Many studies have been done to determine how much and how long we need to save to ensure a sustainable income in life post-retirement. The vast majority of research indicates that the prudent approach would be to plan for at least 25 – 30 years. While there are various factors (such as inflation, withdrawal rate, level of initial capital and investment returns) that influence the level of income you can draw in retirement, as well as how long your capital will last, another important factor, and one which is often overlooked, is the sequence in which retired investors earn their returns.

This year has been a roller-coaster ride for investors, and we’ve seen a great deal of volatility in equities with the stock market reaching record single-day losses. If you’re invested for the long-term and you’re years away from drawing upon the money you have invested, you might not be too worried about short-term declines in performance – probably the smartest thing you can do right now is sit back, wait for things to stabilise, and leave your investments. However, for investors who need to draw on their investments regularly, like those with living annuities, volatility becomes crucially important.

The best way to think about this is if the value of your retirement savings declines near the outset of drawing an income, the amount withdrawn will represent a bigger portion of your investment than if you had experienced growth over the same period. The effect of this is that the base continues to decline with each additional income withdrawal leaving less savings to grow. This could result in retirement savings running out much sooner than if the portfolio experienced positive returns at the start of the withdrawal period.

The past few years have been difficult for investors, particularly those with exposure to the South African equity market as in many cases returns have been dismal. This means that many pensioners are now drawing an income in excess of the return of their investment resulting in capital erosion.

The risk involved in withdrawing money from a volatile portfolio – termed sequence-of-return-risk – is lower when portfolio volatility is lower. The current market capitulation that we are experiencing has highlighted the value of having the right mix of portfolios in reducing this type of risk without compromising too much on longer-term growth. The 36ONE hedge funds can produce positive returns in both rising and falling equity markets (due to their combination of long and short positions) and therefore have the ability to produce asymmetrical returns, which is especially valuable in times of heightened uncertainty. Allocating a portion of one’s savings to the 36ONE hedge funds can aid in controlling the effects of market volatility on a portfolio and could be one way to reduce sequence-of-return-risk. This is best illustrated by way of an example.

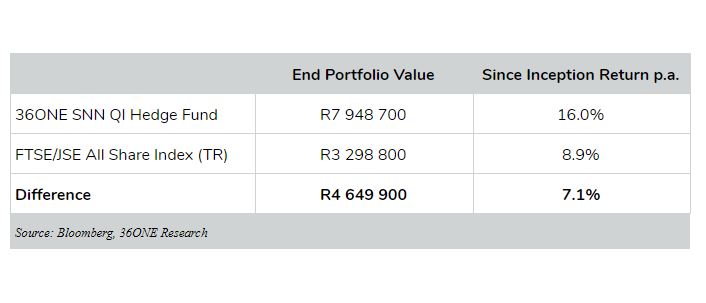

A client has a lump sum of R2 000 000 and decides to invest. They invest R1 000 000 in the 36ONE SNN QI Hedge Fund and R1 000 000 in the FTSE/JSE All Share Index at the start of April 2006 (which is the launch date of the 36ONE SNN QI Hedge Fund). The table below summarises what their investment portfolio would be worth on 31 March 2020 in nominal terms:

Scenario 1: Lump Sum Scenario

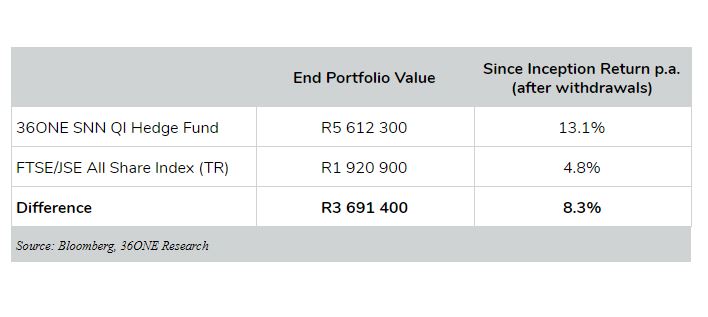

The client would have been substantially better off if they had invested the full lump sum amount in the 36ONE SNN QI Hedge Fund, which does not come at a surprise as the hedge fund has outperformed the FTSE/JSE All Share Index by 7.1% per year over the period April 2006 – March 2020. Let’s take the example one step further: assume that they decided to invest the R2 000 000 as above but also needs to draw an income from each respective portfolio. After some number crunching, they calculate what their living expenses are, and decide that they require a monthly amount of R7 500 which equates to an initial annuity income of 4.5% p.a. (this amount will be drawn monthly). They also choose to increase the income each year and decide to go with an increase rate of 6%. The table below summarises what the investment portfolio would be worth on 31 March 2020 in nominal terms:

Scenario 2: Income Producing Portfolio

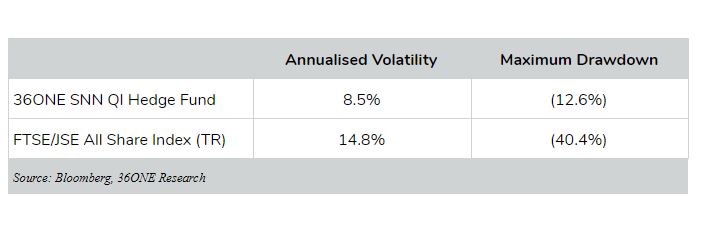

What’s interesting is that when we compare the end values of the income-producing portfolios, the 36ONE SNN QI Hedge Fund outperformed the FTSE/JSE All Share Index by 8.3% p.a. This is higher than the lump sum scenario initially depicted where the 36ONE SNN QI Hedge Fund outperformed the FTSE/JSE All Share Index by 7.1% p.a. Baffled by this the investor decides to speak to their financial adviser who explains that the reason is simply volatility. Over the 14 year period (April 2006 to March 2020) the volatility of the 36ONE SNN QI Hedge Fund was substantially lower than that of the FTSE/JSE All Share Index. Furthermore, the hedge fund experienced much lower drawdowns during the period. The return profile of the hedge fund was substantially more stable than the market over the time period which resulted in a much better outcome for the portfolio invested in the hedge fund.

Risk Measures

While the above scenarios are simplified and don’t take tax and other related investment costs into account, the point is rather to illustrate just how important volatility is for clients in income-producing portfolios. Withdrawing assets in a down market during the early years of retirement is one of the biggest risks to portfolio longevity. When the market recovers, the portfolio may not have as much room to run because it’s been depleted by ongoing withdrawals.

As is evident in the above scenario, higher volatility can act as a drag on performance in income-producing portfolios and can result in clients not meeting their income objectives over the lifespan of their retirement.

We are living longer, which also means that the time we spend in retirement is longer and by implication, more money is needed. Having to draw an income from your retirement savings for longer needs an appropriate investment strategy.

We believe the 36ONE hedge funds are an appropriate strategy – by virtue of the strategies and instruments that we use, we have the ability to participate in up markets but can also protect capital during down markets. Our hedge funds can form a very useful part of an investment portfolio as they have the potential to provide investors with returns that are similar to an equity mandate, but with much lower levels of volatility and much lower drawdowns resulting in better risk-adjusted returns for clients. We believe it is a fantastic complement to a well-diversified portfolio as it can reduce the sequence-of-return-risk without compromising on longer-term growth. DM

Disclaimer: The information presented here is not intended to be relied upon for investment advice. Various assumptions were made. See our full disclaimer here.

Source: Bloomberg, 36ONE Research; Performance to 31 March 2020.

Become an Insider

Become an Insider