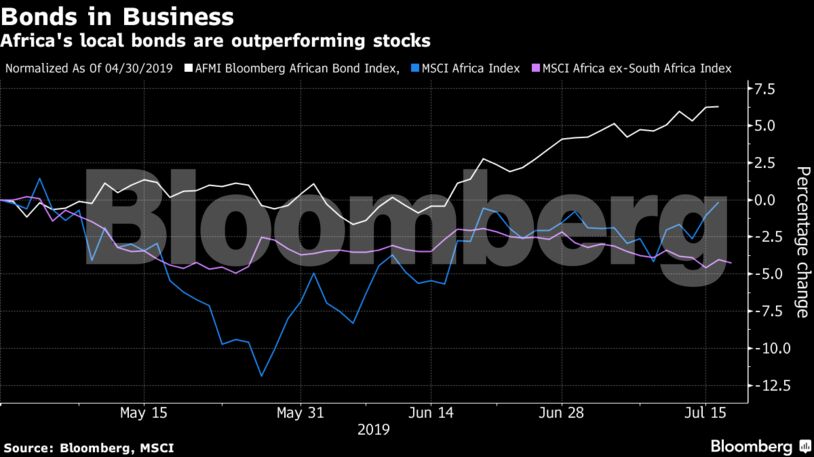

Carry traders have been particularly attracted to Africa. Egyptian-pound bonds, which yield 16%, have made total returns of almost 8% over that period, extending their gain this year to 25%. South Africa’s debt is up 6.9% since the end of April and Nigeria’s 4.7%.

But what’s good for bond traders isn’t necessarily so for equity investors. While the former focus more on the short term, looking for high interest rates and stable currencies, the latter want economic growth. Aside from Egypt, the fastest-growing country in the Arab world, Africa’s major economies aren’t providing much of it. South Africa’s output contracted the most in a decade in the first quarter, while Nigeria’s economy has been anemic since a crash in oil prices five years ago.

South African stocks have slumped 1.6% in local currency terms since April, though a rally in the rand means they’re up slightly in dollars. Elsewhere on the continent, investors aren’t being attracted by low valuations. Excluding South Africa, African stocks trade at a forward price-to-earnings ratio of barely 9, based on estimates for the next 12 months. Emerging- and frontier-market equities each trade at around 12.

Become an Insider

Become an Insider