR – and via it for themselves and the Guptas.

Transnet decided to move the local assembly of CNR’s 232 diesel locomotives from Gauteng to Durban “to stimulate development in other parts of SA”.

CNR initially estimated it would need R9.8-million from Transnet to compensate it for the different conditions in Durban. But then it engaged an opaque local company called Business Expansion Structured Products (BEX) to help it negotiate the “best possible price” with Transnet.

A draft of the CNR-BEX agreement provided that BEX would get an “agency commission” of whatever it could convince Transnet to part with above a benchmark of R280-million. Helpfully, it added: “For example if the [Transnet] price awarded is R650-million, then BEX will be entitled to an agency commission of R370-million.”

A subsequent, signed version raised the benchmark to R580-million. On the face of it, CNR stood to get up to R300-million more and BEX R300-million less – unusual generosity from Essa and the Guptas, who, as we have reported, were behind BEX.

Transnet duly agreed to pay CNR R647.2-million for the relocation – pretty much the “example” of R650-million envisaged in the draft CNR-BEX agreement.

Under the terms of the signed CNR-BEX agreement, this left BEX with a commission of R67.2-million, while CNR would on the face of it laugh all the way to the bank with R580-million.

Would CNR? Seemingly not.

Transnet paid CNR half of the relocation fee, R323.6-million, upfront in August 2015.

The following month, September, CNR Rolling Stock South Africa paid BEX its R67.2-million commission. And CNR (Hong Kong) dumped $8.6-million into Regiments Asia’s Hong Kong HSBC account.

At an exchange rate of R13.50, which had been traversed a few times around then, the dollar-amount CNR paid Regiments equalled R116.4-million, which is exactly the balance of what would have been due to BEX under the draft kickback agreement. (The maths: 50% of R647.2-million less 50% of CNR’s benchmark R280-million and less the R67.2-million BEX got locally.)

So the Guptas, it seems, had their cake and ate it. The kickback that would have accrued to them under the draft was not reduced; it was simply split.

They took the balance in Hong Kong perhaps because they needed the cash offshore. Or because the draft BEX contract, which envisaged a commission for BEX larger than the amount paid to CNR, was just too embarrassing.

Was that the end of it? Probably not, but again we cannot tell. Transnet was yet to pay CNR the second half of the relocation fee, on which the Guptas should have “earned” another R183.6-million (R323 590 747 less 50% of the R280-million benchmark).

But Transnet was to pay that later only, in monthly instalments over the course of two years, after our banking data ends.

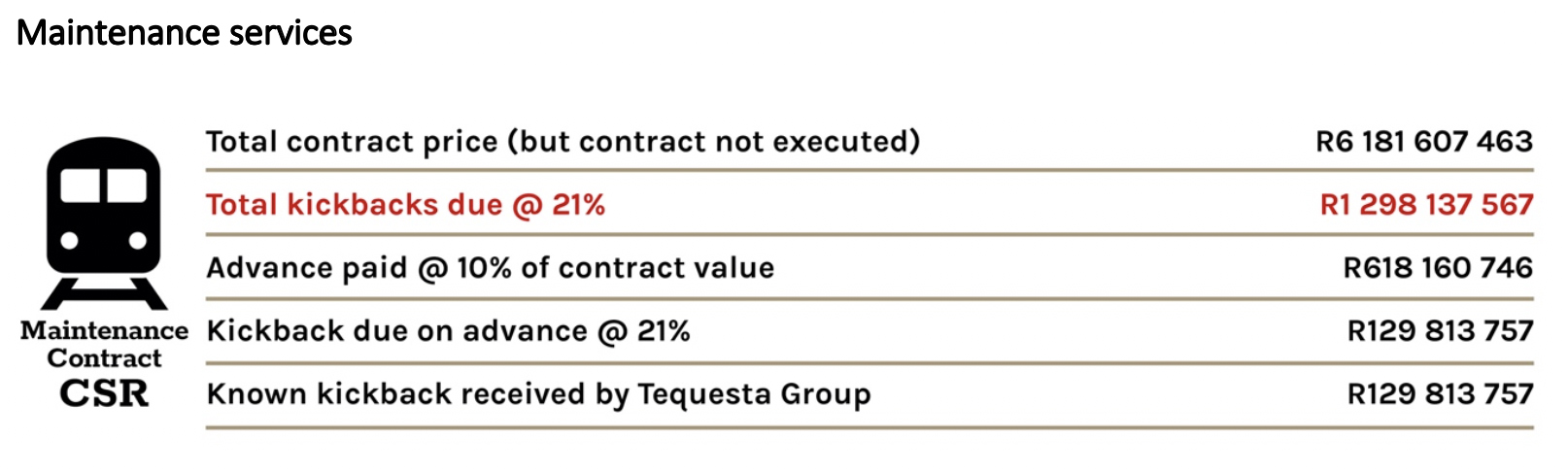

By August 2015, Transnet’s contracting for the 95, 100 and 1 064 locomotives had run its course, with more than R60-billion committed. But the shopping spree was not over. That month, Transnet asked the manufacturers to quote on maintaining their locomotives.

That CSR would be awarded another multi-billion-rand deal (while the other successful bidders for the 1 064 locomotives apparently were not) should come as little surprise.

Two months earlier, on 10 June 2015, CSR Zhuzhou and Regiments Asia, the latter represented as usual by Essa, had concluded yet another “business development services agreement”. CSR would kick back to Regiments 21% of the maintenance contract price.

The process unfolded a little slowly. In mid-July the following year, CSR submitted a best and final offer to Transnet. Two weeks later, Transnet’s board authorised the new group chief executive, Siyabonga Gama, to contract with CSR. After ministerial approval, which was obtained, only Gama’s signature remained outstanding.

We have recounted above how CSR retained 15% of each kickback from Regiments and Tequesta on the 95, 100 and 359 locomotive deals in case the Guptas’ original launderers at Century General Trading and JJ Trading came after CSR for their cut.

Now, effective 3 August 2016, six days after the Transnet board approval, CRRC Zhuzhou (its post-merger name) concluded addenda to the earlier kickback contracts that CSR had with Regiments and Tequesta.

The addenda provided that once CRRC got its letter of award from Transnet for the maintenance plan, CRRC would release the 15% retentions, by then a cumulative R250-million, to the two Gupta Hong Kong fronts. This would be in addition to the promised 21% kickback on the maintenance plan itself.

Now things moved fast.

Nine days later, on 12 August, CRRC Zhuzhou’s local subsidiary had its letter of award from Transnet, complete with Gama’s signature. Unusually, the letter provided for a 10% advance on the R6.18-billion contract even though the letter could only convey “preferred bidder” status and an actual contract had yet to be negotiated.

Attempts to reach Gama for comment failed.

The letter of award triggered CRRC’s release of the retentions to Regiments for the 100 locomotives contract, and likely to Regiments and Tequesta respectively for the 95 and 359 contracts.

On 1 October 2016, according to Transnet correspondence – even though it was a Saturday – Transnet paid the maintenance advance, R618.2-million, to CRRC. Twenty-eight days later, CRRC (Hong Kong) wired $9.5-million to Tequesta’s Habib Bank account in Dubai.

Depending on the exchange rate used, this equalled the exact 21%, R129.8-million kickback envisaged in the agreement between CSR and Regiments. While payment was received by Tequesta, Regiments was entitled under the agreement to nominate a third party.

As things turned out, the payment may have put the pinch on CRRC.

When we revealed in our first #GuptaLeaks story in June 2017 that the Guptas were getting kickbacks from some of the locomotive contracts, Transnet had not yet signed a contract with CRRC for the maintenance plan, despite sending CRRC a letter of award. This appears to have sent the cat among the pigeons.

In October that year, Gama wrote to CRRC explaining that the “corruption allegations that surfaced through the media” and a forensic investigation commissioned by Transnet would hold up the contracting process.

In 2018, Transnet demanded CRRC repay the advance on the grounds that it had not yet performed on it, and that no contract was yet signed. CRRC complied but repaid only the original R618.2-million – not the VAT Transnet had paid on top of it, or any interest.

In February 2019 Transnet wrote to CRRC demanding to be reimbursed R86.5-million in VAT and R136.5-million in interest.

Transnet is still waiting, cap in hand. The Guptas are sitting pretty. Wherever they are. DM

* In this article, unless specified, “the Guptas” is shorthand for the extended family headed by Ajay, Atul and Rajesh Gupta and relevant business associates. All amounts exclude VAT. Foreign currency amounts are converted to Rand at our best estimate of the exchange rate used at the time, not current rates. Additional reporting by Susan Comrie.

*The amaBhungane Centre for Investigative Journalism, an independent non-profit, produced this story. Like it? Be an amaB Supporter to help us do more. Sign up for our newsletter to get more.

Ajay and Atul Gupta, and Sahara director, Duduzane Zuma speak to the City Press in Midrand, Johannesburg, South Africa on 4 March 2011. (Photo: Gallo Images via Getty Images/City Press/Muntu Vilakazi)

Ajay and Atul Gupta, and Sahara director, Duduzane Zuma speak to the City Press in Midrand, Johannesburg, South Africa on 4 March 2011. (Photo: Gallo Images via Getty Images/City Press/Muntu Vilakazi)