The famous phrase by Yogi Berra, “It’s déjà vu all over again,” does not quite do justice to the recent turmoil in the SA currency and debt markets. The hope for a weaker dollar and stronger rand, as well as the lower interest rates, inflation, and faster growth that comes with a stronger rand, has once more been dashed.

Trade wars and currency manipulation do less damage to the US economy than to others, simply because the US is less dependent on global trade and more dependent on the US consumer. Hence in times of trouble, capital flows towards the US, raises the exchange value of the US dollar and depresses bond yields. Emerging market exchange rates weaken more than most and emerging market bond yields rise. The rand generally falls more than most other emerging market currencies.

Funding government debt has become more expensive, even as the volume of debt to fund extraordinary spending on Eskom increases at a very rapid rate. Long-dated SA government-issued (RSA) debt now offers an extra 8% over US Treasury bonds and almost as much extra when compared to other developed market issuers (many of whom now borrow at negative interest rates). SA is now paying 3% more than the average emerging market on its debt (in their domestic currencies).

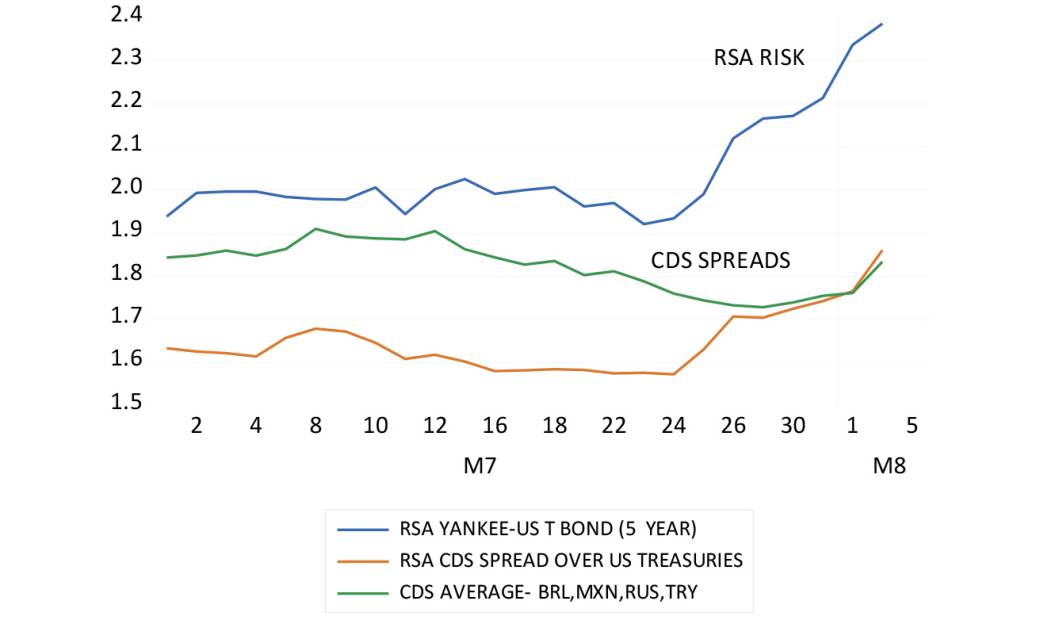

For the government, raising US dollars has also become more expensive. Raising five-year dollar-denominated debt now requires an extra 0.4 percentage points (40 basis points) more than it did in early July 2019. The cost of insuring RSA foreign-currency debt against default has risen similarly and more than it has for other emerging market borrowers.

Sovereign risk spreads for RSA and other US dollar-denominated debt (Source: Bloomberg, Investec Wealth & Investment)

The rand moreover has performed particularly poorly when compared to other commodity and emerging market exchange rates. Since early July, the rand is about 6% down vs the US dollar, 3% down on the Chinese yuan and about 2% weaker vs the Aussie dollar and a basket of nine other emerging market currencies.

The USD/ZAR compared to the yuan and Aussie dollar (1 July = 1). (Source: Bloomberg, Investec Wealth & Investment)

The USD/ZAR vs an equally weighted basket of nine emerging market exchange rates. (Source: Bloomberg, Investec Wealth & Investment)

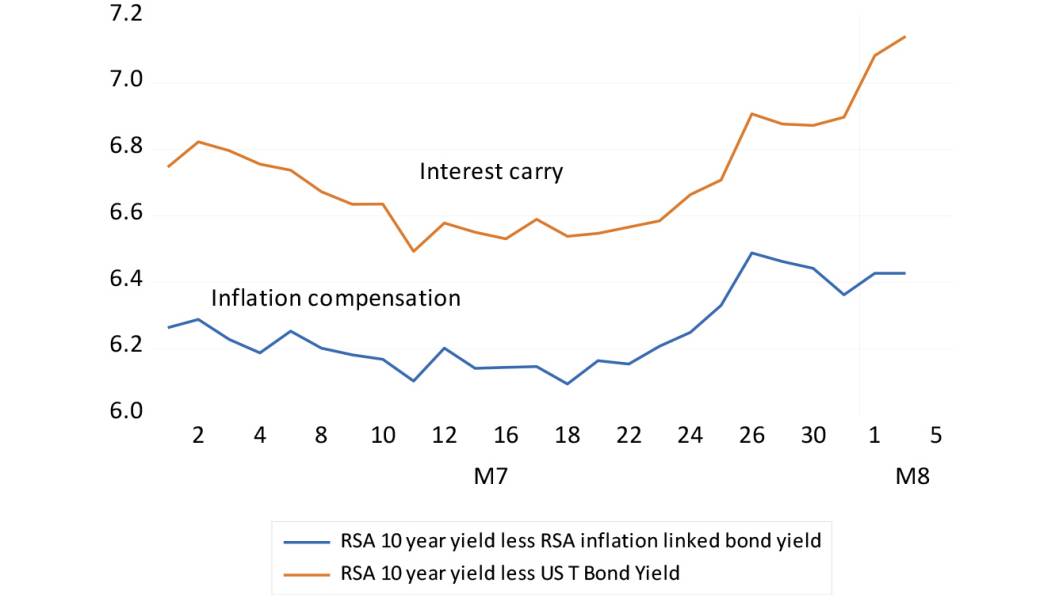

The cost of buying dollars for forward delivery has thus also widened, as has the compensation for bearing inflation risk in the RSA bond market. Both spreads are now over 6% for 10-year contracts. The attempts by the Reserve Bank to reduce inflation expected, by containing inflation itself (now about 4.5%, an outcome achieved by depressing domestic spending), have accordingly failed.

The RSA bond market interest rate carry and inflation compensation. July- August 2019 (10 year yields). (Source: Bloomberg, Investec Wealth & Investment)

It should be recognised that the relative weakness in the rand and RSA bonds actually preceded the impact of the latest Trump tantrum. The Trump tariff threats came only at month-end. The earlier attacks of the Public Protector Mkhwebane on President Ramaphosa moved the market ahead of Trump.

What then can be done to mitigate this volatility and the damage it causes to the SA economy? The Reserve Bank cannot hope to anticipate exchange rate volatility with any degree of accuracy, or impose higher interest rates that offer no defense for the rand; they can only depress demand and growth further. The wise thing to do would be to leave the exchange rate to find its own level and accept higher inflation or the expectation of higher inflation that might follow (and which can easily reverse). The case for cutting or raising interest rates should be made only on the outlook for the domestic economy, which has not been improved by recent global events.

The Reserve Bank has called correctly for structural reform of the kind the President and his cabinet has responsibility for. It demands reforms so that SA can avoid the debt trap that Eskom has lead us into. Any confident sense that SA can address its structural weaknesses will bring immediate reward, in the form of lower interest rates and lower expectations of inflation.

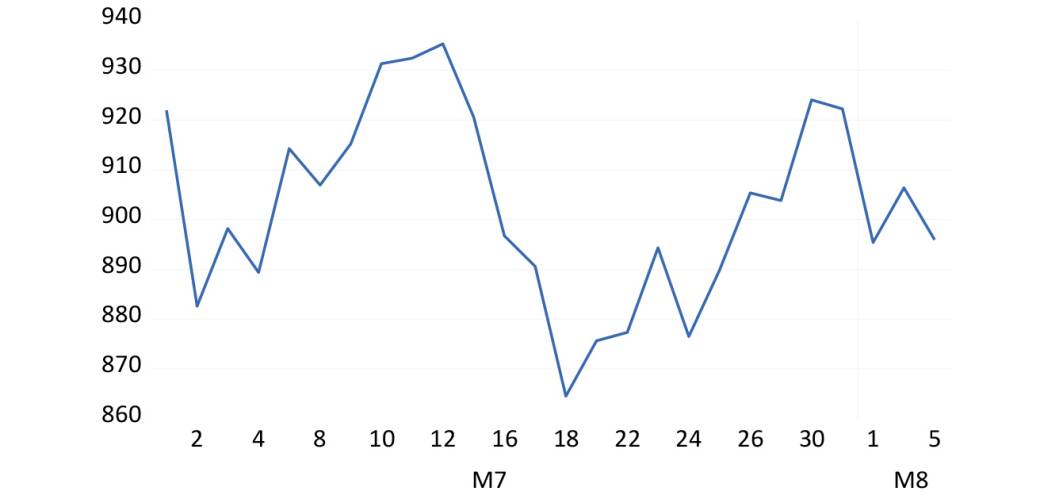

There is some consolation in recent events. The oil price in rands is no higher than it was. It would have been more comfortable had SA still been producing gold on something like the scale of previous years. A mining charter that revives the case for investing in SA mining, would be a confidence booster.

Brent oil rands per barrel. (Source: SA Reserve Bank, Bloomberg, Investec Wealth & Investment)

All rates and percentages as at 6 August 2019. BM

This article originally appeared on Investec’s FOCUS.

Become an Insider

Become an Insider