BUSINESS MAVERICK

Shoprite turns down the idea of paying Christo Wiese R3.3bn for his high-voting shares

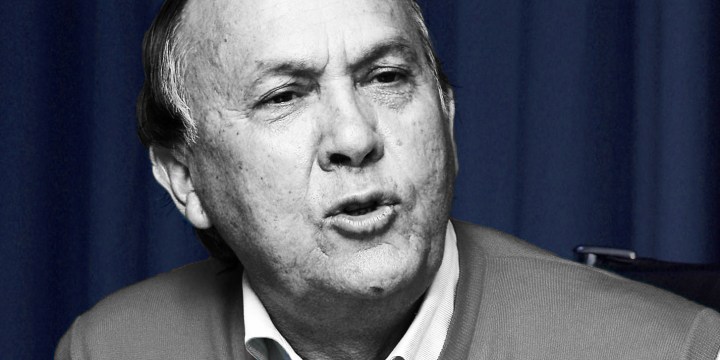

The Shoprite board has announced that it could not get sufficient shareholder support for buying the high-voting shares of the company’s founder Christo Wiese, valued at R3.3bn. For Wiese, the decision constitutes yet another blow after much of his wealth was wiped out in the Steinhoff saga, but it also means he remains the dominant force in the company.

Shoprite has announced that its proposal to buy out company founder Christo Wiese’s high-voting shares for R3.3bn received broad support in principle from shareholders, but not enough to allow the deal to go through. Consequently, it had been cancelled.

The announcement brings to an end a somewhat controversial proposal to convert Wiese’s high-voting shares into ordinary shares. Effectively that would have meant the company would issue new, ordinary shares to Wiese worth about R3.3bn and scrap the old, high-voting shares.

The board’s argument was that the deal would simplify the company’s voting share structure and align the company with international best corporate governance practice. This is because all the shares after the deal would have the same voting rights. This, the board said, would appeal to institutional investors and would have increased a positive demand for the company’s shares.

Wiese’s 305.6 million deferred shares — the high-voting shares in question —control 32.2% of Shoprite’s voting rights, and were issued to Wiese in the year 2000 at a nominal value of 0.1c a share. After the deal, the voting interest of minority shareholders would have increased from 57.7% to 82.2%. Or to put it another way, Wiese’s voting power would have come down from 42.3% to 17.8%, being 3% more than the 14.8% he currently holds.

The problem with the special shares is that it has already been agreed that they expire if Wiese’s shareholding in Shoprite falls below 10% — and they cannot be passed on. They were issued to Wiese personally as the company’s founder, after all.

The deal required a 75% majority to pass, but some crucial shareholders, notably asset manager Coronation, which holds about 5% of Shoprite on behalf of clients, weren’t crazy about the deal. Karl Leinberger, Coronation’s chief investment officer told Business Maverick the proposal was an extremely high price to pay to extinguish what is, in reality, a comparatively low level of risk.

The result is that nothing changes with the company; Wiese remains its guiding force.

Unless of course, he decides to sell. DM

Become an Insider

Become an Insider