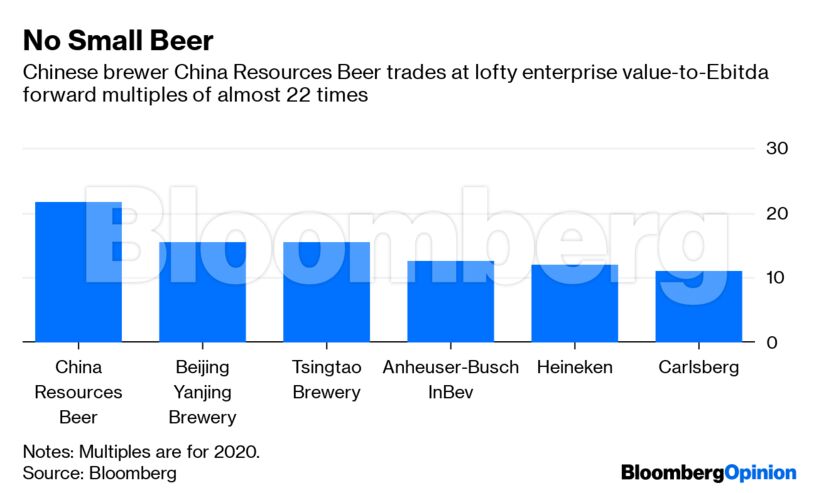

The offering valued Budweiser Brewing between 15.5 times and 18.2 times earnings before interest, tax, depreciation and amortization – well above the multiples for Carlsberg A/S and Heineken NV, and a premium to shares of the parent. The price range of HK$40 to HK$47 ($5.11 to $6.01) a share would have resulted in a market capitalization of $54.2 billion to $63.7 billion.

You can hardly blame investors for wanting to sit this one out. The U.S.-China trade war is at an impasse and the ripples are widening. Singapore, a bellwether for global trade, on Friday posted its sharpest growth decline since 2012. While the Federal Reserve has signaled that interest rate cuts are coming, which has buoyed U.S. stocks, that’s also driving a wedge between the world’s biggest economy and the rest.

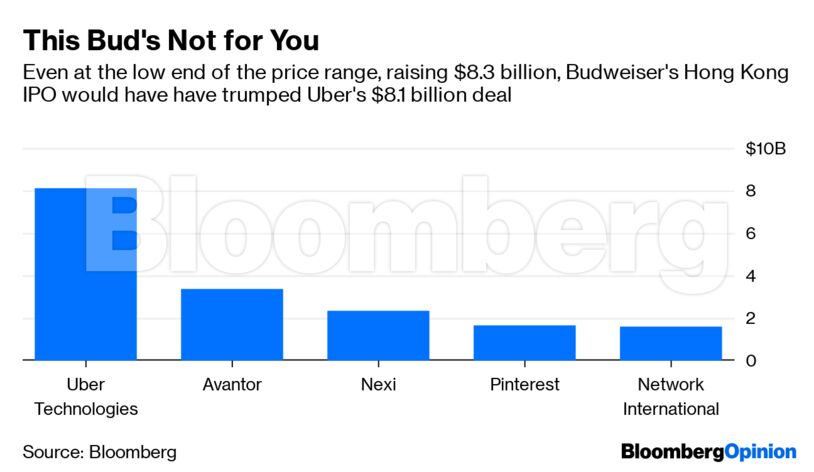

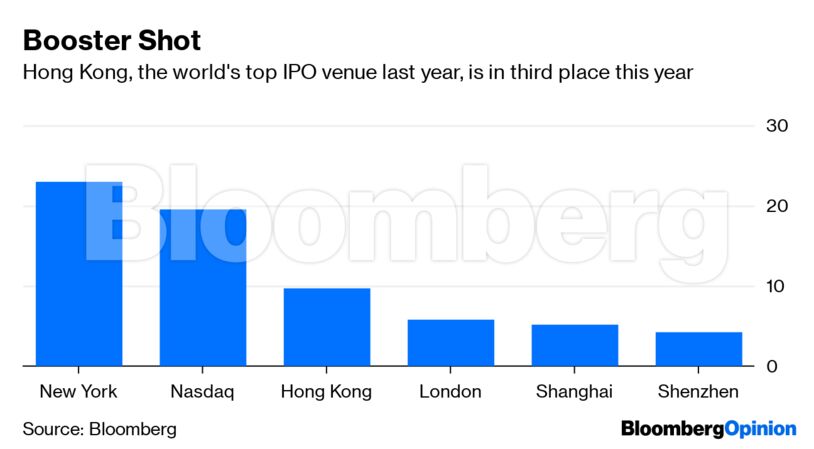

This split is perhaps nowhere more apparent than the IPO market. Listings in the U.S. are on track for their best year since 2014. Hong Kong, the top destination last year, is languishing by comparison, after a series of high-profile bloopers including smartphone maker Xiaomi Corp. in July 2018 and food-delivery giant Meituan Dianping in September. As I’ve argued, reclaiming that crown will be an uphill battle; and now Hong Kong is facing competition from Shanghai for tech IPOs. Alibaba Group Holding Ltd.’s secondary listing plan is a ray of light – but this latest kerfuffle could dim any optimism.

Against this dismal backdrop, it’s little wonder things went south. Yet it’s a mistake to overlook AB InBev’s own missteps. For one thing, the company marketed itself as a purveyor of high-end beer, taking cues from Chinese consumers’ growing taste for foreign brands and craft labels. Perhaps its price range doesn’t look so out of whack when you consider the country’s brewers trade anywhere between 15 times and 21 times, according to Bloomberg data. Yet investors just weren’t convinced that demand would hold up in a slowing economy. The company’s China pitch also ignored mature markets like South Korea and Australia, which make up around half of Budweiser Brewing’s Ebitda, according to Bernstein Research.

Then there’s the fact that growing a brand in Asia’s fragmented market is easier said than done. India, where whiskey is the traditional tipple of choice, and Southeast Asia could have been fertile ground for expansion. One argument for an Asia IPO was that Budweiser Brewing would benefit from local tie-ups. Would the Thai tycoon who owns Vietnam’s top brewer, Sabeco Trading Corp., or the magnate that controls the Philippines’ San Miguel Corp. really cede control to the Belgian brewer for a piece of the Hong Kong listing? I’m unconvinced.

The fatal flaw, however, may have been AB InBev’s hubris. In deciding against a cornerstone investor tranche, the company eschewed a fixture of Hong Kong’s IPO market. It turns out investors really do like the comfort of big names that pledge to hold stock – even if the practice ties up a lot of liquidity. Had Budweiser’s listing succeeded, it would have been a win for market reform, too.

With such a bubbly valuation, AB InBev may have thought its investors were wearing beer goggles. Whether the brewer can make a dent in that $103 billion net debt from its purchase of SABMiller looks a lot less certain after a cold shower and pot of black coffee.

Become an Insider

Become an Insider