OP-ED

Trade in illicit cigarettes on the way to being stubbed out

Research conducted by academics at the University of Cape Town indicates that the government is winning the war against illegal tobacco products and that the once rampant lawlessness in the industry may be coming to an end.

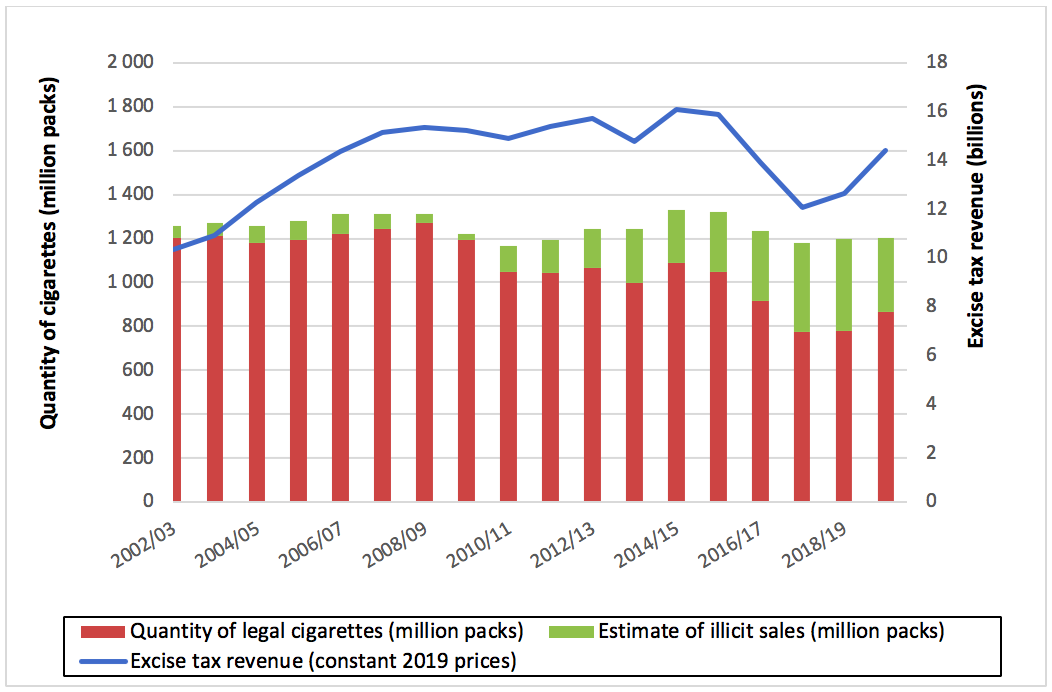

The substantial rise in revenue from tobacco products is a silver lining to South Africa’s increasing fiscal debt. In the 2019/20 financial year, nominal excise tax revenue from domestic production of cigarettes and cigarette tobacco (of which at least 95% is from cigarettes) increased by 19.2% from R12.1-billion to R14.4-billion. In fact, in the 2019/20 financial year the reported revenues were 14% higher than the budgeted revenue.

In recent years, the illicit trade of cigarettes in South Africa has been dominated by undeclared sales and ghost exports. Undeclared sales occur when manufacturers do not report to SARS what they produce (and then sell cigarettes with no excise or VAT paid). Ghost exports occur when manufacturers create the illusion of goods being exported (which exempts the manufacturer from paying excise and VAT). These cigarettes are then sold locally. By looking at declared sales, and comparing this figure to those of previous years, one can gauge whether or not the tobacco industry is accurately declaring what they produce.

In 2018/19, the tobacco industry declared 15.6 billion cigarettes for excise tax purposes. In 2019/20 they declared 17.3 billion cigarettes, an increase of 11%. Should this increase in cigarette sales concern public health advocates? We don’t think so. Smoking prevalence doesn’t change dramatically from one year to the next. The increase in declared cigarettes indicates that illicit trade has probably reached a turning point and is now receding.

The Research Unit on the Economics of Excisable Products (REEP) at the University of Cape Town has studied the illicit cigarette market in detail in recent years. We found that the illicit market grew from less than 5% in 2009 to around 17% in 2014, and then increased to more than 30% in 2017. Undeclared production resulted in a substantial loss in government revenue. The Nugent Commission reported that between 2014 and 2018, SARS had disbanded specialised units that had been established to investigate the tobacco industry. With no oversight, illicit trade flourished. The book Tobacco Wars, by Johann van Loggerenberg, describes the machinations of the tobacco industry in chilling detail.

The diagram above shows the recorded quantities of cigarettes sold in the legal market and the estimated quantities of cigarettes sold in the illicit market, for the period 2002/3 through 2019/20. The illicit estimates are derived from Vellios et al. Illicit trade in cigarettes in South Africa, 2002-2017, Tobacco Control, DOI:10.1136/tobaccocontrol-2018-054798. The line graph shows the real (inflation-adjusted) tobacco excise tax revenue from domestic cigarettes production.

Based on a nationally representative survey conducted in 2017, we found that a significant proportion of smokers in all nine provinces were buying illicit cigarettes. KwaZulu-Natal had the lowest prevalence of illicit cigarette purchases, at 22.8%, while Northern Cape had the highest prevalence at 37.9%. In both 2017 and 2018, we surveyed six townships in four provinces and found that about 35% of the cigarettes sold there were illicit, based on their price. In August/September of 2019 we repeated the survey in the same six townships and found that the illicit market share had reduced to 26%. The sharp increase in legal sales, nationally, in 2019/20 (and the associated decrease in the illicit market) align with these findings from the townships.

In 2018 and 2019, the now-defunct Tobacco Institute of Southern Africa (Tisa), which primarily represented large multinational tobacco companies, led a very vocal #TakeBackTheTax campaign. The campaign publicised that the government was losing R8-billion annually from undeclared sales. South Africans were encouraged to sign a petition imploring the government to address illicit trade. Tisa paid a market research firm, Ipsos, to investigate illicit trade. Unsurprisingly, they reported that nearly all illicit cigarettes could be traced back to local producers who had been eating away at the market share of Tisa members. Despite requests from journalists and academics, Tisa and Ipsos were unwilling to release the research methodology, or the raw data. This reluctance brings into question the credibility of their conclusions.

Had Tisa still been in existence, they would probably claim that the #TakeBackTheTax campaign was successful. While we should celebrate the increase in government revenue from declared sales, the increase should not be ascribed to the #TakeBackTheTax campaign. Tisa represents Big Tobacco, and its activities were aimed at protecting Big Tobacco’s interests. Tisa was at the forefront in undermining SARS. As an example, Tisa formed a direct alliance with the Illicit Tobacco Task Team in 2011, ostensibly to fight the illicit tobacco trade. The Task Team was comprised of a number of subsequently compromised government agencies, but did not include SARS. Why not? In 2018 the Nugent Commission concluded that the Illicit Tobacco Task Team was never there to investigate the illicit tobacco trade, but to investigate instead the “investigators of the trade”.

The creation of the Illicit Economy Unit at SARS seems to have made a huge difference. The SARS Commissioner recently indicated that the Illicit Economy Unit had recovered R2.6-billion since April 2019. This is from cigarettes and other non-tobacco products. After the demise of the specialised units at SARS, the tobacco industry could evade excise taxes with impunity. However, the mere existence of the Illicit Economy Unit is likely to give the tobacco industry pause.

The battle against illicit cigarettes is far from over, but the good news is that South Africa is regaining some lost ground. DM

Corné van Walbeek is a Professor of Economics and the Director of the Research Unit on the Economics of Excisable Products (REEP) at the University of Cape Town. Kirsten van der Zee and Nicole Vellios are Research Officers at REEP.

Become an Insider

Become an Insider